Davey Resource Group

Park and roadside trees are valuable community assets that deser…

Funding options: mix, match, negotiate

If you’re not keeping up with your neighbors, 2016 may be the perfect time to ask for more funding. The economy is better, the climate is changing (literally), and voters are into green solutions.

There are a myriad of sources for funding; some are tried and true, others are “emerging markets” that can offer hefty dividends with a little investment of your time. The secret to financial sustainability is to not put all your eggs in one basket. As a caveat, some of the sources below may not be practical for your particular situation or authorized by your city and/or state.

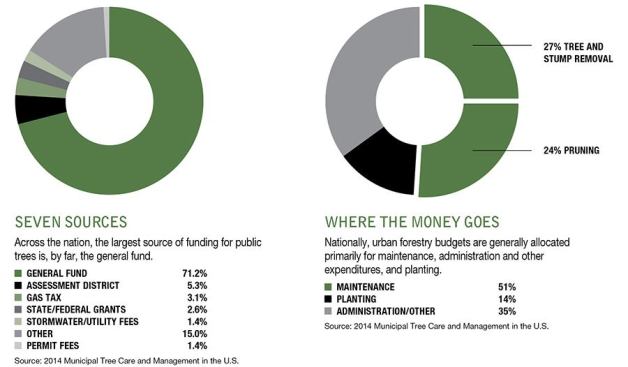

General Fund. As the chart above shows, this is the most common source. So go ahead and ask for a bigger piece of the pie and/or negotiate with other municipal departments to include line items in their budgets that support elements of the tree program.

Federal and State Grants. U.S. Forest Service grants have become more regional and competitive. However, other federal programs support planting, inventories, canopy mapping, and even maintenance:

EPA Urban Waters, Environmental Justice, and 319 grants

- DOT Transportation Investment Generating Economic Recovery (TIGER) grant program

-

Also visit www.grants.gov to see what’s available for your particular need and situation.

If you haven’t already, contact the Arbor Day Foundation to learn who your state Urban Forestry Coordinator is. Stay in touch so you don’t miss regional and state grant programs.

Corporate and Private Foundations. Businesses are anxious to partner with green entities, and endowments are becoming flush again.

As a public agency with nonprofit status, professional staff, and administrative support systems, your program is well-positioned to apply for and receive private grants.

Check out www.foundationcenter.org for sources in your area. Partnering with a local nonprofit can also uncover additional sources.

Taxes, Assessments, and Special Tax Districts. The political atmosphere may not be quite right yet, but taxes are a legal and viable way to fund urban forestry.

Cincinnati’s program is funded by a state-authorized special assessment. St. Louis uses a combination of property tax and sales tax transfers. Burlingame, Calif., receives a portion of the state gas tax.

If increasing or adding citywide taxes is unpalatable, consider including urban forestry projects in Tax Increment Financing, Landscape and Lighting Assessment, and other Special Benefit Assessment Districts.

Capital Improvement Projects. If your city considers the urban forest a capital asset, planting and sometimes even maintenance can be a valid expenditure in major road, utility, and facility project budgets. Milwaukee has successfully incorporated trees into right-of-way improvements for many years.

Stormwater Utility Fees. Stormwater fees are assessed to all property owners, including those who are tax-exempt. This “emerging markets” funding mechanism should merit serious consideration as a stable and reliable resource.

Milwaukee’s win-win strategy is a perfect example. Elected officials understand that treating 13,000 ash trees every year to prevent canopy loss from emerald ash borer averts increases in runoff. Thus, they consider the investment a legitimate stormwater management activity that can be funded by the fee.

They recently approved and earmarked a small increase for urban forestry. It was relatively small, and, thus, relatively painless, compared to increasing sales and/or property taxes.

Permit and Inspection Fees. Urban forestry departments should be reimbursed for the time employees spend reviewing permit applications, reviewing plans, and making site inspections.

Pittsburgh’s program receives a proportional share of permit and inspection fees collected annually, which it uses to offset personnel expenses and fund improvements.

If you’re not revenue-sharing, start exploring the option. The Madison, Wis., program is entirely funded by various departmental contributions and many other cities take the same approach.

Compensatory Payment, Mitigation, and Environmental Fines. When trees are damaged or removed, whether by accident or as part of planned development, municipalities should be compensated.

This requirement, along with compensation method and applicability to public versus private trees, should be codified. Cities with such ordinances have “tree funds” where compensatory payments, mitigation or ‘in lieu of’ fees, and environmental fines are deposited for various uses.

Miscellaneous Sources. Every bit of revenue can help you accomplish projects and keep your funding portfolio diversified. Don’t forget about:

- Adopt-A-Street and memorial tree programs

- Wood product sales

- Utility bill donations

- Community and organizational fundraising events

- Revenues from city-owned concessions and recreational facilities

- Cash and in-kind donations

Funding a community tree program is challenging, but you’re not alone.

Society of Municipal Arborists (www.urban-forestry.com) members are in the trenches every day, fighting the good fight, and want to help you meet your goals.

The organization’s excellent, low-cost Urban and Community Forestry Program Accreditation program builds on the Arbor Day Foundation’s Tree City USA designation. Use it to evaluate your program based on objective and professional standards and communicate its value to the community as a whole.

Having a winning program makes getting the funding you need that much easier.

Jennifer Gulick is senior consulting urban forester for Davey Resource Group, A div. of The Davey Tree Expert, in Walton, Ky. E-mail jenny.gulick@davey.com.