All Energy Solar

To transition to a hybrid alternative-energy system, power to th…

By this time next month, my team will have completed six alternative energy projects that are expected to save our community of 17,000 at least $1.1 million over the next 40 years. Being the state’s first city to implement a public-private partnership for solar-based alternative energy, a complicated financial proposition involving grants and incentives offered by multiple government agencies and suppliers was scary. But we got it done in less than two years.

The projects are a joint effort between Xcel Energy, State of Minnesota, All Energy Solar, Newport Partners, and employees of the City of Red Wing, Minn. We’ve been working toward this point since summer 2011, when I attended an open house at a home showcasing a ground-mounted solar-power system installed by Minneapolis-based All Energy Solar. I went more out of personal curiosity than anything else, but the presentation made me think the technology might work at the public works administration building.

I asked the company representative to contact me.

An offer we couldn’t refuse

Portrait of a public-private partnership

Financing

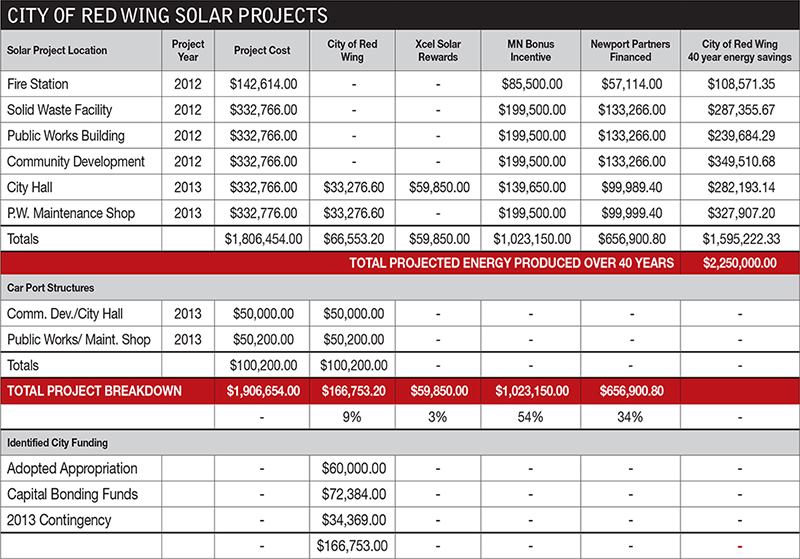

Total cost, six solar-electric installations: $1.9 million

City of Red Wing (Minn.) Public Works Department

Capital investment: $167,000

Operations & maintenance: $250,000 over 40 years

Funding contribution: 9%

Newport Partners LLC

Irvine, Calif.

Financier specializing in affordable housing, historic rehabilitation, and renewable energy tax credits.

Role: $657,000 to be recouped within 6.5 years; 20% rebate on the electricity the city produces for first 6.5 years, 100% in years seven through 40

Funding contribution: 34%

State of Minnesota

Commerce Department

Energy Resources Division

$1,023,150 “Buy Minnesota” Bonus Incentive grant

Funding contribution: 54%

Xcel Energy Inc.

Minneapolis-based utility with 3.4 million electricity and 1.9 million natural gas customers in eight states. Permits to operate two nuclear power plants in Minnesota, one of which is in Red Wing, require Xcel to create alternative-energy sources.

Role: $60,000 Solar Rewards grant

Funding contribution: 3%

Equipment

All Energy Solar

Prescott, Wis.

Sells and installs solar-energy systems in Massachusetts, Minnesota, and Wisconsin.

The Garland Co. Inc.

Cleveland

Manufactures built-up roofing (BUR) systems

Silicon Energy

Mountain Iron, Minn.

Manufactures photovoltaic (PV) modules, commonly referred to as solar panels, which convert solar radiation into direct-current electricity

Our initial discussions were very positive. Everyone was sure that solar energy could lower the building’s electricity consumption.

The problem was cost: $350,000 for a 40 kW system. That was money the city simply didn’t have. The best we could do was add the project to our Capital Improvement Program and see if we could find the funding somewhere down the road.

Then, All Energy Solar President Michael Allen asked if we’d consider doing the project at no cost. Our first reaction was, “Sure, but what’s the catch? Nothing’s free.” But after getting together and hearing about the program he had put together, we began to think it might be possible.

The key word was “possible.” There were a lot of questions, the biggest one being, is this even legal?

Grant funding through Xcel Energy’s Solar Rewards program. Additional funding through the state for buying technology made in Minnesota. Selling federal tax credits and letting someone else benefit from the accelerated depreciation offered for alternative energy projects. Do we have to bid the project? Is this a sole-source possibility? How would we even begin to write a specification that would cover all aspects of such a project? Has anyone ever done this before? Would the system be compatible with the building’s existing electrical systems?

The answers didn’t come quickly, but they came.