You can go crazy trying to explain 84 Lumber.

Who else would spend tens of millions of dollars on a Super Bowl ad that was as confusing as it was controversial? What other firm cheated death with help from a federal grant—and perhaps a jewelry pawnbroker? What other business owners in LBM would host a birthday party featuring Robin Williams, Bette Midler, Christina Aguilera, and the Broadway cast of A Chorus Line?

Then again, what firm has recovered so spectacularly and now is in the middle of one of LBM’s biggest lumberyard expansions?

Head-shaking and eye-rolling are common when other dealers describe how 84 Lumber operates. Love ‘em or hate ‘em, few other dealers have shown as much resilience, creativity, and plain old moxie as this former cash-and-carry based in an obscure unincorporated township south of Pittsburgh.

Maggie’s Time

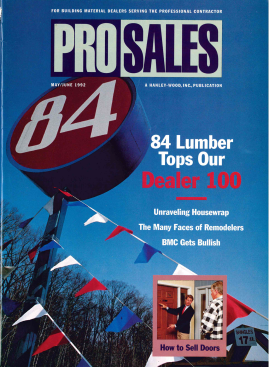

ProSales' May 1992 cover, featuring our first ProSales 100

In 1992, our first ProSales 100 put 84 on the cover in honor of the firm’s top spot on the list. Looking back, that list presaged the end of the era of home centers, as The Home Depot and Lowe’s began to surge nationally. Meanwhile, inside 84, another big change was under way: Maggie Hardy Magerko was succeeding founder Joe Hardy as head of the company.

“When Maggie took over, she changed the direction and vision of the company,” recalls COO Frank Cicero, who at that time had just become head of 84’s operations for a territory stretching from Delaware to Baltimore’s east side. “In the 84 of the past, if we had a product in Pittsburgh, that same product was in California. When Maggie came in, she had the uncanny ability to listen to customers and associates, and if a customer in California says, ‘We need this TigerSaw and these header packages,’ that’s the tool she gave us.

“The difference is taking this nationwide company and really having the ability to listen to customers, and to custom fit every store,” Cicero says. “She encouraged us to be entrepreneurs, listen to our associates, listen to our customers.”

Frank Cicero, COO, 84 Lumber

Cicero also credits Magerko with helping convert 84 from a retail-oriented, cash-and-carry operation to one that focuses on pros. In 1987, he notes, the company had fewer than 90 outside sales reps. Today it has 1,000. A quarter-century ago, you knew you were in an 84 because the only places with heat were at the cash registers and in the bathrooms (where managers often stashed drywall mud so it wouldn’t freeze). Today’s 84 might feature a design center, and lots of buildings are heated. Above all, the product mix varies.

“We are not a cookie-cutter company anymore,” Cicero says. “We are customer-specific, market-driven. I encourage people to see the difference from store to store.”

One new place you can go to see those differences is Holbrook, Mass., on Boston’s southeast side, where 84 is crashing New England’s biggest market with a branch intended to serve high-end customers from Boston to Cape Cod to Providence, R.I. And in April, 84 launched a similar store on Long Island in Riverhead, N.Y.; it already is on pace to collect $10 million its first year, Cicero says.

Today's 84 Lumber: The showroom in Riviera Beach, Fla.

In contrast, for builders in northern Virginia and the District of Columbia there’s a component plant in Winchester, Va., that should hit full production in June. After that, look for a new store in Greensboro, N.C.; another south of Tampa, Fla., that also will serve Sarasota; a second branch in San Antonio; and a revamping of the original San Antonio yard that will feature a showroom.

Out west, 84 moved former HR director Mark Mollico to Phoenix to oversee operations in the Mountain and Pacific time zones. The company is developing property in Tumwater, Wash., to serve the Seattle market, and it’s looking at locations to cater to Portland, Ore.; Salt Lake City; and Stockton, Calif. And unlike virtually every other big dealer, all its growth is organic. It doesn’t believe in buying other dealers.

Grim Times

The current planned surge marks 84’s second great expansion west of the Mississippi. Many yards from its first attempt ultimately were closed during the housing market’s crash a decade ago. Revenues at 84 shrank to $1.42 billion in 2011 from $3.92 billion five years before, and the company closed half its yards and laid off two-thirds of its workers. For several years, 84 operated in large part thanks to a high-interest loan; in effect, this multi-billion dollar operation was living on a credit card.

Craig Webb

84 Lumber circa 2010: A facility in Fallston, Md., with 84's memorable heat lamps

The market’s recovery and a community development block grant helped it survive a period when, according to a Forbes article, Magerko was staring down both personal and corporate bankruptcy. “Magerko decided to buck them all and bet everything she had, from her jewelry collection to her personal checking account, on her ability to turn 84 Lumber around,” the article said.

Unlike scores of other dealers, 84 survived, and Cicero again credits Magerko: “She only had one person to rely on, and that was herself. It was her tenacity, her instincts, that got us through. It was [working from] 6 in the morning to 9 at night. It was hard decisions.”

84’s culture encourages what it regards as nimble thinking but what some other dealers view as being too willing to enter businesses that are too trendy or, to others’ thinking, too problematic. When tiny houses got hot, the company began selling them under private label. When fracking started in upper Pennsylvania, 84 created a division to provide supplies. The company still has GreenEdge Supply, an eco-oriented unit, plus divisions that handle erosion control and disaster recovery. More importantly, it is big on installed sales and serving multifamily builders.

Wide-Ranging Approach

Cicero says this breadth of offerings collectively bolster 84 overall while helping local operations in ways that a one-size-fits-all philosophy would not. “We have successful yards in Morgantown, W.Va., where single-family residential construction there might be 400 to 500 homes a year, but we have a great multifamily business there and build for West Virginia University,” he says. “The company is pacing at $3.1 billion and energy services might be $10 million, but it helps four to five stores in Western Pennsylvania.”

Of that $3.1 billion, Cicero estimates $750 million comes from turnkey and installed services. 84 installs windows in Florida and more in Columbus, Ohio. For Stanley Martin Homes, which puts up about 500 homes a year, “We’re doing soup to nuts—we supply lumber, install insulation, do the windows, do the doors, do the trim—everything except foundations and kitchens. And we supply lumber. They’re asking us to do the framing.”

For all that flexibility, one thing 84 appears to be inflexible on is to stay private—and hungry. “Our personality … is to aspire to be No. 1 in the market you’re in, whether it’s Amarillo or Alamagordo,” Cicero says. “We want to be a family company.”