Do it Best Corp. designed its just-completed Spring Market in Indianapolis to nudge members–for their own good–a bit more forcefully than in past years. Here are key takeaways from the event:

Keep ’em Coming In

Amazon and other online shopping surfaces were an unspoken threat. “We really need to cultivate a sense of urgency,” President and CEO Dan Starr told reporters on May 20. “The competitive landscape in retailing is getting fierce. … You can’t do the things you’ve always done and expect a better result.”

Speaking to the attendees at the market kickoff on May 20, Starr said: “One of my favorite quotes comes from Jack Welch, the former CEO of General Electric. ‘If the rate of change on the outside exceeds the rate of change on the inside, then the end is near.’ We have to…we’re committed to…moving more quickly. In other words, we have to operate at the speed of NOW.”

Notably, two of the ways Do it Best responded involved paint and appliances, products that people still want to see in person before they buy.

Do it Best Corp.

Do it Best's new Color Bar, introduced at its 2017 Spring Market.

Lowering the Color Bar

Do it Best’s paint initiative features a new set of displays designed to make customers feel more confident when they choose a color. The Color Bar has a variety of displays that are meant to be female-friendly, even down to the hook provided at a desktop display where a woman can store her purse while she sorts through color swatches.

“Paint continues to be a key differentiator for bringing consumers into stores,” said Nick Talarico, Do it Best’s vice president of sales and business development. “Paint has not been affected by the shift [online]. And it’s a category where you can win against any competitor out there.”

Craig Webb

An example of Do it Best's new Color Bar display in which the colors of end caps can be changed up to four times a year.

Ch-Ch-Ch-Changes

According to the American Coverings Association, only 7% of all paint gets sold at hardware stores and building material dealers. Those sales were worth $750 million in 2014, the association says. In contrast, specialty paint stores have 59% of the market, home centers 29%, and mass merchandisers 5%.

But while the specialty stores make 70% to 90% of their sales to pros, the association says 96% of paint sales at hardware stores and building material dealers are to DIYers. That’s a much different audience, one that Do it Best requires hand-holding and a helpful environment.

“Selling paint isn’t about selling cans, it’s about selling color,” Talarico continued. “And the color selector is a key element in any paint sale.”

To that end, the Color Bar displays also were designed so that end caps and even the main table can feature new colors as often as four times a year.

Craig Webb

Here's how the same Color Bar display looks with a different color backdrop.

By enabling changes, Do it Best says, dealers can keep the entire unit looking fresh while keeping up with style changes and the seasons.

Frequent Flyers

Marketing Vice President Rich Lynch called on members to use data in new ways, such as by examining whether old practices merit continuing. Case in point: The monthly circular. Every store has key weeks that matter for certain products, and in some months those key weeks could be for vastly different things; May, for instance, typically has outsiized sales gardening and seed at the start of the month, products related to Mother’s Day in the middle, and products devoted to grilling, relaxing–and perhaps painting–at the end. That can be too much to put into just one monthly flyer, he suggested. Meanwhile, other months might not have a key week in them at all. So why stick to a rigid once-a-month schedule?

Lynch also said Do it Best research indicates “Almost nobody in the age of now is holding onto a circular for a couple of weeks and then going into your store.” As a result, he said, putting special prices in the circular good during weeks 3 and 4 of a month “is giving away margins.”

Do it Best

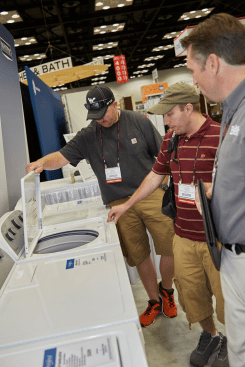

Do it Best members examine the new appliances lineup at the group's Spring Market.

Appliance Opportunities

The collapse of H.H. Gregg and plans to close Sears outlets nationwide mean there are roughly 400 fewer places where Americans can buy appliances. Given that an estimated 126,000 appliances are sold every day, “They’re going to go somewhere,” Paul Eichberger of G.E. America said. “Why not you?”

Eichberger was among the sales reps from appliance companies who came in to show dealers how they could carve out an appliance section in their facilities in as little as 100 square feet and for just $2,400 worth of appliances. Washers, dryers, and refrigerators are likely to have the most appeal, as consumers often don’t even think about buying a new unit until their current model breaks down. Dealers and appliance reps predicted the products will do best in stores located at least 40 miles away from the nearest big-box store.

In 2010, Sears had 31.3% of the appliance business business, Eichberger said, but by 2016’s third quarter it was 22.5% and today it might be around 21%. One point of that market share equals 400,000 units, and while 84% of consumers might start their appliance-shopping experience online, only 12% actually finish it that way. The other 88% still go to a store to buy.