Taking its first big step toward becoming a publicly traded company, US LBM has revealed that in 2016 it incurred a $47.7 million net loss but a profit of $147.2 million after adjusting for interest, depreciation and amortization, and income taxes.

The information was included in an S-1 filing submitted to the Securities and Exchange Commission in which the No. 5 ProSales 100 company set out its plans for an initial public offering. US LBM submitted the document quietly in early May. ProSales became aware of it only today, thanks to a note from our “Big Deals” columnist, Michael Collins.

US LBM Website

US LBM was founded in 2009 with three business units that were cast-offs from Stock Building Supply when that one-time giant was going through bankruptcy-law reorganization. Since then, it has become one of America’s most acquisition-minded LBM operations, acquiring more than 40 companies, It also has opened 19 new greenfield locations, giving it 240 locations serving 29 states. (See its portfolio.) That growth, plus the company’s tech achievements, helped it become ProSales’ 2015 Dealer of the Year.

The investment fund Kelso & Co. acquired a majority stake in US LBM in August 2015 and would continue to control the dealer after the IPO. Management and key employees now hold about 10.7% of the company’s equity.

The S-1’s registration document shows that US LBM recorded $2.66 billion in sales in 2016 at a $1.92 billion cost of sales, giving it a gross profit of $745.4 million; that’s a gross margin of 28%. Selling, general and administrative expenses totaled $597.1 million, while depreciation and amortization came to $109.5 million. Deduct those from the gross profit and operating income falls to $38.8 million.

Then came $80.6 million in interest expense and $5.6 million in unnamed other expenses and $343,000 in income tax. Those sent US LBM to a net loss of $47.7 million.

As with many big and publicly traded companies, US LBM likes to focus on EBIDTA–earnings before interest, taxes, depreciation, and amortization. By that metric, its EBITDA was $147.2 million.

US LBM also reports Adjusted EBITDA, which counts earnings not only before the other EBITDA items but also before IPO-related expenses ($14.2 million in 2016), acquisition expenses ($4.8 million), equipty-based compensation and profit interests ($6.1 million), management fees ($5.6 million), goodwill impairment ($2.3 million), consultant fees ($7.1 million), and other charges. Put them into the mix and US LBM’s Adjusted EBITDA totals $187.9 million.

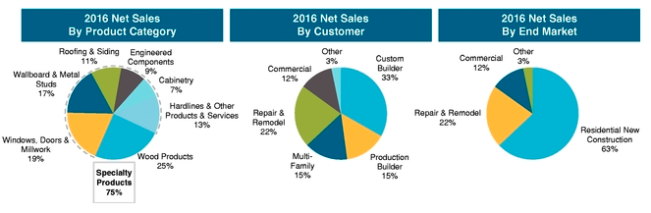

The registration statement also revealed the company’s product mix, sales breakdown by customer, and sales by end market.

US LBM

Among other details revealed in the registration statement:

* US LBM made a point of saying that its specialty products–basically everything aside from lumber and engineered–now account for 75% of all sales, up from 69% in 2014.

* Goodwill totaled $648.4 million, or about 35% of the company’s assets as of December 2016. Intangible assets supplied another $314.3 million of the company’s $1.83 billion in total assets.

* The company’s debt as of December 2016 included $746.6 million in a first-lien term loan, $20.5 million in a second-lien term loan, and $133.8 million in an asset-based lending agreement.

* Ten customers account for 9% of all net sales.

* The company had a net loss of $198 million in 2015 (when it acquired 18 businesses), but a net profit of $15 million in 2014.