Builders FirstSource (BFS), the nation’s biggest pro-oriented lumberyard, reported today its net income rose 28.8% in the second quarter from the previous year to reach $37.9 million. This came on a 9.9% rise in sales to $1.8 billion.

Gross margin improved a tick, to 25.0% from 24.9% in the April-to-June 2016 quarter. Operating income improved by 19.5% to hit $91.3 million, in part because selling, general, and administrative expenses rose more slowly than total sales–just 8.1% year over year. Interest expenses shrank 21.2% to $33.7 million, but income tax expenses nearly quintupled to $19.7 million. Net profit as a percentage of net sales grew to 2.05% from 1.76%.

“[W]e grew sales, excluding closed locations, by 10.1% in the first half of the year,” CEO Floyd Sherman said in a statement. “We saw an increase in sales to the single-family construction end market of 7.4%, as well as growing our sales in the repair and remodeling end market by 5.1%. Additionally, we saw growth in value added products of 9.6%.”

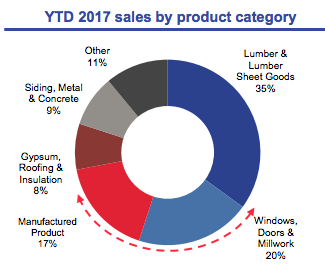

Lumber and sheet goods accounted for 35.6% of all sales revenue, up from 33.5%. The share from manufactured products held steady at 17.0%, while for windows, doors and millwork slipped 10 basis points to 19.5%. The share of sales from gypsum, roofing, and insulation dropped half a percentage point to 7.8%.

The Dallas-based company’s balance sheet as of June 30 shows that goodwill accounts for $740.4 million of the $3.13 billion in assets, while long-term debt is at $1.89 billion. Chief Financial Officer Peter Jackson said BFS aims to cut its debt leverage ratio, now at 4.8. to below 4 by year-end.

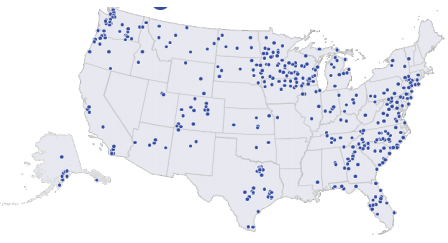

Builders FirstSource locations as of August 2017

BFS reports adjusted EBITDA–earnings before interest, taxes, depreciation, amortization, and “other management-identified adjustments,” which it said mainly involve severance and one-time costs. By that measure, adjusted EBITDA rose to $124 million from $116.7 million.

The company also reports adjusted net profit, which it defines as net income plus integration-related expenses, debt issuances and refinancing costs, changes in tax valuation allowances, and facility closure costs. On that count, adjusted net more than doubled in the second quarter to $43.9 million from a year-earlier $20.9 million.

BFS ranks No. 2 on the latest ProSales 100. It posted $6.37 billion in revenue in 2016.