While self-driving cars, drones, and factory robots get the headlines, the tech systems that empower LBM operations are making less attention-grabbing but still valuable advances. Major providers like DMSi, Epicor, ECi Spruce, Kerridge Commercial Systems (KCS), and Ponderosa all are seeking to improve the efficiency, profitability, and speed of a firm’s operations.

A stand-alone customer relationship management system from DMSi called Building Results CRM tracks sales opportunities according to the stages of construction, the company says. The system also allows sales reps to schedule meetings in real time and review order histories and accounts from their smartphones.

Earlier this year, Epicor launched its BisTrack version 5.5 for North America. Part of the software is a new Pricing Planner tool, which allows dealers and distributors to make pricing decisions and apply rules-based price adjustments. The software can also perform “what if” analysis to predict the potential results of price changes prior to implementation.

“Dealers obviously want to maximize the profits from each item sold, but, if they get too aggressive, they can price themselves out of business,” says Jason Parchomchuk, manager of BisTrack product management.

Parchomchuk says the Pricing Planner helps “identify the products that are most price-sensitive and should be priced competitively, as well as the blind and noncomparable products that can be priced higher.”

ECi Spruce included unit tracking in its B2B mobile application ProLink. This feature allows customers to view and pay bills, shop for products, and place orders. It also connects to ECi’s AnyWare Delivery Tracking software, which enables contractors to view turn-by-turn as their delivery moves to a jobsite.

KCS, a firm headquartered in Britain that aims to make its K8 software as popular here as it is already in Europe, is also focusing on the distribution chain. Alan Cross, KCS executive vice president for North America, says dealers need to be aware of what is making them money and which products are doing well and to give salespeople a deeper and more nuanced understanding of the company’s margins. “The mind-set for these companies [in favor of getting more understanding] is definitely there,” says Cross. Mobile phones have never been more prevalent, and Cross says KCS will continue concentrating on “app-based products, with major development of mobile-oriented delivery management.”

KCS arrived in the U.S. in 2015 through its purchase of Dancik International, a Cary, N.C.–based maker of software for flooring dealers. Then, in 2016, it acquired Mincron Software Systems, a Houston-based firm that primarily serves distributors of plumbing, HVAC, and waterworks products. Now it’s rebranding Dancik and Mincron with the Kerridge Commercial Systems name.

On the horizon, there are a number of areas in which technology aims to streamline business in LBM.

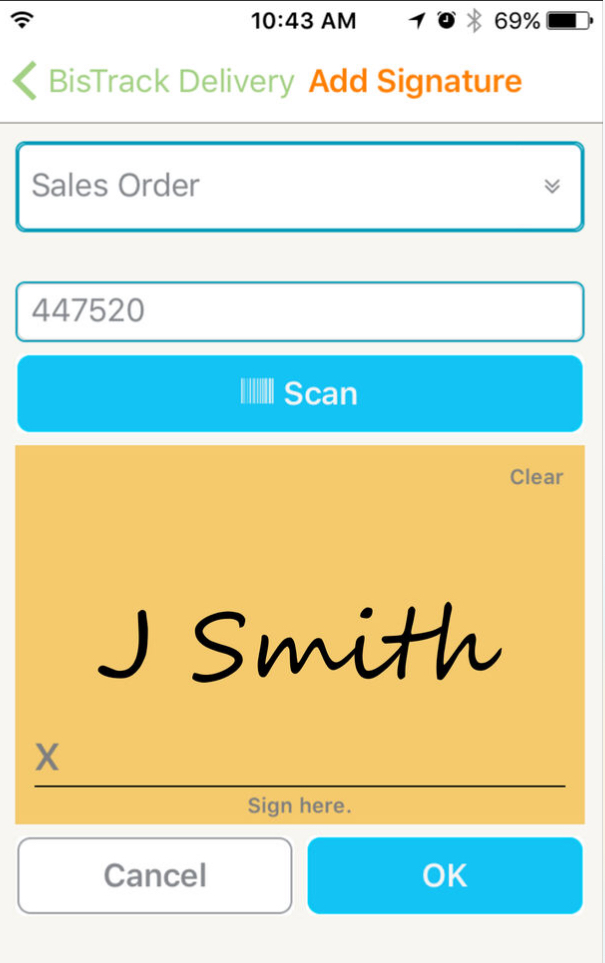

Sarah Bell, a business development manager at Ponderosa, says the company has been focusing heavily on developing mobile apps, especially for Android devices. “Eliminating paper is a key to reducing costs,” says Bell, and things like mobile “signature capture, barcoded transactions, and photographs reduce paper and time and make the whole delivery process more efficient.”

Ponderosa is also rolling out a new interface compatible with Windows 10. Bell says quantifying and tracking labor could save businesses a lot of money.

“LBM is struggling with this,” she says. “Since the recession, companies haven’t been able to track labor in production. Technology that allows companies to track materials used, time, number of workers, and other key production metrics will be valuable.”

Another task where technology can help dealers is deliveries. In order to have the most efficient system possible, Bell says all the “tools have to be tightly integrated.”

“LBM has to get better with GPS and route optimization—can they change the route on the fly?” she asks. “Can they pick up materials at the same time? Are sales reps getting real-time [data]?”

One key, according to Cross, is for firms “to actually use the software and see it as their friend.”

Though ECi Spruce believes businesses have gotten better at doing what used to be paperwork online, some things like payment processing are still resistant to change. “The online and big-box retailers have adjusted margins to accommodate the cost of payment processing and seem to be surviving,” says John Maiuri, president of ECi’s building and construction division. “So many people no longer carry quantities of cash; by not embracing and leveraging card processing features, we believe many [dealers] are potentially letting some business slip away to others.”

For these tech companies, Amazon is a name that gets thrown around a lot. But LBM should be trying to emulate, not replicate, the Silicon Valley giant, these experts tell ProSales. Companies that can integrate, automate, and improve efficiency will have the advantage, they say.