One-time charges depressed Beacon Roofing Supply’s operating and net income in its fiscal fourth quarter ended Sept. 30 from the previous year, even though sales jumped 9.8% to $1.29 billion, the company reported today.

The net income slipped to $45.1 million (3.5% of net sales) from a year-earlier $47.4 million (4.0%), while operating income dropped to $87.2 million (6.8% of net sales) from $95.9 million (8.1%). The gross margin slipped to 25.0% from 25.7%.

Herndon, Va.-based Beacon, the third-biggest dealer on the ProSales 100, pointed out that after-tax acquisition costs related to its 2015 takeover of Roofing Supply Group totaled $12.6 million in the July-to-September 2017 quarter compared with $6.2 million a year earlier. Remove those from the results and adjusted net income actually rose in 4Q17 to $57.8 million from $53.6 million a year earlier, the company said.

Add those acquisition costs to the other elements of EBITDA–income before interest, taxes, depreciation, and amortization–plus the impact of stock-based compensation, and Beacon’s adjusted EBITDA rose to $132.6 million (10.3% of net sales) from $127.5 million (10.9%).

Residential roofing products sales rose 9.3% in the quarter to $699.1 million, or 54.2% of total sales. Sales of non-residential roofing products sales increased 5.3% to $373.7 million, or 29% of all sales. And complementary product sales jumped 20.7% to $217.0 million, roughly 16.8% of the total. Same-day sales excluding acquisitions rose 8.2%.

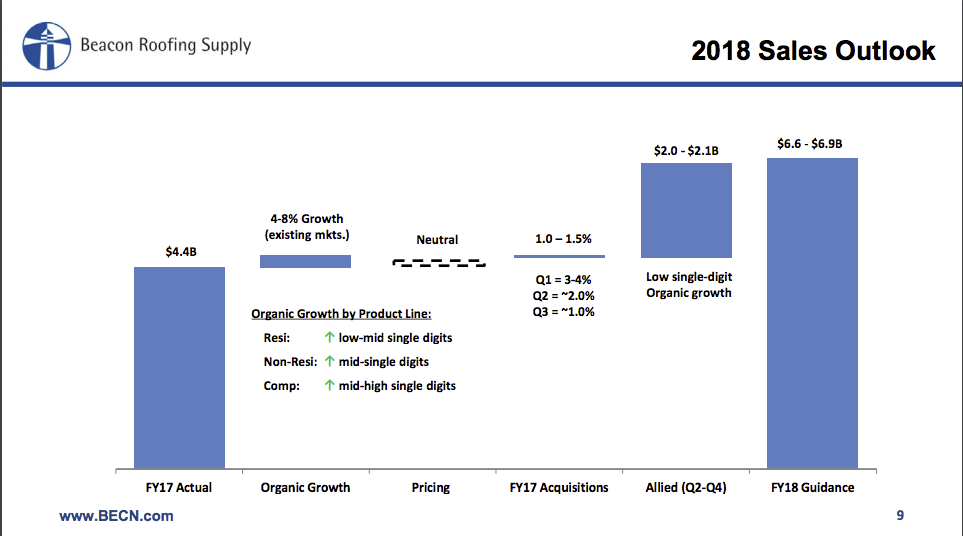

“[M]onthly sales trends accelerated throughout the quarter and early 2018 visibility is supported by solid re-roofing trends and two meaningful storm events,” President and CEO Paul Isabella said in a statement. “… Adding to our great financial performance in 2017 was our August 24 announcement of the Allied Building Products acquisition, which remains on track to close on schedule on Jan. 2. The addition of Allied will enable Beacon to reach new heights in 2018.”

Beacon’s balance sheet shows that goodwill accounts for $1.25 billion of the company’s $3.45 billion in total assets, while intangibles contribute another $429 million. On the liabilities side, the company has $721.3 million in long-term debt.

For all fiscal 2017, the company reported net income increased to $100.9 million (2.3% of net sales) from $89.9 million (2.2%). That came on a 6% rise in sales to $4.38 billion.