The recently enacted tax reform package and other accounting adjustments savaged Builders FirstSource (BFS) financial results for the fourth quarter, leading it to report today a loss of $42.7 million for the period despite a 15% rise in sales to $1.8 billion.

The No. 2 ProSales 100 dealer reported $56.3 million of debt refinancing costs and $29 million in revaluation expenses as a result of the Tax Act. BFS had net income of $6.4 million in the year-earlier period.

Operating income rose 27%, to $64.8 million. Adjusted EBITDA grew 14.2% to $12.1 million.

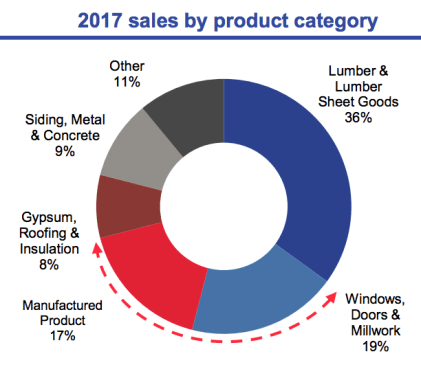

From BFS presentation to analysts March 1, 2018

The Dallas-based dealer credited just over half of its sales growth to higher commodity lumber prices, while sales volume growth contributed another 5.6 percentage points. As was the case with other dealers, lumber price run-ups led to reduced margins; at BFS, the gross margin slipped to 24.2% in the October-to-December period from 25.3% a year earlier. “Commodity price inflation relative to our short-term customer pricing commitments” was a major reason why, BFS said.

“We had a strong finish to the year, growing sales per day, excluding closed locations, by 13.2% in the fourth quarter,” CEO Chad Crow said in a news release. “We saw an increase in sales volume in the single family construction end market of 7.5%, and 5.2% in the repair and remodeling / other end market. Additionally, we saw growth in manufactured products of 11.3%.”

BFS presentation to analysts March 1, 2018

For all 2017, BFS recorded a net profit of $38.8 million, down substantially from $144.3 million in 2017. That’s in large part because the company recorded $53.1 million in income tax expenses in 2017 while tallying $122.7 million in income tax benefits in 2016. Sales rose 10.5% to $7.0 billion and operating profit increased 20.6% to $285 million.

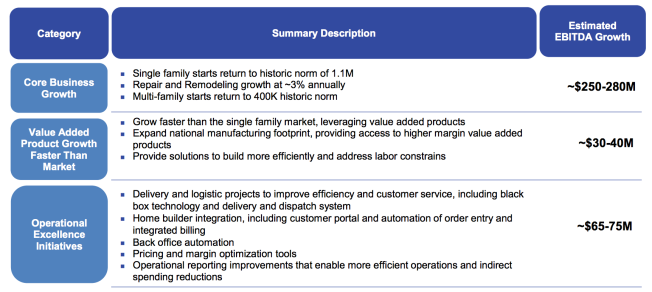

While tax reform shrank the bottom line number in the fourth-quarter report, BFS expects the 2017 Tax Act will result in approximately a 25% effective tax rate in fiscal 2018. “The tax reform will enable us to repay debt more quickly and have additional cash on hand for our priorities, namely; funding growth initiatives,” Chief Financial Officer Peter Jackson told analysts on March 1. Those growth plans include operational excllence initiatives, expansion of the national manufacturing footprint so more value-added products can get sold, and faster growth in the single-family market.

From BFS presentation to analysts March 1, 2018

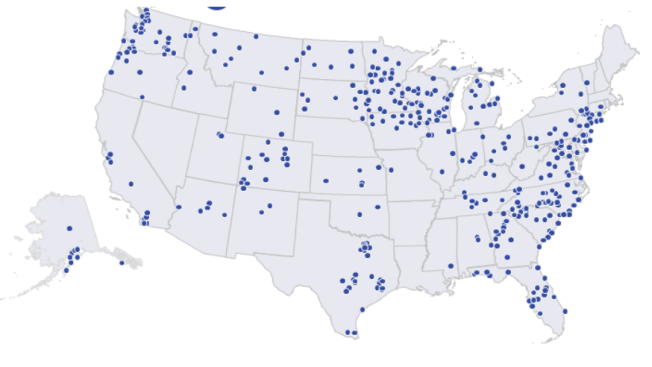

BFS now counts more than 400 locations of all types. “We opened four new plants in 2017,” Crow told analysts. “Right now, we have scheduled to open three new truss plants in 2018. And then some of the efficiency gains are also in upgrading the existing plants, putting in automated lines, overhead laser projection. When you do all those things to a plant, you can add anywhere from 20%, 30%, 35% efficiency to those plants. So combined, there’s a lot to get excited about in growing the value-added side of the business.”

On the balance sheet, goodwill accounts for $740 million of the company’s $3.0 billion in assets as of Dec. 31, while long-term debt totals $1.77 billion. “Our continuing focus on cash generation remains a priority, allowing us to fund these initiatives while continuing to deleverage the balance sheet,” Crow said. “We generated $119 million of net free cash flow in 2017 after funding $62 million of capital investments and reduced our leverage ratio to 4.2 times, 0.6 times lower than prior year.”