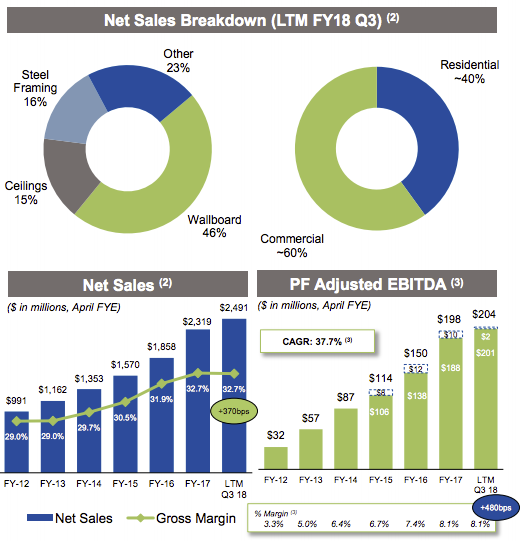

Higher sales, fatter margins, and tax reform combined to more than double GMS Inc.’s net income to $19.7 million in its fiscal third quarter ended Jan. 31 from $8.2 million a year earler, the specialty wallboard, ceilings, and steel studs dealer announced today.

Sales increased 4.1% to $585.5 million; same-store sales rose 2.9%. The gross margin expanded to 33.4% from 33.0%. Operating income swelled 12.5% to $22.67 million. And the income tax line swung to a $4.5 million benefit from a year-earlier $5.4 million provision, thanks largely to recognition of an income tax benefit worth $7.8 million because of the re-measurement of deferred tax liabilities. That re-measurement was prompted by the tax reform legislation enacted in December.

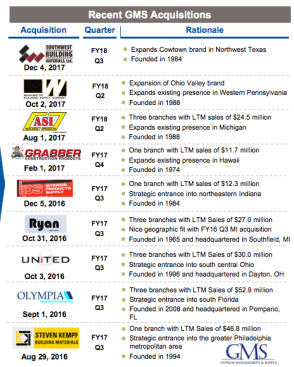

GMS presentation to analysts March 6, 2018

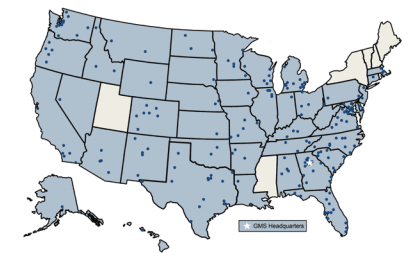

GMS (previously known as Gypsum Management and Supply) ranks 8th on the current ProSales 100 list, having posted $2.23 billion in sales in 2016, 92% of it to pros. The company has 210 facilities nationwide, all flying the flags of local companies.

Wallboard sales rose 0.6% in the November-to-January quarter from the year earlier to reach $256.4 million even though volume shipments dropped 1.9%, partly because of bad weather in the South. A 2.9% boost in prices made the difference. Ceiling sales rose 10.5% to $90.4 million, while steel framing sales increased 3.5% to $96.7 million. Price gains helped both the ceiling and steel framing lines.

GMS presentation to analysts

“We delivered record revenue and adjusted EBITDA performance during the third quarter, topping a very challenging year-over-year comparison,” President and CEO Mike Callahan said in a news release. “I am particularly encouraged that we delivered solid organic revenue growth despite the impact of adverse weather conditions in the southern U.S. … We completed one acquisition in the quarter and maintain a very robust pipeline that we anticipate will become more active over the next few quarters. Looking towards the balance of the year, we remain confident in our ability to deliver another year of record net sales and adjusted EBITDA.”

Atlanta-based GMS defines adjusted EBITDA as earnings before interest, taxes, depreciation, amortization, stock appreciation expenses or income, redeemable noncontrollable interests, equity-based compensation, severance and other permitted costs, the gain or loss on the sale of assets, changes in fair value adjustments to inventory, interest rate cap mark-to-market changes, secondary public offering costs, and debt transaction costs. By that metric, adjusted EBITDA rose to $42.2 million from $40.7 million. The margin was unchanged at 7.2%.

The company’s balance sheet as of Jan. 31 showed that goodwill accounted for $426.8 million of its $1.42 billion in total assets, while non-current long-term debt totaled $581.5 million.