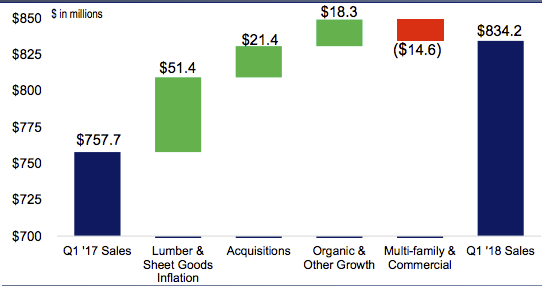

Higher prices for lumber and more components sales enabled BMC Stock Holdings’ net profit to more than quadruple in the first quarter to $15.4 million from a year-earlier $3.7 million on a 10.1% rise in sales to $834.2 million, the company reported today.

Roughly 6.8 points of that 10.1-point sales increase came from higher selling prices for lumber and sheet goods, the nation’s second-biggest full-service lumberyard said. Recent acquisitions added another 2.8 points, while the final half point came via organic growth.

A 100 basis-point increase in profit from lumber and sheet goods from 2017’s first quarter enabled gross margin to rise to 23.9% from 23.5%. Gross profit increased 11.7% to $199.1 million.

Selling, general, and administrative expenses increased by 7.6%, to total $160.2 million. Roughly $4.5 million of the $11.3 million rise at the Atlanta-based dealer related to expenses at acquired facilities, and $3.5 million was for higher employee compensation.

BMC presentation May 8, 2018

Notably, the company also incurred $1.8 million in severance and executive search costs related to the Jan. 10 departure of president and CEO Peter Alexander. The Board of Directors has narrowed the field of candidates, BMC reported, but no successor has been found as yet.

Operating income rose nearly 1.5 times, ascending to $24 million from $10.5 million. BMC’s version of adjusted EBITDA–net income plus interest expense, income tax expense, depreciation, amortization, merger and integration costs, non-cash stock compensation expense, acquisition costs, and other items–jumped to $47.2 million (a 5.7% margin) from $33.6 million (4.4% margin).

Sales of lumber and sheet goods rose 17.9% to $288.1 million, or just over a third of all sales. Structural component sales did even better, skying 23.6% to $135.8 million. Net sales of the company’s Ready-Frame system rose 47.1% to $50.2 million.

The balance sheet shows that goodwill accounts for $264 million of the $1.54 billion in total assets. On the liabilities side, long-term debt totaled $357 million.