Builders FirstSource (BFS) combined a 13.4% rise in net sales with relative cuts in overhead and interest payments to produce a 49.3% jump in net income for the second quarter from the year before to reach $56.6 million, the company reported today.

Higher commodity prices propelled about two-thirds of the 13.4% sales rise while increased volumes produced the rest, the Dallas-based dealer estimated. But those same increases also were cited for a 130-basis-point decline in gross margin to 23.7% because of the run-up’s impact on short-term customer pricing commitments.

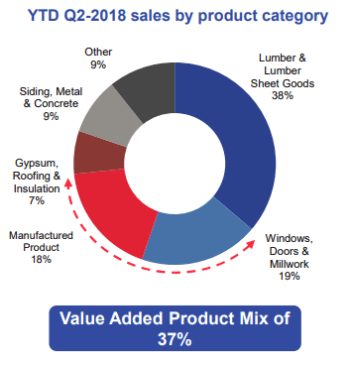

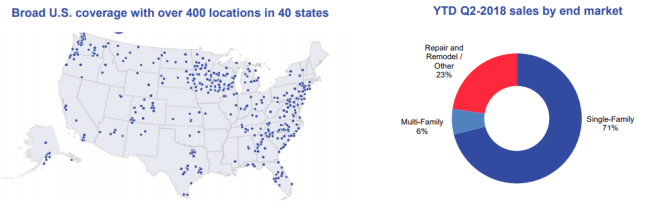

BFS presentation to analysts Aug. 8, 2018

Selling, general and administrative (SG&A) expenses rose 6.0% to $391.8 million. That’s 18.7% of sales compared with 20.0% in 2017’s April-to-June period. “The significant decrease .. was driven by cost leverage and continued cost management,” BFS said.

Meanwhile, interest expense declined to $29.0 million from $33.7 million a year before–a product largely of refinancing transactions executed in 2017, it said.

BFS prefers to measure itself in terms of adjusted EBITDA–earnings before interest, taxes, depreciation, amortization, integration-related expenses, and other unusual costs. By that metric, adjusted net income rose 45.6% to $62.6 million from $43.0 million.

The assets side of the company’s balance sheet as of June 30 shows goodwill amounts to $740.4 million of the $3.2 billion in total assets, while long-term debt stands at $1.95 billion.

BFS presentation to analysts Aug. 8, 2018

BFS ranks second on this year’s ProSales 100 and is the biggest full-service lumberyard on the list.

Aug 8 update:

During a conference call with analysts, BFS CEO Chad Crow outlined the company’s growth plans. They include three new truss plants, 10 new lines in existing plants, one new millwork facility, and capacity additions to many more. “We’ll continue to invest in these higher margin products in order to grow them faster than the overall housing market by adding further to our existing network of 57 manufacturing facilities strategically located across the country,” Crow said, according to a transcript of the conference call. Later, he said BFS’ plans “call for investing in 17 new truss and eight millwork indoor facilities over the next four years, including the four facilities under way this year.”

With regard to operating expenses, Crow said BFS is seeking to get one-third of its planned $65 million to $75 million of annual savings from improved deliveries. “We’ve rolled out our new delivery dispatch management system to about 100 of our locations and expect to have that rolled out to 140 by year end,” he said. “And we’re starting to see a gap now between the markets that are on the system and have been on it a while and have adopted it versus those that aren’t on it yet. We’re seeing driver on road percentage go up. We’re seeing engine idle times decrease.”

In addition, BFS plans in the fourth quarter to offer incentives to drivers to begin managing their day by the company’s desired metrics.