BlueTarp Financial’s Building Supply Index experienced year-over-year decline for the first time since 2016, driven largely by a decline in consumer confidence, according to the Maine-based credit management company.

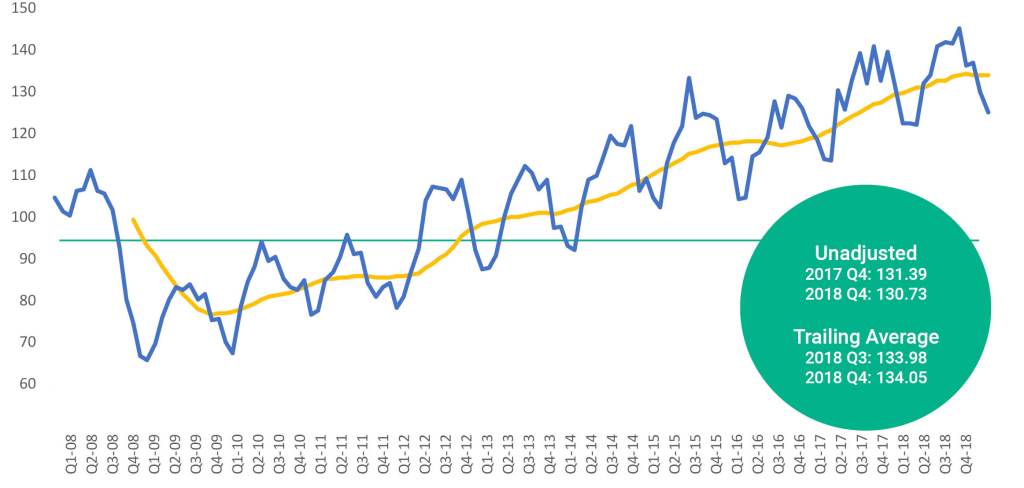

The index—based on public data such as consumer sentiment, building permits, and construction spending, along with proprietary data—was a seasonally unadjusted 130.73 in the fourth quarter, down 0.66 points from the fourth quarter in 2017. The decline year-over-year was the first such slowdown since the second quarter of 2016. The seasonally adjusted, 12-month trailing average was 134.05, up 0.07 points from the third quarter reading.

The index value of 100 is benchmarked to April 2013, and values above 100 reflect healthy economic activity. BlueTarp bases its proprietary data on accounts with more than 120,000 pro customers that it manages for more than 2,000 building material suppliers nationwide.

The year-over-year decline in the index can largely be attributed to a drop in consumer confidence. The consumer confidence index reached a two-decade high reading of 137.9 in October 2018, but dipped to 128.1 in December 2018.

Photo Courtesy of BlueTarp

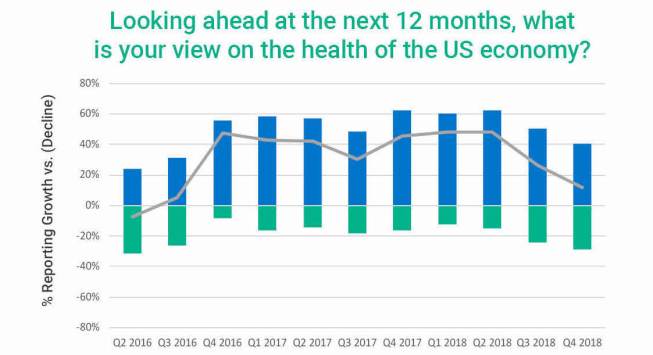

BlueTarp conducts a supplemental survey gauging contractor sentiment. The survey found that confidence in the future health of the economy continues to waver among contractors. Only 40% of surveyed contractors anticipate an economic improvement within the next 12 months, a near 20% decrease from the third quarter of 2018. On the contrary, nearly 30% of contractors anticipate an economic decline. Uncertainty among contractors was sparked by rising tariffs, interest rates, and trade issues.

“Q4 gave many a reason to pause. The equity markets tumbled from October levels and the partial government shutdown took their toll on consumer confidence. Our contractor survey also reflected greater concerns,” said BlueTarp CEO Scott Simpson. “The equity markets have recovered somewhat in Q1 which may slow pessimism piling up on top of pessimism.”

Photo Courtesy of BlueTarp

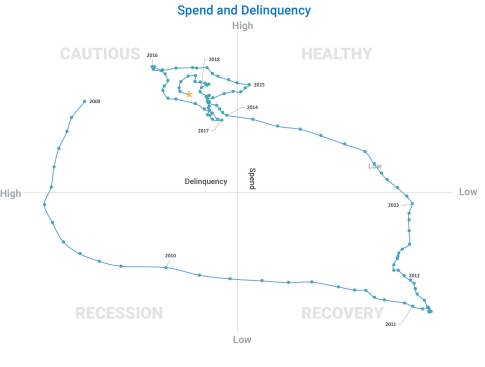

One of the ways BlueTarp tracks trends is with an X-Y axis chart showing customer preference (above) in terms of both spending and delinquencies. For the past several years, BlueTarp says accounts have been in the Cautious quadrant, in which spending is high, but the delinquency rate is slightly worse than desired.