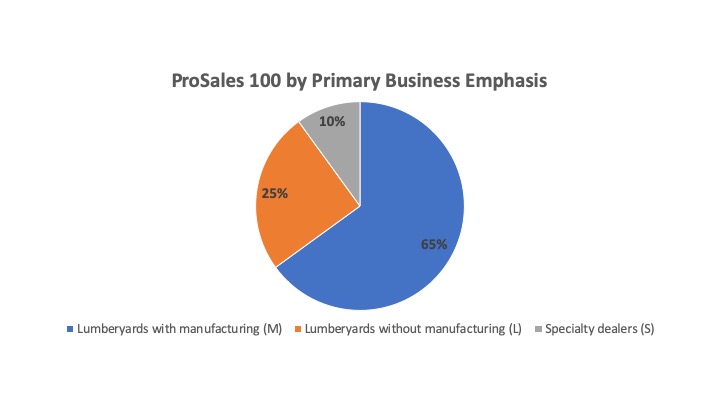

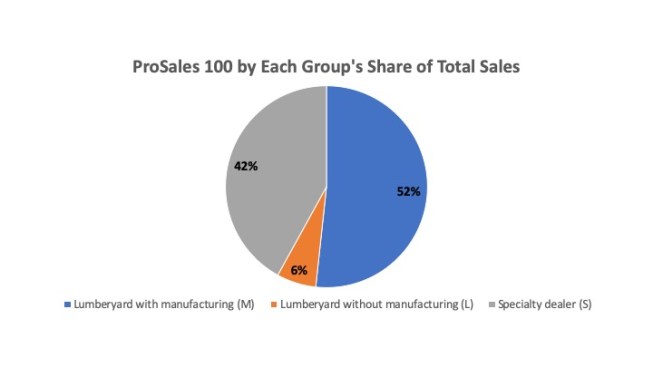

To gain a broad view of all 100 dealers on the list, it’s important to recognize the three types of companies that are represented: lumberyards with manufacturing capabilities, lumberyards without manufacturing capabilities, and specialty dealers.

The largest group on the list consists of 65 lumberyards with manufacturing capabilities. This group generated $31.7 billion (nearly 52%) of the group’s overall revenue. There are 25 lumberyards without manufacturing capabilities, which contributed only $3.9 billion (about 6%) to the group’s overall revenue. There aren’t many specialty dealers on the PS100 list—you’ll find only 10. However, this small group punches well above its weight, accounting for an impressive $25.8 billion (42%) of the PS100’s overall revenue.

Compared to last year’s list, the share of lumberyards without manufacturing dropped from 30% to 25% this year. On the contrary, yards with manufacturing edged up from 59% last year to 65% of the companies in this year’s group. Specialty dealers changed slightly from 11% of last year’s list to 10% of this year’s group. Considering the growth of the overall industry in recent years, the numbers suggest that if your company is only focusing on selling products and not providing additional services, business will only get tougher, especially during an economic downturn.