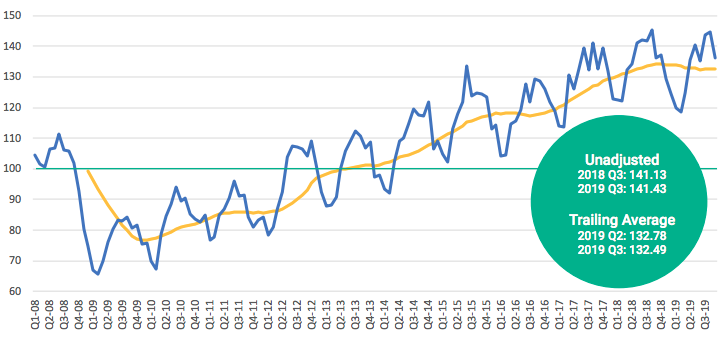

BlueTarp Financial’s Building Supply Index remained flat through the third quarter, with the Q3 2019 unadjusted index reading of 141.43, the same as the unadjusted index a year ago. The trailing 12-month average for the index, which accounts for seasonality, also remained flat at 132.49 compared to the previous quarter, according to BlueTarp.

The Building Supply Index is based on public data such as consumer sentiment, building permits, and construction spending, along with proprietary data. The index value of 100 is benchmarked to April 2013, and values above 100 reflect healthy economic activity. BlueTarp bases its proprietary data on accounts with more than 120,000 pro customers that it manages for more than 2,000 building material suppliers nationwide.

BlueTarp Financial

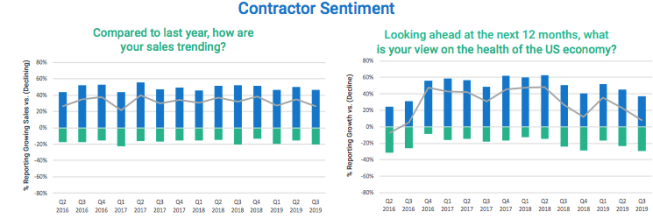

While the overall index level remains robust, BlueTarp says there are warning signs of a potential economic slowdown on the horizon. BlueTarp’s contractor spending has been declining over the last 15 months and reached its lowest levels since 2014. BlueTarp’s supplemental contractor survey in the third quarter saw a material decline in the outlook of the future. Nearly 30% of contractors that BlueTarp surveyed thought the economy would decline in some way within the next 12 months, an increase from 22% in the second quarter. Concerns over the trade war and the upcoming presidential election are the primary drivers of the increase in contractor uncertainty, according to BlueTarp.

“Average spend per contractor has hovered around the same level for most of the last four years,” Scott Simpson, CEO of BlueTarp, said in a public statement. “The next 3-4 months will be telling to see if the decline, we are now seeing, stops, reverses itself, or continues.”

BlueTarp Financial

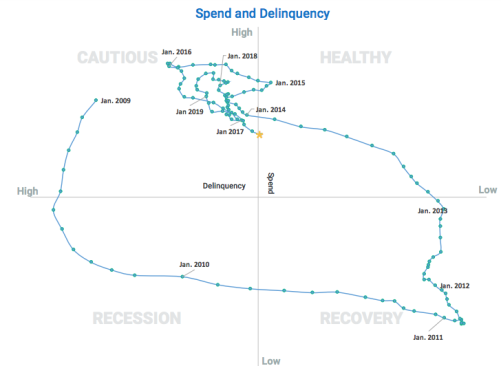

One of the ways BlueTarp tracks trends is with an X-Y axis chart showing customer spending and delinquencies. For the first time in nearly four years, BlueTarp reports accounts are in the Healthy quadrant, in which spending is high and the delinquency rate is low.