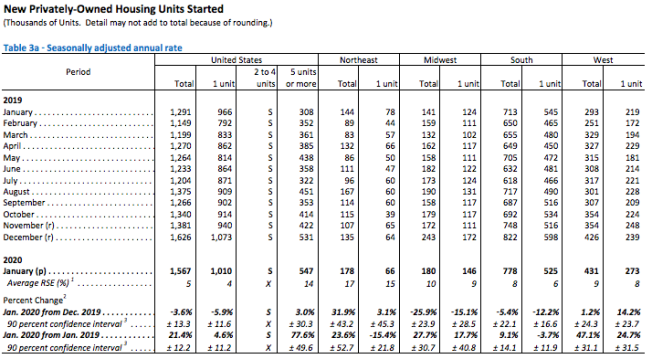

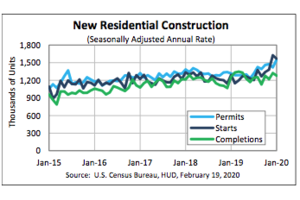

Privately‐owned housing starts in January were at a seasonally adjusted annual rate of 1,567,000, 3.6% below the revised December estimate of 1,626,000, but 21.4% above the January 2019 rate of 1,291,000, the Commerce Department reported Wednesday. Single‐family housing starts in January were at a rate of 1,010,000, 5.9% below the revised December figure of 1,073,000. The January rate for units in buildings with five units or more was 547,000.

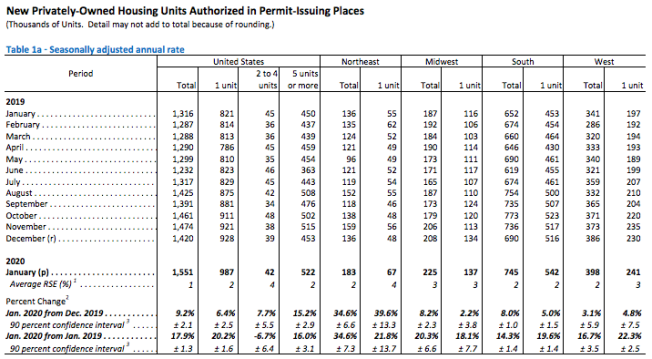

Privately‐owned housing units authorized by building permits in January were at a seasonally adjusted annual rate of 1,551,000, 9.2% above the revised December rate of 1,420,000 and 17.9% above the January 2019 rate of 1,316,000. Single‐family authorizations in January were at a rate of 987,000, 6.4% above the revised December figure of 928,000. Authorizations of units in buildings with five units or more were at a rate of 522,000 in January.

Privately‐owned housing completions in January were at a seasonally adjusted annual rate of 1,280,000, 3.3% below the revised December estimate of 1,323,000 but 1.5% above the January 2019 rate of 1,261,000. Single‐family housing completions in January were at a rate of 877,000, 3.5% below the revised December rate of 909,000. The January rate for units in buildings with five units or more was 397,000.

Lawrence Yun, chief economist for the National Association of Realtors, parsed the report: “The latest month’s decline in housing starts is nothing to be concerned about. This housing data is quite jumpy. What is important is the trend line, which is clearly on an upward path. Higher housing permit issuances are also a positive indicator for even greater production in the months ahead. Housing starts of 1.57 million units (annualized rate) in January following 1.63 million in December marks the only two months in over a decade where activity has been above the historical average of 1.5 million a year. More construction will mean more housing inventory for consumers in the later months of this year. Spring months could still be quite tough for buyers, since it takes time to convert housing starts into actual housing completions. As trade-up buyers move into these new completed homes in the near future, their existing homes will be released onto the market.”

Joel Kan, AVP of economic and industry forecasting at the Mortgage Bankers Association, said, “The housing market is

still experiencing supply shortages in many areas, but January’s residential construction data show yet another step in the right direction. Following a surge of activity in December, housing starts pulled back slightly in January, but the current pace is still over 1.5 million units – remaining close to the highest levels since 2006. Single-family starts decreased last month, but exceeded an annual pace of one million units for the second month in a row, and the first time since 2007. Multifamily starts also continue to be robust, rising for the second straight month and seeing the strongest month of production since 1986. In a promising development for new housing supply levels, single-family permits increased for the third month and to the highest level since 2007. Similar to the findings in MBA’s January Builder Applications Survey released this week, home builders are continuing to ramp up production to meet the demand from potential buyers, and mild winter weather is helping some of the increased activity in the Midwest. The success of the spring buying season greatly depends on how much new and existing inventory is on the market.”