In March, the novel coronavirus (COVID-19) quickly disrupted many American lives and businesses. It brought some industries to a grinding halt and damaged many companies to varying degrees financially. Fortunately, state and local stay-at-home orders across the United States largely deemed construction supply dealers as essential businesses, enabling them to keep operating during the pandemic. Actually, according to the Hanley Wood State-by-State Tracker of stay-at-home orders, not one state deemed construction supply dealers non-essential. However, several states, such as New York, New Jersey, and Pennsylvania, had either deemed commercial and residential construction as non-essential businesses or issued a stay-at-home order that was too vague to make a clear determination. This is naturally taking its toll on dealers, especially as so many of them heavily depend on pros for their business.

As dealers do their best to serve customers, several unanswered questions remain. How long will this pandemic last? How will it affect employees and business? How does my company compare with other businesses in the LBM industry?

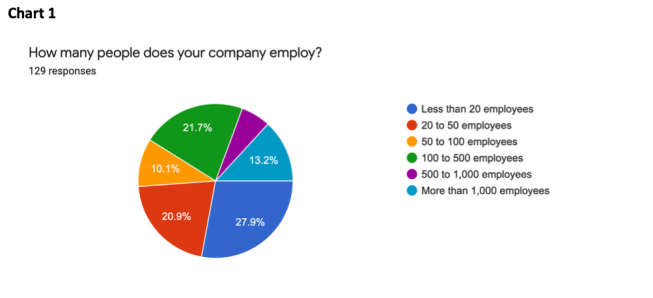

To get a sense of what dealers are thinking, regarding the coronavirus and its impact on their businesses, ProSales magazine surveyed 130 LBM professionals earlier this month (between April 3 and April 9). The results of our exclusive research are below, but here are some highlights worth mentioning:

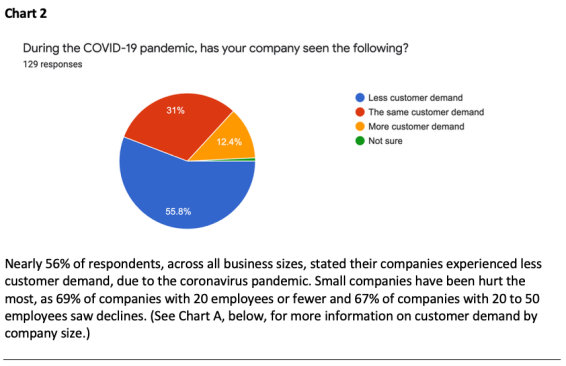

- Nearly 56% stated their companies had already experienced a decrease in customer demand due to the coronavirus pandemic (Chart 2).

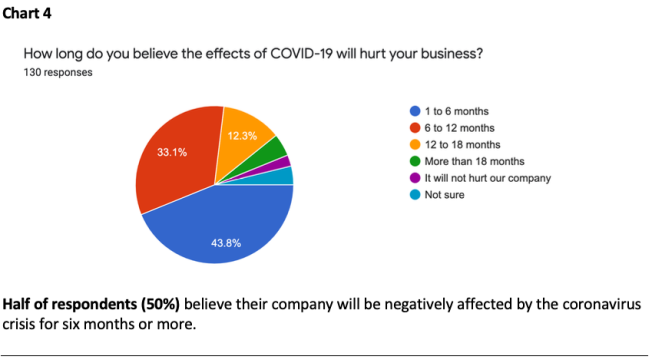

- Half (50%) of respondents believe the viral outbreak will negatively affect their business for more than six months (Chart 4).

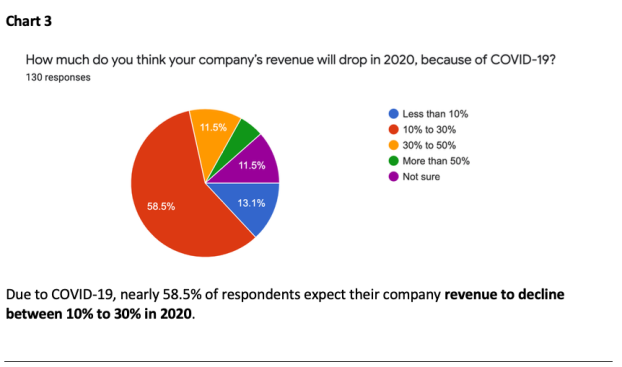

- More than half (58.5%) believe their companies will lose 10% to 30% of their revenue in 2020, due to the coronavirus (Chart 3).

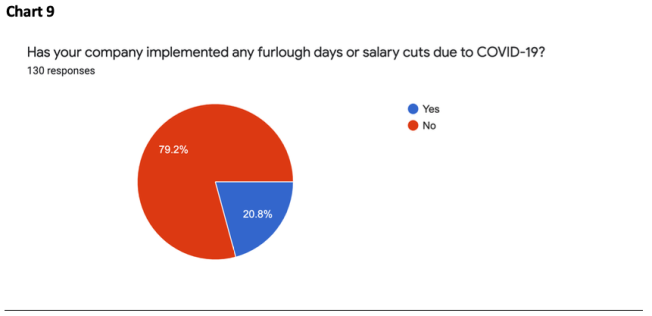

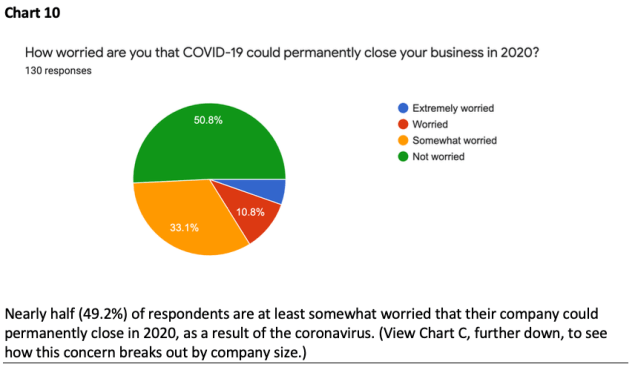

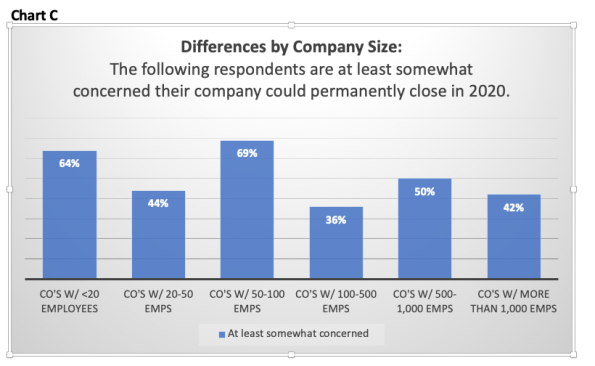

- Nearly half (49.2%) state they are at least “somewhat worried” that revenue lost due to the coronavirus could force their company to permanently close this year (Chart 10). To see how this concern breaks out by company size, view Chart C toward the bottom.

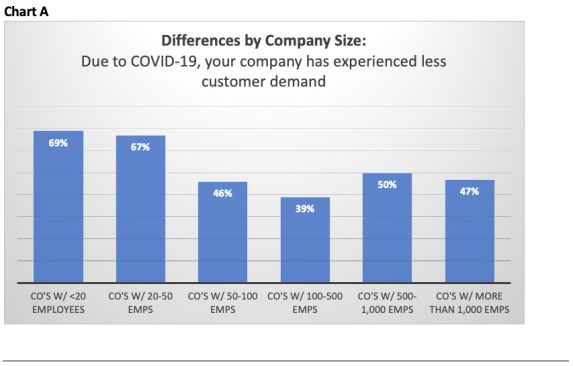

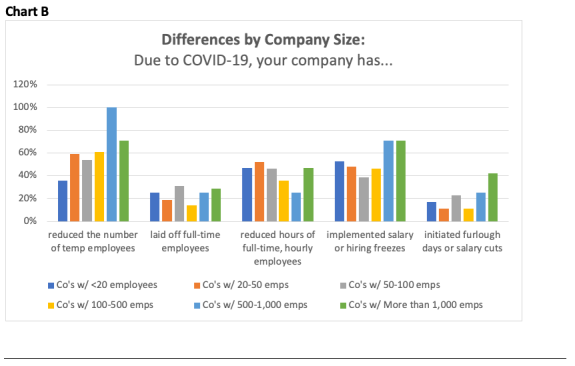

The first 10 charts reveal the results of all survey respondents, across all company sizes. Charts A, B, and C (toward the bottom) reflect respondents’ answers grouped by company size.

-

Congress’s Small Business Stimulus Plans Quickly Fall Short

The Paycheck Protection Program and the Economic Injury Disaster Loans stimulus plans ran out of money.

-

Selling During the Coronavirus Pandemic

Life is 10% what happens to us and 90% how we react to it.

-

COVID-19: ‘An Economist’s Worst Nightmare’

In a recent webinar, Ali Wolf, chief economist for Meyers Research, says she is hoping for a steep but short recession.

-

ABC Supply, SRS, and 84 Lumber Respond to Coronavirus

The dealers share their business continuity plans amid the developing global pandemic.

-

Coronavirus Business Continuity Plans You Can Implement Now

See how different construction industry pros are preparing their businesses and employees for the COVID-19 pandemic.

-

Department of Homeland Security Designates Residential Construction as Essential

States are permitted to make their own determinations, as Pennsylvania and New York have banned new home construction.

-

Maintaining Business Continuity with a Remote Workforce

Evelyn Lee shares tools and best practices for design firms that are transitioning their operations in wake of the COVID-19 global pandemic.