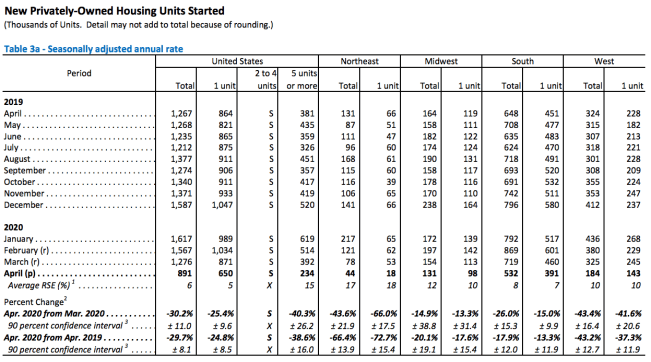

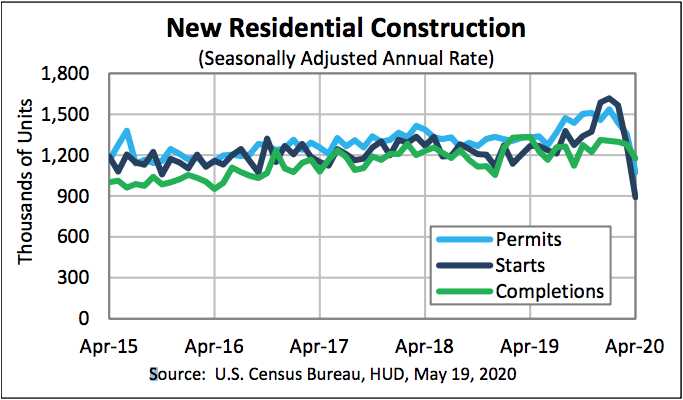

Privately-owned housing starts in April were at a seasonally adjusted annual rate of 891,000, 30.2% below the revised March estimate of 1,276,000 and 29.7% below the April 2019 rate of 1,267,000, the Census Bureau and the Department of Housing and Urban Development jointly announced Tuesday. Wall Street was expecting an annual pace of 900,000 due to the economic shutdowns related to the COVID-19 outbreak.

Single-family housing starts in April were at a rate of 650,000, 25.4% below the revised March figure of 871,000. The April rate for units in buildings with five units or more was 234,000, down 40.3% from March.

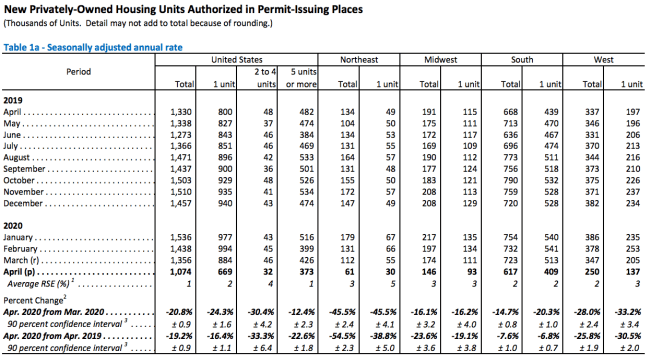

Housing units authorized by building permits in April were at a seasonally adjusted annual rate of 1,074,000, 20.8% below the revised March rate of 1,356,000 and 19.2% below the April 2019 rate of 1,330,000. The reading beat analyst expectations of a rate of 996,000.

Single-family authorizations in April were at a rate of 669,000, 24.3% below the revised March figure of 884,000. Authorizations of units in buildings with five units or more were at a rate of 373,000 in April, down 12.4% from March.

Housing completions in April were at a seasonally adjusted annual rate of 1,176,000, 8.1% below the revised March estimate of 1,279,000 and 11.8% below the April 2019 rate of 1,334,000.

Single-family housing completions in April were at a rate of 865,000, 4.9% below the revised March rate of 910,000. The April rate for units in buildings with five units or more was 304,000, down 16% from March.

Joel Kan, AVP of economic and industry forecasting at the Mortgage Bankers Association, assessed the damage. “Both single-family and multifamily starts dropped over the month due to the impacts from COVID-19-related social distancing efforts and declining construction activity. This was the lowest level of overall housing construction since 2013 – and is in line with the 12% year-over-year drop reported in MBA’s Builder Application Survey (BAS) last week. Permits for new construction were also down significantly over the month, but completions did not decline to the same extent, as projects in many parts of the country were allowed to continue.

“While our forecast is for a rapid rebound in housing activity later in the year as home buyer traffic returns, housing supply remains very tight. Today’s news – combined with the April employment report showing almost one million construction job losses – may potentially slow the rebound in new construction that will be needed to completely revive the housing market.”