Never better. Ever better.

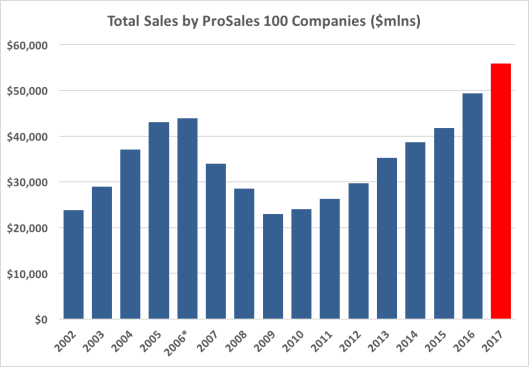

Take your pick from these two ways to describe the 2018 ProSales 100 (click here to register and view the list) and either will apply. The group’s $55.85 billion in collective revenues in 2017 is unprecedented in the list’s 26-year history, even after adjusting for inflation. And yet, even with that accomplishment, one gets the sense that America’s biggest pro-oriented dealers have set themselves up to climb to even higher levels in the years to come.

Yes, part of the 15.1% gain by this year’s group from what they sold in 2016 can be credited to higher lumber prices. They also benefited from the 2.5% rise in housing starts and from a robust remodeling market. But there also are signs that dealers have become more efficient. Payroll count increased only 7.3%—less than half the sales growth rate—to reach 108,673, while the number of facilities climbed just 2.9%, to 4,476.

“A world record year,” wrote Bill Gutherie of Michigan’s Gutherie Lumber, where sales jumped 23.5%, to $70.8 million, and sales per worker climbed 14%. “We sold lots and lots o’ sticks.”

ABC Leads Again

The ProSales 100’s membership evolves each year, reflecting construction supply’s general trends toward dealmaking and specialization. No. 1 ABC Supply represents both. Its sales leaped 30.1%, to $9.33 billion, in part through its December 2016 acquisition of L&W Supply, giving it strongholds in both roofing and gypsum supply. ABC also bought a company in Ohio last year and opened 12 greenfield locations.

Builders FirstSource (BFS) comes next; it has just about finished digesting ProBuild, a former No. 1 it acquired in 2015. BFS is followed by Beacon Roofing Supply, another roofing specialist, which in January completed its acquisition of Allied Building Products. While Allied now is part of Beacon, it shows up at No. 7 on the list because our results cover the 2017 calendar year. And even if Beacon’s takeover of Allied—2017’s biggest deal—had been completed that year, the combination wouldn’t be enough to move Beacon up from No. 3 in the rankings.

The top 10 list continues with BMC, 84 Lumber, US LBM, Allied, GMS, SRS, and a newcomer: Foundation Building Materials, a California–based drywall distributor that went public last year. The list of specialty dealers also includes a business that focuses on one product (U.S. Fence), an exteriors specialist (Lansing Building Products), and a holding company whose portfolio includes a bit of everything (Kodiak Building Partners).

All told, specialty dealers make up 11% of list members but account for 44.1% of the sales. Lumberyards with manufacturing facilities make up 59% of the total and 48.3% of sales. And lumberyards without manufacturing are 30% of the group but contribute just 7.6% of PS100 sales.

There’s a belief that small, independent dealers are a dying breed. Census Bureau numbers through 2015 suggest that thousands of construction supply companies with 20 employees or fewer have bit the dust, but consolidation among bigger dealers has thinned those ranks too. As a result, the percentage of under-20-employee outfits versus those with 21 workers or more has remained roughly the same this century. That said, the big are getting bigger. The top 10 grew revenues by 16.2% while the other 90 increased 12.3%. The 10 giants’ $39.71 billion accounted for 71.1% of all 100’s revenues, the first time ever that the top 10’s share has exceeded 70%.

Revenue Sources

PS100 members might share a common affection for professional contractors—69 of the 100 get at least 90% of their revenue from pros—but how they earn their coin varies dramatically. For example, take the top five gainers in sales percentage. The leader, Building Component Supply (up almost 105% after absorbing a sister company), specializes in trusses and wall panels. No. 2 Parks Building Supply (up 55%) added a contractor-oriented appliance program, expanded its cabinetry and countertop business, and got more into the more commercially oriented categories of gypsum, metal studs, and acoustical ceiling panels. No. 3 Kodiak Building Partners (up 46%) owed much of its growth to acquisitions. The fourth-fastest grower, NorCal Lumber (up 42%), specializes in turnkey framing for multifamily and similarly big projects. And No. 5 Tindell’s (up 40%) is a lumberyard that benefited from rebuilding efforts after a fire. Installed sales and truss manufacturing also helped.

Lumbering Along

If you were to put all of the PS100 dealers into a pyramid tiered by revenue growth, you’d bury five dealers underground; they lost money. The base layer would consist of 43 companies whose revenues grew between zero and 9.9%. Above that would be 29 PS100 dealers with revenue growth of 10% to 19.9%. One level higher, you’d place 13 dealers that grew 20% to 29.9%. And at the peak would be 10 companies with at least 30% gains.

Virtually every dealer benefited from increases in products, particularly lumber. The Random Lengths average composite price for framing lumber rose 19.4% in 2017, and its annual average price for structural panels jumped 18.1%. That far outpaces products like steel goods, which rose 7.8% on the Producer Price Index, and asphalt/felt products used in shingles, up 2.6%. Lumber’s increases certainly propelled some of the most wood-dependent members of the ProSales 100, such as Idaho Pacific Lumber, where sales jumped 18.6%, and Bridgewell Resources, which had a 20.1% gain. BFS says higher commodity prices generated roughly three-fifths of its 10.5% revenue gain in 2017, while BMC figures the price increases were responsible for nearly half its 8.8% increase. So far this year, dealers are getting even more benefits from lumber.

Efficient Selling

Some of the most significant statistics in this year’s report involve sales per employee, because higher sales numbers per worker should lead to higher profits. The PS100’s average sales per employee grew 7.3% in 2017, to reach a record $513,963. To put that achievement in context, go back to what the ProSales 100 did in 2006, just before the peak of the housing boom. Those PS100 companies generated $44.95 billion in revenue with a total of 126,477 workers. That works out to $347,463 per worker. Adjust that number for inflation and you come up with PS100 companies getting the equivalent of $424,470. And that was at a time when dealers have said they’ve never been busier.

By contrast, the per-worker sales average in 2017 was 21% better. How? Because dealers today are generating more revenue more efficiently than ever before.

One would think that the dealers who specialize in brokering lumber sales—firms like Shelter Products, Matheus Lumber, Bridgewell, and IdaPac—would gain the most. All four of them do rank way above other PS100 members on a per-employee basis, ranging from $3.2 million for Shelter to $1.6 million for IdaPac. But if you examine the percentage increase in sales per worker between 2016 and 2017, other dealers move to the top.

Fewer People, More Revenue

For instance, Big Creek Lumber boosted sales by 24% even as its year-end employee counts dropped to 103 from 112. That produced a 35% year-over-year gain in sales per worker. The story is similar at Foxworth-Galbraith, where sales rose 28% but the number of employees dropped to 950 from 1,000. That also yielded a 35% year-over-year efficiency gain. At Bailey Lumber & Supply, the employee count fell by 13% but sales went up 7.1%, so per-employee sales grew by 24%. And Sims-Lohman went from 470 to 424 employees while pushing sales 8% higher. That produced a 20% gain in sales per worker.

Sometimes those gains weren’t intentional. Big Creek says it would have hired more people if it could, but its market just over the hills from Silicon Valley is desperately short of good workers. As one might expect, dealers that don’t sell much lumber or that have lots of retail sales didn’t rise to the top of this category. Siding and exteriors specialist Lansing Building Products boosted sales 15.5% to keep its No. 15 ranking on the list, but sales gain per employee was a middling 10.6%. Meanwhile, three of the most rural PS100 members—Higginbotham Bros. of Texas, Mead Lumber of Nebraska, and Bloedorn Lumber of Wyoming—saw their sales per employee slip amid weak to no sales growth.

Revenue Prospects

For this year, the 86 PS100 members who responded to questions about prospects gave answers that align with what economists are saying. The dealers said new-home builders were most likely to bring them more revenue in 2018, with 82% of respondents expecting that customer segment to grow.

Metrostudy agrees: The data division of ProSales’ parent company predicts housing starts will rise 4.5% this year, to 1,256,000, and keep growing through 2020. Remodelers came in second, with 65% of PS100 dealers seeing even more growth from that sector on top of what have been unprecedented boom years for repair and remodeling.

Remodeling, a sister publication to ProSales, reports this month that sales for the top 300 full-service remodelers on its Remodeling 550 list jumped 8% in 2017 from the year before and is forecast to rise another 12.2% this year. Meanwhile, the 150 biggest home improvement companies on the Remodeling 550 reported that sales rocketed 41% last year from 2016. This same group predicts a 17% jump in sales this year.

Metrostudy’s Residential Remodeling Index finds that economic conditions for remodeling today are even better than they were at the housing market’s peak in 2007—and they’ll keep improving consistently for several more years. Then there’s the Joint Center for Housing Studies of Harvard University, which predicts 2018 home improvement and repair spending will rise 6.6%, to $414 billion.

In contrast, only 38% of participant PS100 companies predicted higher sales from retail customers, and 57% expected no change. This might relate to dealers’ relative lack of interest in the segment, particularly now that pros are doing so well. Dealers were pretty evenly split on whether commercial sales would grow or remain unchanged. Multifamily had a similar divide: 46% of the PS100 respondents predicted growth, while 47% said there’d be no change. This also was the only area with any real expectations of decline: 7% of respondents expected less business. That’s no surprise, as the multifamily segment is considered weaker these days than single-family: Metrostudy predicts virtually no growth in the segment through 2020.

Yardage Markers

The 4,476 facilities controlled by this year’s PS100 represent a relatively small, 2.9% increase from what they had a year earlier and 3.4% more than all the facilities owned in 2016 by last year’s PS100 (remember, the list’s composition changes every year). Five companies showed double-digit gains and accounted for 80 of the 127-yard increase for the entire group. Those five were SRS Distribution (30), Kodiak (17), Beacon (12), Foundation (11), and Allied (10). It’s no surprise that these also were among the most active dealers in the mergers and acquisitions market. All but Kodiak also appear in the PS100’s top 10, a group whose signs are up in 66% of all PS100 yards.

The average facility generated $12.5 million in sales. Lumberyards with manufacturing operations averaged $13.7 million per location, and lumberyards without manufacturing averaged $9.5 million per yard. For specialty dealers, the mean was $12 million per facility. The highest sales-per-location numbers belong to Reliable Wholesale Lumber, whose two facilities averaged $77.4 million apiece. Next came seven one-location yards: Gutherie ($70.8 million), Oldham Lumber ($66.9 million), Graves Lumber ($64.6 million), NorCal ($59.4 million), Buck Lumber & Building Supply ($57.0 million), Yoder’s Building Supply ($51.4 million), and Louis J. Grasmick Lumber ($48.5 million).

IT Plans

ProSales research

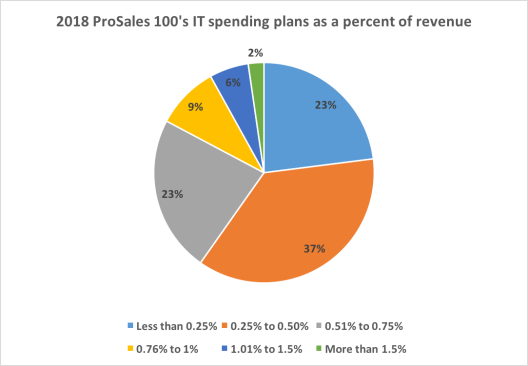

Perhaps it’s because times are good, or perhaps it’s because the competition is hotter, but PS100 dealers appear to be investing more in technology. Take the question about percentage of revenues that will be spent on IT this year. Just over a third of the 2017 ProSales 100 companies that answered the question said they would allocate less than 0.25% of revenues for IT. Among this year’s respondents, it was far less: only 23% said they’d spend less than a quarter of a percent. Meanwhile, the share of all dealers saying they’ll spend between 0.51% and 1% on IT rose to 32% from 24%.

ProSales 100 research

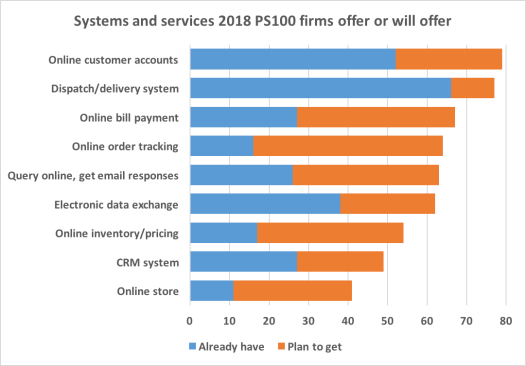

What are they investing in? At least 42 of the 100 plan to put it into mobile applications, and nearly a quarter plan to get a customer relationship management system. Only about one out of eight plan to acquire a computerized dispatch/delivery system, but that’s in part because 73% said they already have one. As for online customer services, of the 83 to 90 PS100 members who answered particular questions, online customer accounts that show invoices, purchasing, and payment history was the feature offered most widely today; nearly 60% already do so. The most popular future online plans included order tracking, a store in which you actually can order products and pay for them at the same time, and systems in which a customer can enter queries online about product availability and get a reply via email.

ProSales 100 research

Component and Installation Work

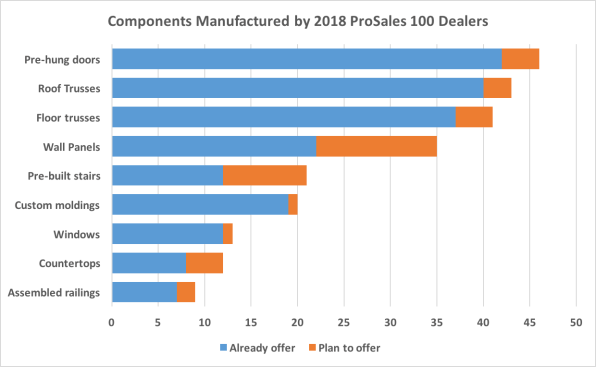

The ProSales 100 for years has split between companies that simply sell products and those that provide additional services like installed sales and component manufacturing. That split continues this year, with 61 PS100 members reporting they install stuff and 59 saying they manufacture components.

It’s probably no surprise that the products dealers install most are among the products that cause builders and homeowners the most grief: Windows, doors, and cabinets. But the installed services that dealers are most likely to add come in the earlier, rougher stage of home building: tasks like framing, installing roof and floor trusses, and putting in stairs and decks. This could be a by-product of the labor shortage afflicting builders, who have found that dealers can provide workers as well as products, all for a turnkey price. Pre-hung doors are the most popular offering on the components side. That’s followed in order by roof and floor trusses, wall panels, pre-built stairs, custom moldings, windows, countertops, and assembled railings. All these categories are slated to grow, with wall panels leading the way. Only 22 make wall panels now, but 13 dealers said they expect to start.

Products Sold and Displayed

For all the talk suggesting lumberyards and specialty dealers are different beasts, the product mix for some goods is more consistent than you might think. Walk into nine out of 10 ProSales 100 stores and you can expect to see lumber (dimensional, treated, and engineered), doors, and housewrap. A vast majority also sell windows, molding, millwork, decking, railing, adhesives, caulks, and sealants.

Only further down can you see dealers’ specialties showing through. Three out of five dealers sell countertops or metal studs. Just under half sell concrete block; a third sell lighting; and one out of four offers hardscaping.

ProSales 100 research

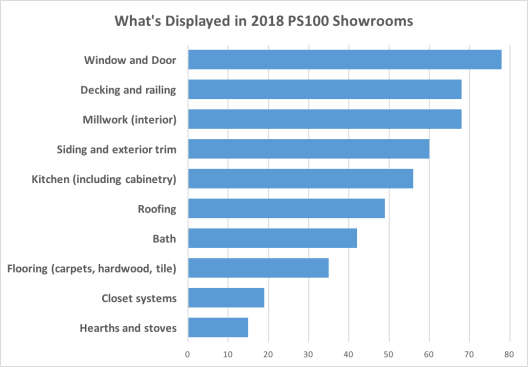

Of the 93 companies that responded to a question about showrooms, 85% said they had a place to display products. Windows and doors were the most frequent goods on display, appearing in 84% of the dealers with showrooms of any type. Next came decking and railing as well as interior millwork, both viewable in 73% of the dealers. After that came siding and exterior trim (65%), kitchens and/or kitchen cabinetry (60%), roofing (53%), bathroom items (45%), flooring of all types (38%), closet systems (20%), and hearths and stoves (16%). Just under a quarter of dealers who reported having showrooms said at least one of those spaces was in a stand-alone building.

Priceless Achievements

Every year, we ask dealers to list major accomplishments. During the Great Recession, the most common comment was, “We survived!” Now, there’s lots of talk about records broken and new heights achieved, but you also can find notes about workplace accomplishments that don’t appear directly on the balance sheets.

ABC Supply noted that it won a Gallup Great Workplace Award for the 11th time, while Hancock Lumber was named among the Best Places to Work in Maine for a fourth straight year. Lansing Building Products took pride in enhancing the company culture—as well as upgrading its software. Parr Lumber launched an employee training, development, and retention program. Community service got mentioned as well. Sims-Lohman committed to donating cabinets and countertops to the local Habitat for Humanity’s ReStore outlet, and its employees also volunteered time in Cincinnati schools.

Then there were achievements like Drexel Building Supply’s creation of the Blue Door Coffee Co., a shop where all profits are donated to charity. And among its other big achievements: It “continued to change the world with good deeds, acts of kindness, and caring customer service.”

Never better, ever better, indeed.

+++

About the ProSales 100

The ProSales 100 comprises the country’s top professional-oriented full-line lumberyards and specialty dealers ranked by the dollar value of their sales to pros in the United States. This is the 26th year that we have published such a list.

Most of the data contained in the report, as well as in the graphs and charts, comes from information turned in by the companies via a survey conducted this spring. In a few cases, the data used here were gleaned from publicly available earnings documents, such as SEC filings, or from the firm’s website.

The numbers are meant to show activity during 2017, so in a few cases where fiscal years differ, the companies’ figures were adjusted to cover the calendar year. None of the numbers represents estimates made by ProSales of a company’s sales, facilities, or personnel.

Percentages shown in the tables and charts throughout this report are based on the number of dealers responding to the related survey questions.

With a few exceptions, participants needed to have at least 50% of their sales come from professional builders, remodelers, or other contractors in order to be included on the list. In one case, the numbers reported are for the part of the company that caters to professional contractors.

To be included in 2019’s PS100 survey, please contact ProSales editor Craig Webb at cwebb@hanleywood.com or 202.736.3307.