The second-quarter earnings season is over and some big deals have been consummated, so what has been the impact on the ProSales 100 rankings? We can’t say definitively, as fewer than half of the top 15 report their earnings. But if you take those companies’ numbers and do some informed speculating about the rest, it’s possible to estimate where things stand.

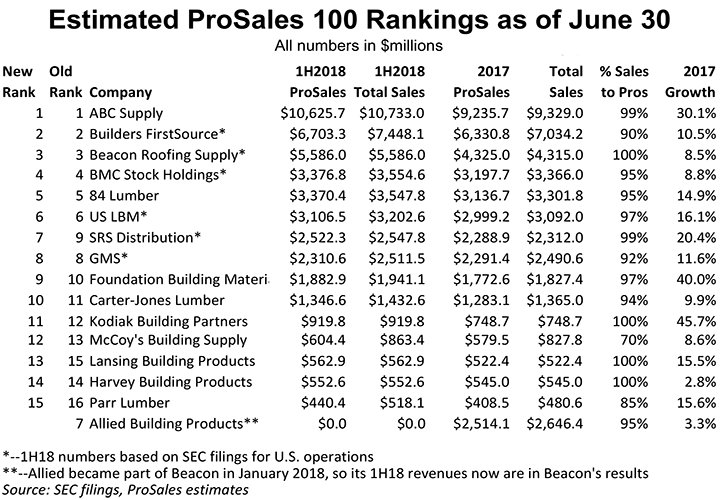

The table above shows those results. The numbers for the public companies represent what those firms reported for the four quarters ending June 30. GMS is an exception, as its fiscal year closes on April 30, so what’s reported here covers the 12 months through that date.

Of these firms, the biggest change in revenue involves Beacon Roofing Supply, which took over Allied Building Products in January. Allied’s revenues for only the first six months of this year are included, but even if we went back and inserted Allied’s revenues for the back half of 2018, Beacon’s spot at No. 3 on the list wouldn’t change.

Beacon and another specialty dealer, Foundation Building Materials, also required more than the usual adjusting because both have Canadian operations. The calculations in the table are based solely on their U.S. sales as reported to the Securities and Exchange Commission (SEC).

Then there’s US LBM. While this dealer still is privately held, it has been planning for more than a year to go public. As part of that process, it has filed and regularly updated a registration document with the SEC in which it’s possible to figure the firm’s sales.

All of the other companies on the list are privately held and thus have not reported their first-half revenues. So, to come up with our estimates, we cut their 2017 total in two. One half stayed unchanged, while we multiplied the other half by 2017’s growth rate, operating under the assumption that the company had continued growing its revenue this year on the same upward trajectory as last year. Then we combined the two numbers.

While the official ProSales 100 rankings are based on sales to pros rather than total sales, either way the standings are the same. The major difference between this table and the one for all of 2017 is that the eighth through 15th-ranked companies here moved up a notch, now that Allied no longer exists. In addition, if Lansing Building Products did keep growing at a 15.5% clip while Harvey Building Products was at 2.8%, then our calculations indicate they swapped places.

Farther down the list is one more change. In its entry for the ProSales 100, Zeeland Lumber initially erred in telling us that pros accounted for 48% of its sales. That chopped its $128.7 million in sales to just $61.8 million in pro sales, putting it 77th on the list. Zeeland later corrected its numbers to say pros figure in 96% of its sales. That means the company’s pro sales total is $123.6 million. That would be enough to elevate it to 49th on the 2017 list— or 48th, once you eliminate Allied.

Again, these are guesstimates. We won’t know for certain how all the top dealers are doing until we collect ProSales 100 data for all of 2018. That list will be published in May 2019. If you deserve to be on it, let us know.