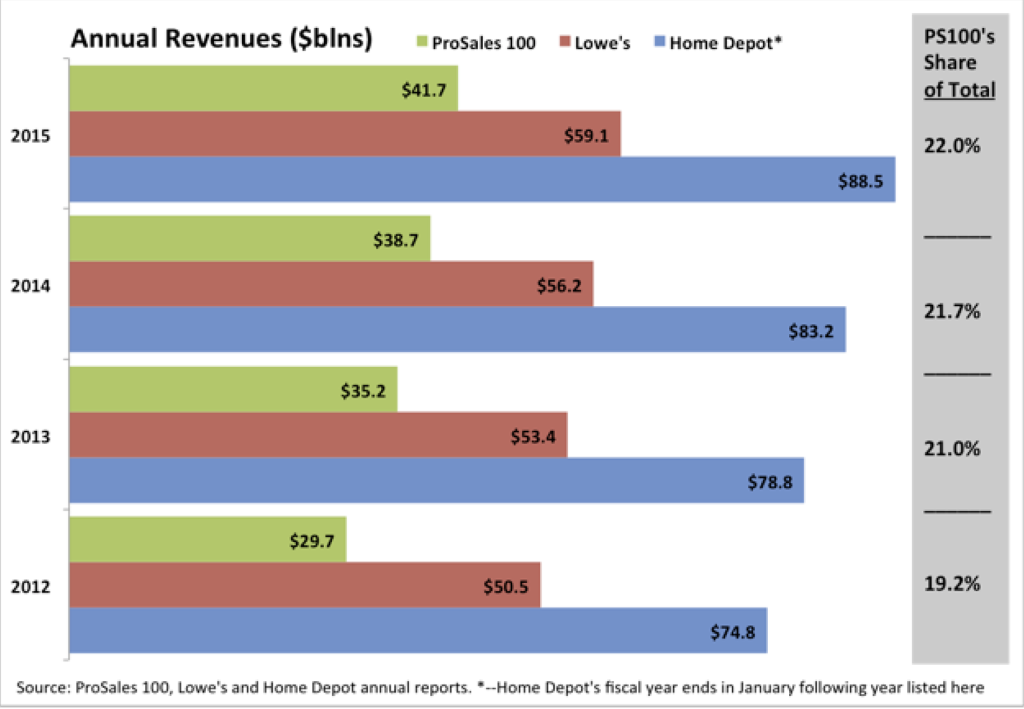

ProSales 100 companies’ sharp revenue gains since 2012 have enabled them to claw back a few percentage points of market share in their competition with The Home Depot and Lowe’s, the latest PS100 report suggests.

The $41.7 billion in sales that ProSales 100 companies racked up last year accounts for 22.0% of the total sales accumulated by PS100 firms and the two major retail-oriented building supply chains. The PS100’s share was 19.2% in 2012.

The collective ProSales 100’s revenues have grown 40.4% since 2012, double the growth of The Home Depot at 18.3% and Lowe’s at 17.0%. Combined, spending at the three groups is up 22.1%, to $189.3 billion in 2015 from $155 billion in 2012.

The average ProSales 100 company gets nearly 90% of its sales from professional builders, remodelers, and non-retail sources. The Home Depot says it gets 30% of its revenues from pros, including painters and maintenance workers as well as builders and remodelers. Lowe’s hasn’t been as specific, but it also says pros contribute a significant minority of total sales.