Growth

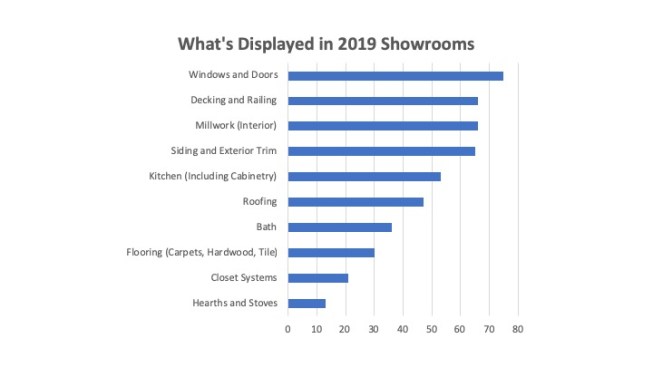

The majority of pro dealers (80%) have a showroom. Of those, nearly all (about 94%) display windows and doors, 83% offer decking and railing products, as well as millwork, and 81% have siding and exterior trim in their showrooms.

Understanding which products are most popular with pro dealers is certainly helpful, but it’s also helpful to look at how each SKU is performing against other products in its segment. This is where enterprise software can help. For example, Michelle Valdez, category business manager at Central Valley (No. 54), and a ProSales magazine Four Under 40 winner, encourages her replenishment managers to use analytics to more closely evaluate sell-through data and space-to-sales information to make sure they focus on keeping top-selling items in stock. These efforts enabled the company to increase sales close to 20%, Valdez states.

View the profile of PS100 up-and-comer Central Valley

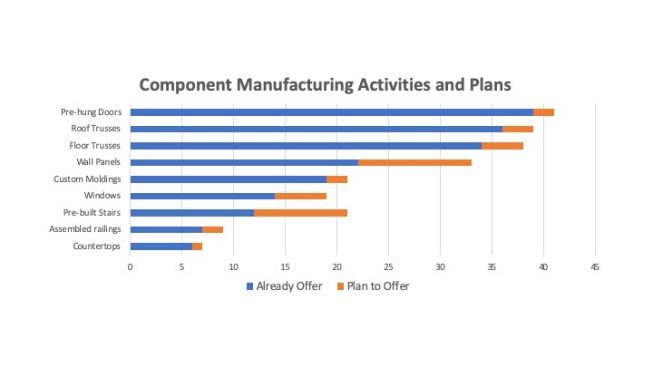

When it comes to innovation, Central Valley hasn’t stopped there. Recognizing the potential that additional services can have on its bottom line, the company opened a prefab wall manufacturing facility in May 2018.

The move toward additional services, such as component manufacturing and installed sales, has become a compelling one for many pro dealers. Already, a sizeable portion of PS100 members offer installed sales, with windows, entry doors, and cabinets being the three most popular installations. The biggest year-over-year jump was in window installations, with 42% of dealers offering this service, up from 37% last year. Moving forward, the items pro dealers most plan to install include stairs, molding/millwork, and wall panels.

Made of Mettle

There’s no doubt that last year was a volatile one, thanks largely to the significant swings in lumber prices. Naturally, this rattled a few nerves. “Markets don’t like uncertainty. What we’ve seen in the industry over the past six to 12 months is a lot of uncertainty,” BMC’s Flitman said at the ProSales 100 conference.

In fact, John Ganahl, CFO of Ganahl Lumber (No. 19), stated that a big accomplishment for his company this year was that it “survived the most turbulent commodity market that I have seen in my career.”

But not only did Ganahl survive, the company thrived, growing revenue 15.6% in 2018 to $444.3. Ganahl is a prime example of the industry’s resilience being tested during a challenging business climate.

So, even if the LBM industry is on the precipice of an economic downturn, as some industry experts suggest, this year’s PS100 leaders have proven they have the mettle to carry them through it.