Bright Spots

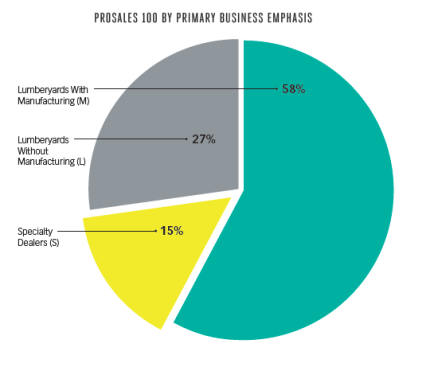

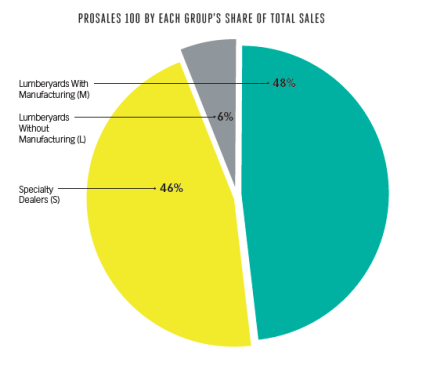

Specialty dealers, once again, had an impressive year. There are only 15 of them on the PS100 list, which represents a 50% increase from last year, but they have a sizable presence, accounting for 46% of the revenue generated by the entire list. It helps that five of them (ABC Supply, Beacon, GMS, SRS, and FBM) are among the 10 largest dealers on the list. As a group, these dealers increased revenue by $2.3 billion from last year, representing a 9.6% improvement over 2018. What’s more, of the 15, only one specialty dealer’s revenue declined in 2019.

Read the ProSales 100 profile on Simonson Lumber.

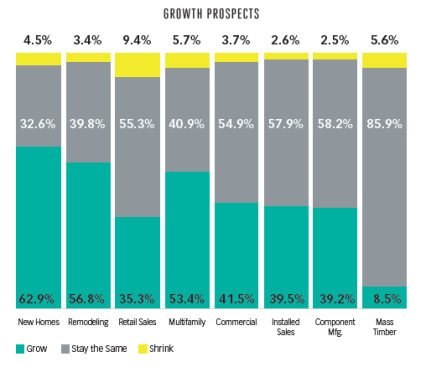

This year, we added a new category to the Growth Prospects chart—Mass Timber (see page 37). The idea of building tall mass timber structures has been gaining traction since the International Code Council passed 14 tall-mass-timber code change proposals in December 2018. The multifamily industry is beginning to embrace mass timber for various reasons, such as its ability to lower labor costs, decrease a building’s overall weight, offer more durability than concrete in high-seismic regions, and contribute to carbon sequestration. Many states have started pursuing early adoption of the 2021 International Building Code. In fact, by June 2019, more than 500 mass timber projects were already in design or under construction. Some dealers, such as Idaho Pacific Lumber (No. 30), Western Building Center (No. 61), and Moynihan Lumber (No. 76), are already selling into this emerging market, and nearly 9% of respondents expect to grow this part of their business in 2020.

Disruptions

Despite these and other successes, there’s some evidence that suggests the industry’s health appeared to be in decline heading into 2020. While the top 100 dealers grew their cumulative revenue over last year, the rate of growth slowed. From 2016 to 2018, the cumulative revenue of the top 100 dealers grew by more than 10% for each of these three years. In 2019, however, that annual growth rate fell to 2.4%.

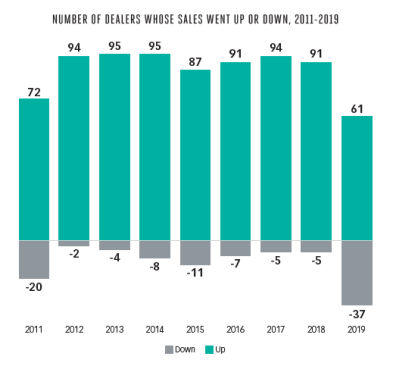

A deeper look at the top 100 dealers reveals a more startling number. Last year, only five of the top 100 dealers saw a drop in annual revenue. This year, revenue declined for 37 dealers. For those with revenue declines, the average drop was 7.8%, but some reported falling much further—as much as 24%.

Lumberyards with manufacturing capabilities struggled the most last year. They make up more than half (58%) of the dealers on the leaderboard, and 25% of them experienced a revenue decline last year. These 25 dealers represent about 67.5% of all of the dealers that experienced a revenue decline in 2019. Collectively, this group’s revenue fell about 0.45% to $30 billion last year.

Revenue for lumberyards without manufacturing capabilities remained relatively flat last year at nearly $4.1 billion. Of the 27 dealers in this group, revenue declined for 11.

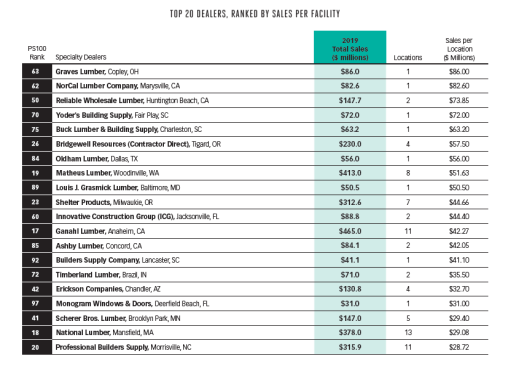

Part of the problem for some dealers had to do with efficiency. In 2019, the PS100 averaged $20.7 million per facility, down from $21.95 million in 2018. Last year, the PS100 averaged $593,280 in sales per employee, which is down from $599,110 in 2018. These numbers will likely improve, as acquiring dealers better integrate their people, processes, and technologies, as well as streamline their operations.

Unfortunately, last year’s long winter and the heavy rainfall in the Midwest and across the United States didn’t help dealers. At Do it Best’s Spring Market in May last year, Todd Hixson, division manager at the co-op, stated, “Normally, by now, we have a lot more slabs in for basements. Some of those basements are probably inground pools right at the moment. We’re waiting for them to dry out. We usually have a lot more framed up [by now] … but things just haven’t started that way.”

Additionally, Hixson pointed out that the average size of new homes had been “dropping considerably over the past six months to a year. That takes less lumber. It takes less panel products. So, if the mills are producing the same amount of products, then it’s got to go somewhere. The thing is, it’s not going offshore that much.” China was a “huge importer of spruce and fir” from Canada and the U.S., Hixson said. That was until the trade war with the U.S., he added, when China made Russia its top supplier.

Read the ProSales 100 profile on Zuern Building Products

Compounding their problems, due to the industry’s ongoing labor shortage, builders and remodelers struggled mightily to make up for lost business in the first half of the year. Fortunately, that didn’t stop them from trying.

Head Fake

In December, housing starts soared to 1.6 million. (For some perspective, the last time housing starts were this high was in December 2006.) And from December 2019 to February 2020, the period in which we collected the 2020 ProSales 100 data, housing starts remained above 1.5 million.

Business was booming, which is likely why more dealers expected revenue from new home, remodeling, retail, and multifamily sales to grow as a percentage of their overall sales in 2020. For example, 62.9% of dealers expected new home sales to generate a larger portion of their overall sales in 2020. That’s up considerably from 44.3%, last year.

Mike Hammond, president and CEO of Hammond Lumber Company (No. 25 on the PS100 list and this magazine’s Dealer of the Year), vouches for the strong start to 2020. “We closed out Q1 with record sales up 21%,” he says.

Then, the coronavirus hit.