For dealers, a more detailed approach to specifications or preferred brands also requires that they maintain a direct link to builders and general contractors … or at least carry or have access to inventory that those customers are apt to specify for their subs.

Turnkey or Not? Without the volume or internal staff to strike national contracts with its preferred manufacturers and distributors, Christopher Homes instead relies on its subs to supply both materials and labor, called turnkey or labor and materials (L&M) contracts, in hopes of getting the best overall price, service, and products.

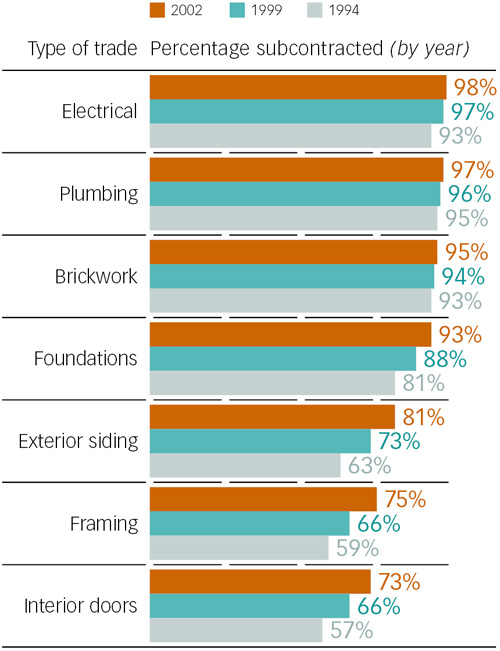

In fact, subcontracts for framing, roofing, siding, windows, and doors are all trending toward L&Ms. Though 80 percent of framing contracts were labor-only in 2002, according to the NAHB survey, that figure had dropped from 87 percent in 1999. Similarly, about half of all roofing and siding jobs are now turnkey, while L&M subcontracts for door and window work rose from 32 to 43 percent in four years.

As one example, regardless of the size and type of its builder clients, Old Country Roofing is a turnkey operation. The size of the company, including five divisions and some of the nation’s largest builders in its fold, helps Old Country Roofing negotiate terms and prices. “Because we’re a large company, manufacturers and distributors want to cater to us,” says Boles. “We have stronger relationships with suppliers, so builders look to us as the resource for products.” And better pricing.

Despite purchasing freedom, Boles and her leads maintain a constant link with the builder’s superintendent regarding materials. “It’s our job to make sure the order gets placed, but that requires communication and coordination with the super regarding the schedule and specifications,” she says, which then translate to conversations upstream with manufacturers, distributors, and local dealers to make sure those expectations are met.

Before he left the builder side to manage NAHB-RC quality programs, Alexander partnered with the local outlet of a national dealer chain to provide turnkey framing through the supplier’s installed sales program. “I knew we’d be protected by the size of that organization to get materials and labor on schedule,” he says, as well as reducing losses caused by materials shortages and theft.

But turnkey is not what every builder prefers. “I don’t like letting someone have that much control over the process,” says Alex Hannigan, president of Hannigan Homes in Orlando, Fla., expressing the other side of the coin from the perceived risk abatement qualities of L&M contracts. “If the subcontractor goes away, I lose the relationship with him and the supplier.”

Case in point: Hannigan’s mason is pressing him to gain turnkey status, but the builder has resisted so far, in part because his concrete block supplier, which offers an exclusive line of specialty products, sells only to a limited customer base, including Hannigan Homes. “We’re on that list because of our relationship [with that supplier],” Hannigan says.

But just because Hannigan resists signing turnkey contracts with his subcontractors doesn’t mean he won’t allow them to purchase products on his behalf. “There’s no reason the trim carpenter can’t do a takeoff on what remains to be done [near the end of a job] and call in that order directly [to the supplier],” he says. “I want the carpenter and the supplier to each maintain an allegiance to us, but allowing him to make that purchase expedites the process.”