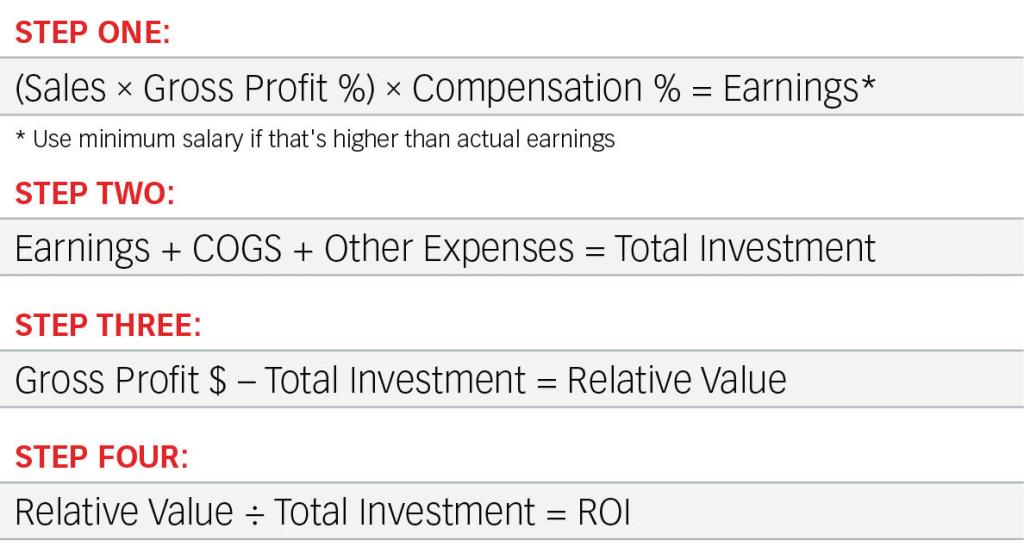

Consultant Jim Enter likes to say a rep must sell at least $2.5 million per year to earn his keep. That’s too high a number to be useful at many yards. So he crafted a formula that measures any rep’s return on investment (ROI).

Let’s say Mary and Joe work at a yard that netted $133,454 on sales of $1.8 million and recorded $285,986 in expenses. Joe outsold Mary, but at lower margins. On the other hand, Joe gets a guaranteed minimum salary if his earnings don’t top that level, as happened here.

Cost of Goods Sold covers credit used to buy the goods plus the price of holding them in inventory. Each rep then is charged an equal amount for the dealer’s other sales-related costs.

Add the rep’s earnings to those costs and you get the total investment per rep. Then subtract that number from the gross profit, divide it by the total investment, and you get the ROI.

All Special Report Articles

It’s Time To Run Your LBM Business Differently

As housing revives, follow these ideas to revive your business so it can handle and profit from increased business.

New Ways To Measure Your LBM Business

Fine-tune your operation’s performance by adding these innovative metrics.

Why Dealers Should Prepare To Accelerate in 2013

Housing data expert Jonathan Smoke predicts growth virtually everywhere nationwide.

Housing Data Expert Gives Tips on Tracking Your Local Economy

Hanley Wood Market Intelligence’s Jonathan Smoke gives advice on which economic indicators deserve the most attention, how economists work, and what to expect through 2014.

Five Steps to Funding Tomorow’s Growth

Get on better footing with lenders by building relationships with myriad money sources.

To Move Forward, Go Back — Back to Basics

Old-school management techniques are some of the best things you can do to advance when housing revives.

Three Reasons Why Lumber Shortages Are Likely by Late 2013

Tighter credit, scaled-back production, and a trucker shortage have put the entire supply chain in limbo.

How a Small Dealer Can Figure Its Sales Reps’ ROI

Consultant Jim Enter offers this formula to help you decide whether your reps are generating sufficient sales.

Hiring? Consider Options Besides Full-Timers

Temps, ‘1099’ contract workers, part-timers and outsourcing firms all might be better.

Why Dealers Should Consider Subcontracting Rather than Hiring New Workers

Veteran LBMer Dena Cordova makes the case for rebuilding your staff in part by hiring ‘1099’ workers.

Past Decisions Hurt Dealers Today as They Seek New Execs

Layoffs during the downturn thinned the ranks, soured young people to an LBM career.

A Dealer’s Guide to Polite Poaching of OSRs

Dealers say there’s an active market in seeking out other dealers’ sales reps. But there’s etiquette to be followed in pursuing those people.

As Business Grows, Dealers Need To Upgrade Tech Capabilities

How do you provide personal TLC when you’re getting busier? By investing in technology.

Mind the (Tech) Gap

Young remodelers are more tech-savvy than their older counterparts. For good or ill, that’s going to change how dealers work with this group.