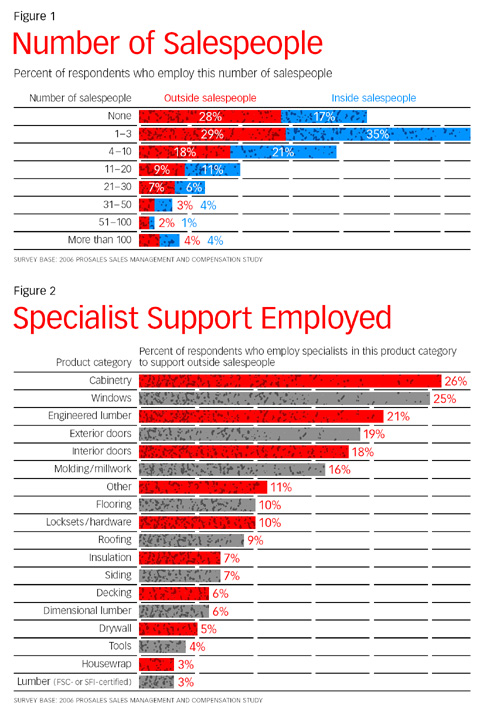

Most of their sellers, say these dealers, are generalists, in that they sell everything their companies carry, although some products seem to require more attention than others. While the survey found that 37 percent of those polled don’t have salespeople who specialize in any one product, cabinetry, windows, and engineered lumber are among the categories where at least one-fifth of the survey’s respondents have specialists on board to sell (see Figure 2, above). Several of the dealers interviewed would add framing packages to that list, as well.

Many of the interviewees say outside sellers are being asked to play a larger role in their builder-clients’ job-site management. “We have some guys who are practically running their builders’ jobs for them and have been out there directing concrete trucks where to pour cement,” says Ridout. James Wallace, contractor sales manager for Franklin Building Supply’s headquarters yard in Boise, Idaho, refers to his outside sellers as “unpaid superintendents” for builders “because at least every other day they are on the jobsite checking things out. That makes it kind of hard for builders to do without us, which is a good thing.” Martin notes, though, that getting builders to pay for that service isn’t always easy. “You have to sell that value from the top,” meaning that senior-level managers become involved.

While outside salespeople typically are a pro dealer’s primary point of contact with builders and remodelers, many dealers appear to have set up their selling teams in a way where no one person becomes the sole face of the company for any one client, so that in the event a salesperson quits or is fired, the customer is less inclined to follow him or her to a competitor. “All of our salespeople do takeoffs, but the support staff enters the quotes and handles the shipments,” says Steve Haynes, McCray’s vice president and general manager. “The builders are our customers, not [the outside salespeople’s] customers.”

Nate Bond, director of sales for Hillsboro, Ore.–based Parr Lumber, whose 60 outside salespeople write $380 million in annual business, is a big advocate of pro dealers having a strong inside sales team (Parr has 60 insiders working for its yards) as a way to “check the power of the outside salespeople, because it ties the business to the company, not the individual. The seller accepts that checked power because he’s writing so much more business.”

Bond believes the days of the “independent” field salesperson are steadily fading, and what’s emerging is an “interdependent” seller who relies on a team of people, shares information, interacts more directly with the yards’ managers, and is tech savvy. He believes this breed of sellers will become so indispensable to their customers that they will be working in “a non-compete environment.” Bond says Parr expects its outside sales team to be fully interdependent sometime within 2010 and 2012. Reaching that goal will require “a strong bench, a strong compensation program, and more people with core competencies.”

Lucrative Rewards There is ample evidence that the autonomy outside salespeople might have once enjoyed is giving way to an organic method of selling that involves more people within a dealer’s organization. Take the ability of sellers to negotiate price with customers to close a deal. The survey finds that 57 percent of the dealers polled allow their sellers to lower prices with management’s approval; another 29 percent say their sellers can make price concessions on their own. “The smaller the job and the more seasoned the salesperson, the more flexibility he has,” says Hamid Taha, Alpine’s vice president of operations.