A sign that could have appeared in any town has caused quite a stir. The message is direct: “Stimulate your ass to work—Every business in town is hiring.” For business leaders, it aptly voices their frustration when trying to compete with the younger generation’s attitudes. It also ignites debate on local and federal labor policies—does the government create disincentives to work? Or, are businesses not responding to the needs of the unemployed, not offering a living wage, and therefore deserve to fail?

This sign is the latest instance of what I call “The Great Employee Wage Debate,” which judges the cost of labor for any business versus society’s expectations of perceived living wages.

Labor Costs

The more significant the burden on a business for all labor costs (including all paid benefits and the labor law compliance regulations), the more expensive it is for a company to hire an employee and pay higher wages. Regardless of their good intentions, artificially driving up labor costs and labor law burdens from local and government policies will accelerate the drive to eliminate labor within every business.

Private industry worker compensation costs for employers averaged $36.64 per hour worked in June 2021. Wage and salary costs averaged $25.89 and accounted for 70.6% of employer costs, while benefit costs averaged $10.76 and accounted for 29.4%, according to the Bureau of Labor Statistics. The Small Business Administration (SBA) reports there is a rule of thumb that the cost of benefits is typically 1.25 to 1.4 times the salary, depending on certain variables.

When lawmakers push for additional labor policies upon the private sector for labor wage improvements and benefits (increased cost burdens), there is something else to think about: just 42% of working Americans support the other 58%. The result of long-standing trends is that the percentage of private-sector employees is the lowest since 1983. The private sector is responsible for paying for the public sector.

All businesses will continually seek to lower labor costs by reducing the employee hours, minimizing the number of employees, eliminating positions by using automation, and continuously refining current practices.

“Livable” Wages

It seems so many people are stating that a business, any business, should be paying a “livable” wage, no matter the task, skills, or other needs. How do you define a “living” wage, and does that mean every employee must be working full time? Some people find $12/hour acceptable because it is supplemental income and others need $30/hour to support their families. A business is only responsible for paying the prevailing market wage of what someone is willing to accept for the work done. Believe it or not, market determination will establish the correct level. Wages will be offered and rejected/accepted. And just like every other commodity being affected by current events, we are currently in an inflationary market that includes wages.

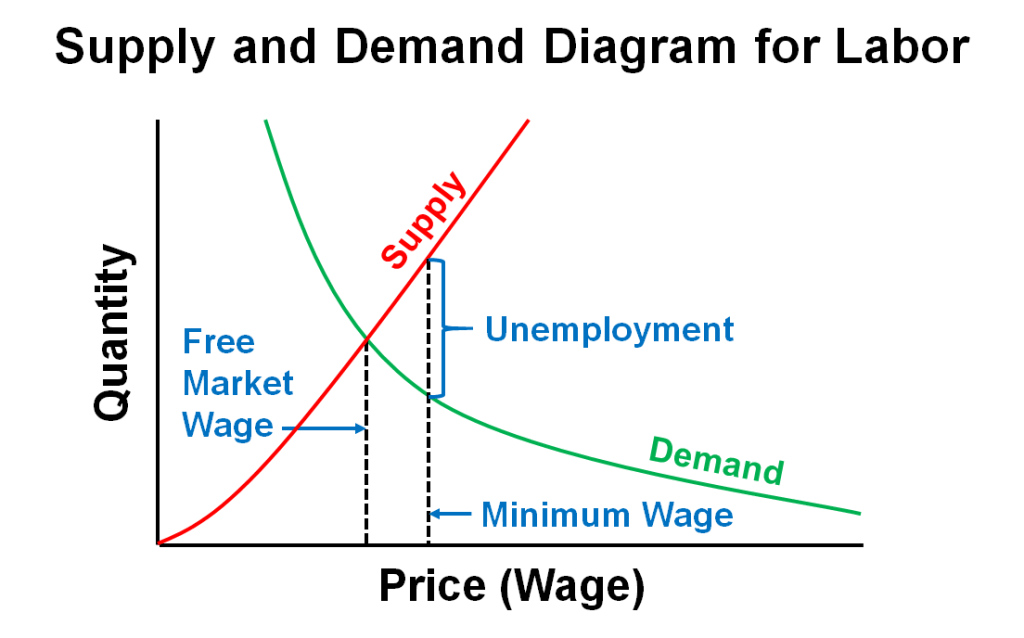

Right now, demand versus supply, starting wages are much higher than the minimum wage in most areas of the country. In the displayed graph, the Free Market Wage line would be to the right of the Minimum Wage line for most current unemployment markets. However, this graph illustrates a valid point about wages versus supply and demand.

Consumers (buyers) and competition between businesses (sellers) drive businesses to continually find lower operating costs to maintain profitability for the sustainability and growth of their company. Without question, all labor cost burdens are part of the equation of profitability. Without profits, all companies cease to exist, and therefore employment opportunities cease to exist. Some argue that businesses should not even operate if they do not pay a “living” wage. If this is the case, why do we allow imported goods from any foreign country with a lower standard of living and a lower “living” wage that enables a business to operate at a lower cost? Why would anyone be allowed to purchase clothing, cars, electronics, and every other kind of product from China or another country?

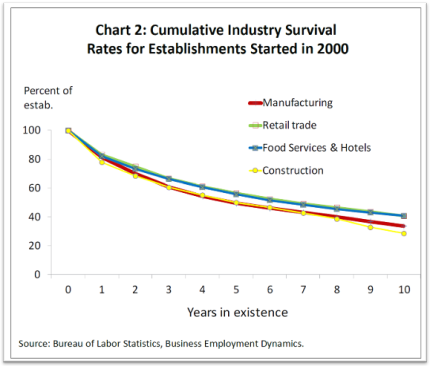

According to the U.S. Bureau of Labor Statistics data, about 20% of U.S. small businesses fail within the first year. By the end of their fifth year, roughly 50% have faltered. After ten years, only around a third of businesses have survived.

Foreign competition and labor costs have a direct negative impact on small and mid-size businesses. Think Amazon or Walmart versus hometown stores and local manufacturers.

The simple fact is that we allow importing cheaper products from other countries so that the vast majority of people have a higher standard of living and a comfortable lifestyle. There has to be a reasonable balance between government policies and the cost of labor burdens on businesses for a healthy economy.

Executive Pay

Executive pay for publicly traded companies, such as the Fortune 500 companies, is not a reality for about ½ of the workforce in the U.S.

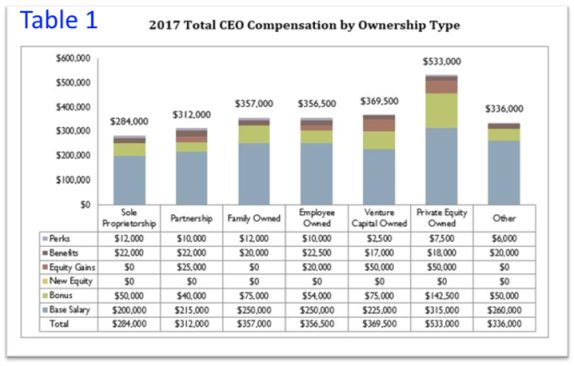

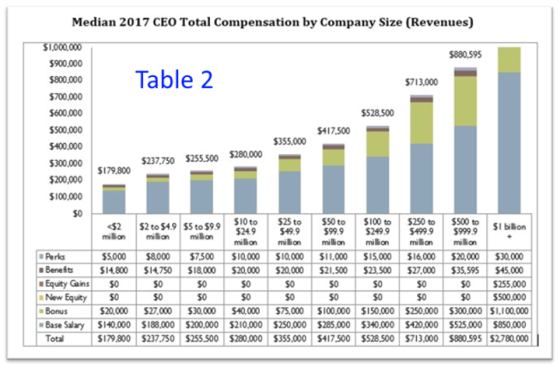

The Small Business Administration (SBA) defines a small business as a firm with fewer than 500 employees. According to the U.S. Census Bureau, in 2017, small businesses employed 47.5% of the entire country’s workforce. Small businesses account for 99.7% of all companies in the U.S. As shown in Tables 1 and 2, executive compensation is relative.

The age-old argument that company executives should receive less pay and give more to the non-executives is a political argument to gain political power, not to understand wage compensations realities. There is indeed a disconnect between those who shoulder the responsibility of profit/loss of a company versus those who have never felt the weight of that kind of responsibility. Those who have owned a business know what the “burden of being paid last” truly means.

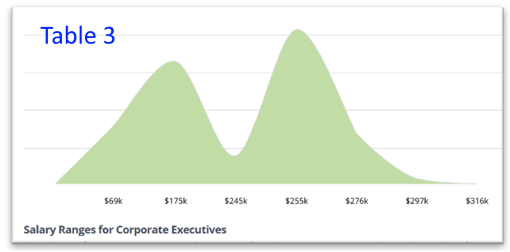

As shown in Table 3, the average Corporate Executive in the U.S. makes $239,797. The average bonus for a Corporate Executive is $49,322, representing 21% of their salary, with 100% of people reporting that they receive a bonus each year.

For a considerable segment of businesses, reducing the average executive’s compensation to increase non-executive wages would typically have minimal impact and could be harmful. Like the non-executive wage, the basic supply and demand laws apply to keep these talented people from seeking employment elsewhere.

Wages and Healthy Business Employment Practices

Let us face some fundamental truths when it comes to the employment practices of any business. Usually, when unemployment is high, a company can have average or poor labor practices and still keep and attract new hires. However, when the locally unemployed numbers are low, current and potential new employees have choices. In other words, it is all about the bargaining strengths of the employer versus an employee. How a company chooses to operate regarding what they define as good labor practices is up to them.

So what are the fundamental truths of market wages? Classical economists, who argue that wages are determined by supply and demand, can define market wages just like all prices. They call this the market theory of wage determination. For the worker, the market wage is the highest wage offered by any employer they are willing to consider. For the employer, it is the lowest wage that the potential and existing employee with the needed skills, work ethics, and acceptable personal character required to perform the necessary tasks is willing to be paid.

It is the employer’s responsibility to provide market wages. Failure to pay market wages means turnover will be a chronic problem because employees will eventually leave for better pay, vacancies will be a chronic problem because employees are finding better pay elsewhere, and employee performance will suffer.

Conversely, when someone is employed in an occupation that is not meeting their basic monetary needs, the employers are not responsible for each employee’s monetary needs, employees will eventually find other employment to meed their monetary needs, and employers will find other employees to fill open positions with proper market wages.

Employee and Employer Food for Thought

The “Great Employee Wage Debate” is not new, and it is not over. The roadside signs may change, but a few facts should be remembered.

It is important for employees to remember that at every job, one should either learn or earn. Either is fine; both is best. But if neither is able to be achieved, then employees should leave on good terms. One’s reputation as a worthy employee will travel to the next opportunity.

For employers, it is important to remember the root causes of typical production/service problems. Quality problems are typically caused by a high employee turnover rate, which indicates poorly trained and an unskilled staff. Output issues, however, are generally caused by high employee turnover rates and likely having insufficient staffing. Overall, the top cause of poor retention of existing employees and trouble hiring new employees is a resistance to paying market wages for the type of worker needed.