Metrics That Make Music

Now that you have the basics, it’s time to consider other measuring devices. Some of them are so standard it’s likely you’re using them already; among them are days of sales outstanding, inventory turnover, return on assets, and debt as a percentage of total capitalization. But look also at these:

Accounts payables as a percentage of inventory. Generally, this should be above 50%, says Richard Heath, an accountant who manages several dealer roundtables.

The relationship between custom orders and inventory turns. It’s not uncommon for dealers to get as much as 35% of their sales from special orders, but because special orders aren’t always classified as inventory, they don’t get counted when figuring inventory turns. Heath figures that if you were doing seven to eight inventory turns when only 10% to 12% of your sales were special orders, if your business rises to 25% to 35% special orders, you should consider yourself as turning inventory 10 times.

The spread between gross profit and personnel cost as a percent of revenue. Wider is better here, and Heath says using this metric forces the owner to act in one of two ways: cut personnel costs as margins shrink or else keep staff on hand and seek to boost margins.

The dealership’s “blood pressure.” To get this, add days receivable outstanding with days of inventory and subtract from that total the days payable. This gives you a cash conversion factor–how many days it takes for business to convert sales into the dollars you use to fund your business. “If your cash conversion cycle is hitting 85-90 days, that’s not good,” Heath says. To lower it, increase the amount of payables, decrease inventory, or cut receivables.

Rent vs. Salary. Let’s say you already charge your company rent on the land that you own. But is that rent artificially low? Why not raise the rent to the market rate but keep your salary at current rates, or even lower it? Because most people focus on salaries and not rent, you look better to your peers and still take home as much money.

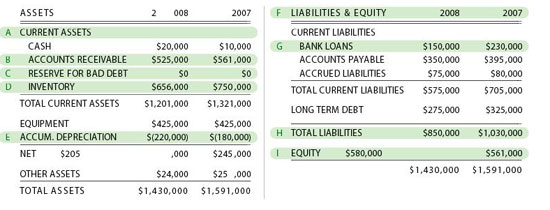

Trust, but verify. Rader makes it a habit to compare the inventory total on the balance sheet to the actual physical inventory.

Less important now. Heath says he used to dog dealers to make sure their after-tax return on sales was at least 4%. “Now I’m happy with a positive number,” he says.

The real bottom line: You gotta care. Above all, to succeed these days you need to care about numbers, even if it doesn’t come naturally. “Don’t rely solely on your accountants to know what’s going on,” Loomis told LBM dealers during a seminar in February. “Accountants can put the statements together, but it’s the general management that needs to decide what is done.”