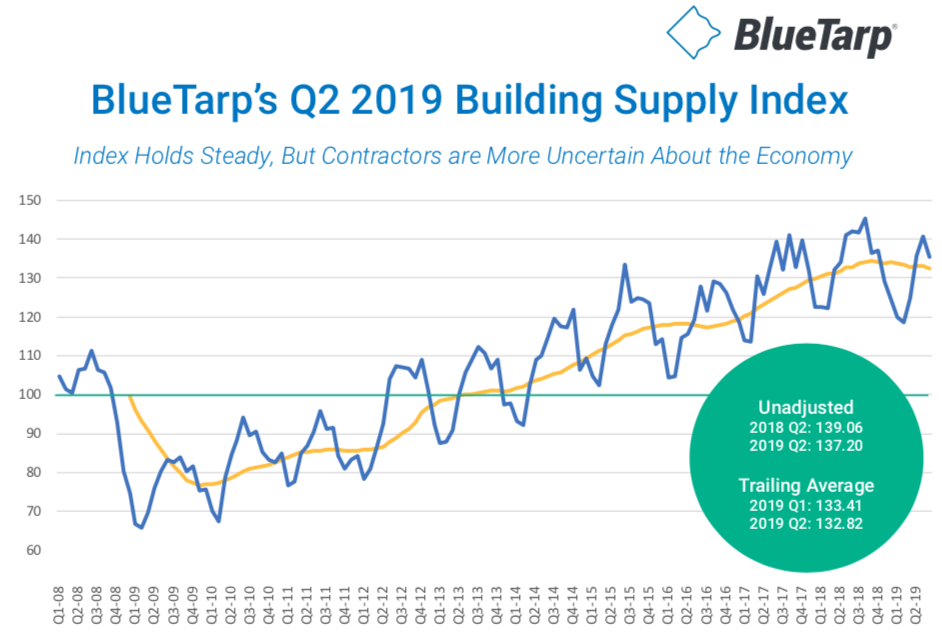

BlueTarp Financial’s Building Supply Index remained relatively steady, with the unadjusted Q2 index declining to 137.20 from 139.06. The trailing 12-month average for the index has been flat to slightly down since peaking in the third quarter of 2018, according the BlueTarp.

The Building Supply Index—based on public data such as consumer sentiment, building permits, and construction spending, along with proprietary data—posted a seasonally adjusted, 12-month trailing average of 132.82, slightly down from the reading of 133.41 in the first quarter of 2019.

The index value of 100 is benchmarked to April 2013, and values above 100 reflect healthy economic activity. BlueTarp bases its proprietary data on accounts with more than 120,000 pro customers that it manages for more than 2,000 building material suppliers nationwide.

BlueTarp Financial

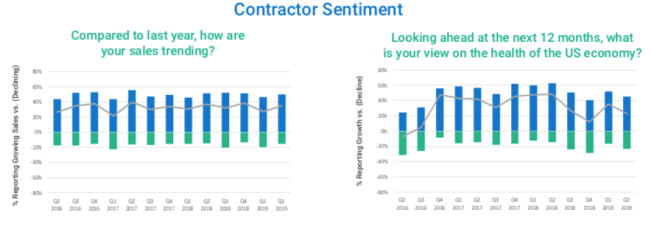

While the Building Supply Index remained steady, BlueTarp’s supplemental contractor survey revealed a significant increase in contractor fears about the economy. Nearly 25% of surveyed contractors believe the economy will decline in some way in the next 12 months, an increase from 16.3% in the first quarter. The 2020 election was the most commonly cited causes for contractor uncertainty.

“Just like the macro drivers, contractor sentiment is strong overall but increasingly jittery,” said Scott Simpson, CEO of BlueTarp. “The escalation, of US-China trade tensions, suggests a real threat to continued economic expansion. We’ll see more pronounced pessimism in next quarter’s survey if this continues or escalates even further. The 2020 election cycle introduces yet another variable, too.”

BlueTarp Financial

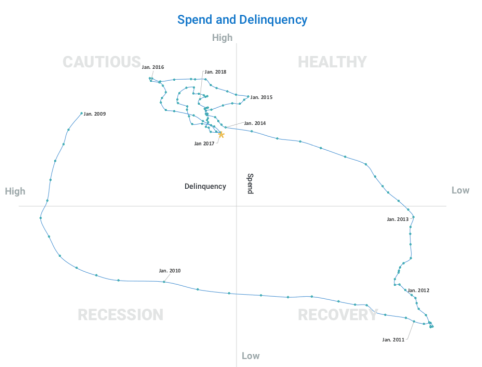

One of the ways BlueTarp tracks trends is with an X-Y axis chart showing customer preference in terms of both spending and delinquencies. For the past several years, BlueTarp says accounts have been in the Cautious quadrant, in which spending is high, but the delinquency rate is slightly worse than desired.