GMS, the specialty dealer that ranks 8th on the ProSales 100, announced today its net income shot up 60.7% year-over-year to $14.3 million in its fiscal fourth quarter ended April 30, while net sales grew 16.7% from the year-earlier quarter to a record $615 million.

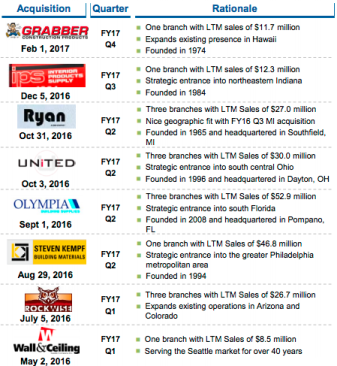

Eight acquisitions this past fiscal year, including one in Hawaii in the fourth quarter, powered much of the gain. Operations in business during the previous year’s fourth quarter had a year-over-year gain of 5.6%, GMS said, and the $215.9 million in sales that the new stores contributed for all of fiscal 2017 amounted to 45% of GMS’s sales gain for the year; same-store sales were up 10.0%.

Gross profit rose 15.4% to $201 million and represented 32.7% of net sales. Operating profit rose 25.8% to $30.3 million.

The Tucker, Ga.-based specialist in wallboard, ceiling systems, and steel studs prefers to measure itself in terms of adjusted EBITDA: earnings before interest, taxes, depreciation, and amortization as well as before stock appreciation rights expenses, equity-based compensation, severance costs, transaction costs, management fees, interest-rate swaps, secondary public offerings, and debt transaction costs.

By that metric, adjusted EBITDA rose 19.5% for the quarter to $52.1 million and amounted to 8.5% of net sales. “Through our proven growth strategy, we remain confident in our ability to capitalize on healthy demand trends and execute on our robust acquisition pipeline to build upon our market leading positions and continue to deliver strong performance in net sales and adjusted EBITDA in fiscal 2018,” President and CEO Mike Callahan said in a statement.

GMS

GMS acquisitions in 2017, taken from a presentation to analysts on June 29, 2017.

Wallboard sales in the quarter rose 13.4% from the year-earlier period to reach $282.2 million; sales by volume increased 11.1% to 906 million square feet. Ceiling sales went up 11.9% to $87.5 million, steel framing sales jumped 28.9% to $100.2 million, and sales of other products swelled by 18.5% to $145.1 million.

The company’s balance sheet shows that goodwill accounts for $423.6 million of its $1.39 billion in total assets, while on the liabilities side GMS has nearly $595 million in long-term debt. The previously private company went public last year and since then has been expanding dramatically. It now claims 205 yards almost nationwide, all flying the flags of 53 subsidiary companies.

GMS joined the ProSales 100 this year for the first time. It had $2.23 billion in sales in calendar 2016.