Beacon Roofing Supply’s net profit rose 8.8% in its fiscal third quarter ended June 30, climbing to $44.7 million from a year-earlier $41.1 million on a 5.3% sales gain to $1.21 billion, the company reported today.

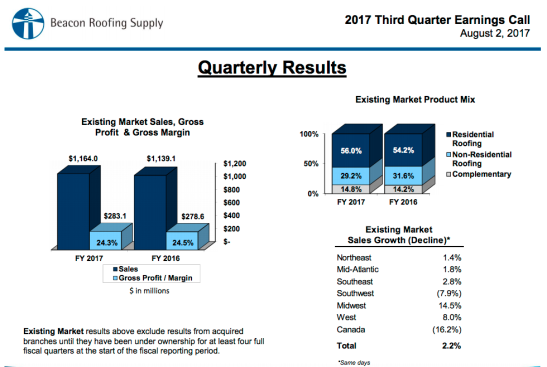

Acquisitions over the past year by the No. 3 ProSales 100 company helped boost total sales, as same-store revenue increased just 2.2%. Gross margins held steady at 24.5%, while net income as a percentage of sales rose to 3.7% in the April-to-June period from 3.5% a year earlier.

“Overall existing market sales growth was encouraging when viewed against the significant rain disruptions in the eastern U.S., consecutive mild winters lessening demand across Northern markets, and the challenging comparison to last year’s Q3,” President and CEO Paul Isabella said in a statement.

Beacon Roofing Supply

Slide from Beacon Roofing Supply's Aug. 2, 2017, earnings call with analysts

Sales of residential roofing products rose 8.3% year over year and complementary product sales jumped 15.7%, but non-residential roofing product sales fell 4.7%.

Beacon likes to measure itself in terms of adjusted net income, which excludes non-recurring costs and the amortization of intangibles that stem from acquisitions. Those charges amounted to $6.8 million in the latest quarter vs. $5.4 million a year before. Adding them to net profit produces a gain in adjusted net to $51.4 million from $46.6 million.

Beacon also uses adjusted EBITDA to track its progress. That’s earnings before interest, taxes, depreciation, amortization, acquisition costs, and stock-based compensation. For the latest quarter, Beacon’s adjusted EBITDA grew to a shade under $120 million from $109.6 million a year earlier.

The assets said of Beacon’s balance sheet as of June 30 shows goodwill accounts for $1.26 billion of the company’s $3.42 billion in total assets. And on the liabilities side, long-term debt and borrowings under revolving lines of credit total $1.17 billion.

Beacon operates 385 branches in 48 states and six Canadian provinces. It posted $4.13 billion in sales last year.