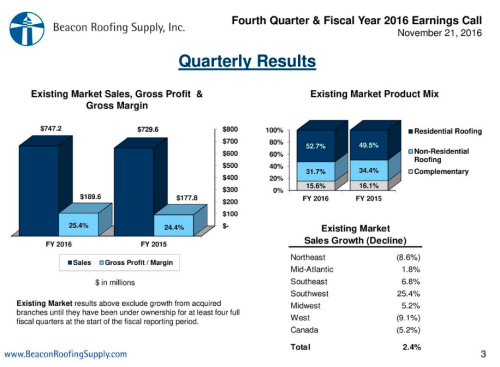

Powered by its acquisition of Roofing Supply Group (RSG) and more than a half-dozen other firms, Beacon Roofing Supply today announced its net profit jumped 53.9% to $47.4 million in its fiscal fourth quarter ended Sept. 30. That came on a 49.1% jump in sales to a quarterly record of $1.17 billion. Excluding acquisitions, sales rose 2.4%.

“Net income for the quarter was favorably impacted by strong volume growth within residential roofing and a significant improvement in gross margins which increased 140 basis points over the prior year,” the Herndon, Va-based company–No. 4 in the ProSales 100–said in a news release. “This was partially offset by declining organic sales of our other two product lines.”

Gross profit rose to 25.7% from 24.3% a year earlier. Operating income jumped 62.0% to $95.9 million. Net income rose to represent 4.0% of net sales from 3.9% in the July-to-September 2015 period.

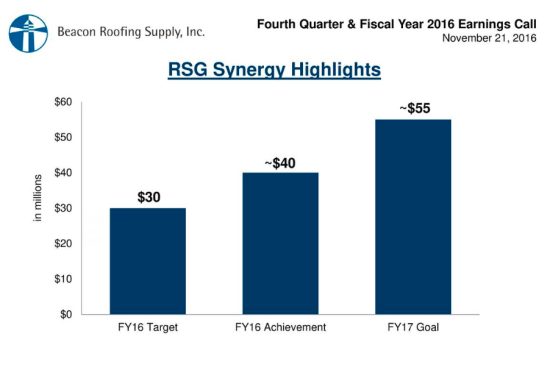

Beacon’s acquisition of RSG. which took effect Sept. 1, 2015, brought it what was then the No. 11 company on the ProSales 100, with 83 locations and roughly $1.2 billion in revenue in 2014. Since then the company has made seven more acquisitions, most notably Roofing & Insulation Supply, a 20-branch dealer with locations in 13 states. During its presentation to analysts, Beacon said it has consolidated 30 of RSG’s branches.

Net income for the fiscal year ended Sept. 30 jumped to $89.9 million from $62.3 million as sales rose 64.1% to $4.13 billion. “Net income for 2016 was favorably impacted by higher levels of storm demand, particularly in Texas, as well as a significant 80 bps year-to-year improvement in gross margins,” Beacon reported. “This was partially offset by increased operating expenses driven by the incremental costs associated with the RSG acquisition made at the beginning of this fiscal year.”

The company prefers to measure itself using adjusted EBITDA–earnings before interest income, taxes, depreciation, amortizations, stock-based compensation, non-recurring acquisition costs, and “adjustments to contingent consideration.” By that metric, adjusted EBITDA rocketed to $127.5 million in the fourth quarter from a year-earlier $77.7 million.

The company’s balance sheet for the year ended Sept. 30 shows goodwill accounted for nearly $1.2 billion of the company’s $3.11 billion in assets, while on the liabilities side the company had $722.9 million in long-term debt and $1.79 billion in total liabilities.