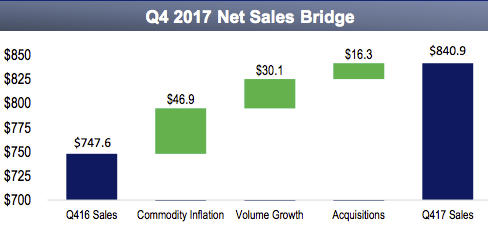

BMC emphasized words like “acceleration” and “acquisition” today while announcing a tax-assisted 69% jump in net income to $17.6 million in the fourth quarter from a year before on a 12.5% rise in net sales to $840.9 million.

The report was the first since the Atlanta-based dealer–the second-biggest full-service lumberyard in the nation and the No. 4 ProSales 100 company–announced it had parted ways with Peter Alexander as president and CEO,

Half of the increase in net income–roughly $3.6 million–came as a result of recently enacted tax reforms. Gross profit rose 8.5% to $196 million. Gross margin slipped to 23.3% from 24.2.%. Operating income rose 12.2% to $24.9 million.

“We saw an acceleration in the fourth quarter of year-over-year growth in our key, value-added product categories, including structural components and millwork, doors and windows,” interim President and CEO David Keltner said in a statement. “… As we enter 2018, the team is energized and eager to pursue and accelerate our growth strategies. Specifically, we intend to build upon our solid foundation of value-added products and services, while enhancing our operational excellence and high-performing culture to drive continuous improvement throughout the organization. We also expect to pursue our strategic expansion plans through additional bolt-on acquisitions.”

One sign of that strategy was evident today when BMC announced it had acquired Shone Lumber, a Delaware-based, three-unit dealer that generates about $70 million annually from sales to custom builders and remodelers in Delaware, New Jersey, and the Philadelphia market.

In a conference call with analysts, Keltner laid out a four-point strategy:

- Push growth in trusses, millwork, doors and the company’s Ready-Frame system while substantially growing sales to professional remodelers. That group currently accounts for about 11% of total sales.

- Enhance customer service and operational excellence by improving efficiency through kaizen events, installing a fully automated truss plant in Atlanta, and boosting the ecommerce platform.

- Launch a leadership development program and reinvigorate the company’s training program.

- Make strategic “tuck in acquisitions.”

On that last point, Keltner said BMC will be looking to acquire businesses that have robust value-added services (such as millwork and truss operations), are strong with remodelers, or are located in markets that help fill in a strategic blank spot on the service map or can help boost BMC to No. 1 or 2 in market share. The Shone Lumber deal does many of those things at once, BMC officials noted.

BMC presentation to analysts

For 2018, BMC forecast organic sales volume growth of 2% to 5%, roughly 4% to 6% higher sales because of commodity inflation, and another 2% extra sales because of acquisitions. So overall, it’s figuring its operating margins will rise 8% to 10%.

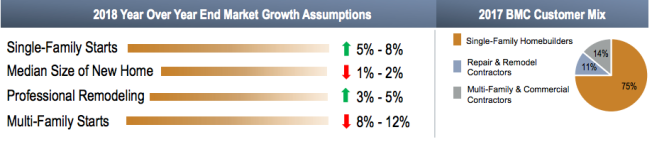

BMC bases that forecast in part on a single-family market that it believes will increase 5% to 8% in terms of overall starts but with a higher share of smaller, more modestly priced homes. That means the company will ship not just a smaller framing package but also fewer windows, doors and millwork. Meanwhile, the multifamily market, which accounts for onw-seventh of BMC’s sales, is expected to decline by 8% to 12%, while remodeling looks to keep growing. That’s one reason why BMC aims to sell more to remodelers.

BMC presentation to analysts

BMC estimated that roughly half its 12.5% gain in net sales was become of higher lumber and sheet goods prices, while about one-third came from increased volumes and the rest was from acquisitions. At the same time, it blamed those commodity price hikes for the reduced gross profit as a percentage of sales.

The company’s balance sheet shows goodwill accounts for $261.8 million of the company’s $1.47 billion in assets. Meanwhile, long-term debt as of Dec. 31 stood at $349.1 million.

BMC likes to measure itself in terms of adjusted EBITDA, which it defines as net income plus interest expense, income tax expense, depreciation and amortization, merger and integration costs, non-cash stock compensation expense, impairment of assets, acquisition costs, loss on debt extinguishment, inventory step-up charges and other items. By that metric, the company’s adjusted EBITDA for the fourth quarter rose $3.1 million from the year-earlier period to total $47.6 million, while margin declined to 5.7% from 5.9%.

For all of 2017, net income nearly doubled to $57.4 million from $30.9 million, but BMC noted its 2016 results include a pre-tax impairment charge of $11.9 million nad a pre-tax loss on debt extinguishment of $12.5 million. Net sales totaled $3.37 billion, an 8.8% rise that drew half its increase from higher lumber prices. Gross margin slipped to 23.6% from 2016’s 24.0%. The company operates in 18 states from the mid-Atlantic to California.

There was no word on when a new CEO will be announced, Keltner said a search firm has been hired to find a permanent replacement for Alexander.