BMC Stock Holdings (BMC) reported today its net income fell just $400,000 in the second quarter from the year-earlier period to total $17.6 million, while net sales rose 11.1% to $886.4 million. A $2.7 million increase in merger and integration costs affected the bottom line, it said.

Recent acquisitions accounted for $19.2 million of the company’s $88.8 million gain in sales in the April-to-June period compared with 2016’s second quarter. President and Chief Executive Officer Peter Alexander noted that $45 million of the company’s total sales were attributed to the company’s Ready-Frame product.

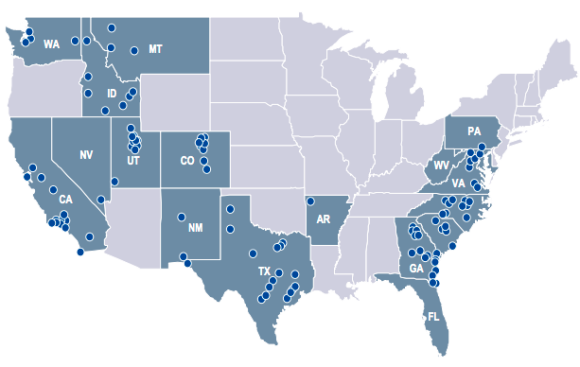

BMC's locations as of Aug. 3, 2017

Gross profit rose 10.5% to $211.7 million (23.9% of sales) from $191.7 million (24.0%). “Volatility in the cost of lumber and lumber sheet goods constrained our gross margin percentage in the second quarter, and recent Canadian wildfires have extended this period of market volatility into the third quarter,” Chief Financial Officer Jim Major said. “However, over the longer-term, we anticipate our gross margin percentage will improve relative to our second quarter 2017 performance and commodity inflation will ultimately provide a more significant tailwind for our operating results.

Selling, general, and administrative costs increased 12.8%, in part because of the opening of new facilities as well as higher insurance costs. Merger and integration costs increased to $6.3 million, compared to $3.6 million in the second quarter of 2016, the company said.

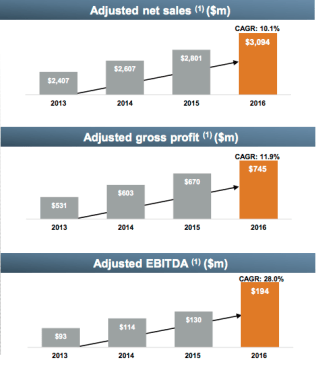

BMC's adjusted sales and profit statistics, 2013-2016

BMC measures itself in part through adjusted EBITDA, which it defines as earnings before interest, taxes, depreciation, amortization, merger and integration costs, non-cash stock compensation expense, acquisition costs, impairment of assets, and inventory step-up charges. By that metric, adjusted EBITDA edged up to $59.6 million, or 6.7% of sales, from $57.5 million (7.2%).

The company also talks in terms of “adjusted net income,” in which it counts not just net income but also merger and integration costs, non-cash stock compensation, acquisition, costs, impairment of assets, and the tax effects created by those adjustments. BMC said its adjusted net income grew to $22.96 million from $21.57 million.

Sales of structural components (including Ready-Frame) amounted to 15.6% of sales, lumber and sheet goods 32.8%, millwork (including doors and windows) 27.2%, and other products 24.4%.

The Atlanta-based company’s balance sheet as of June 30 showed that goodwill accounted for $262.1 million of the company’s $1.53 billion in total assets, while long-term debt totaled $410.9 million.