Foundation Building Materials (FBM), the 10th-biggest dealer on the ProSales 100, reported today that its net income grew by nearly one-third in the second quarter from the year before, hitting $5.4 million, on a 14.3% increase in net sales to $605 million.

[Aug. 10 update: The sales number above, reported in FBM’s initial announcement, covers both U.S. and Canadian facilities. On Aug. 10, FBM’s SEC filing said U.S. sales for the quarter totaled $537.8 million. The rest of this story continues to be based on FBM’s operations in both countries.]

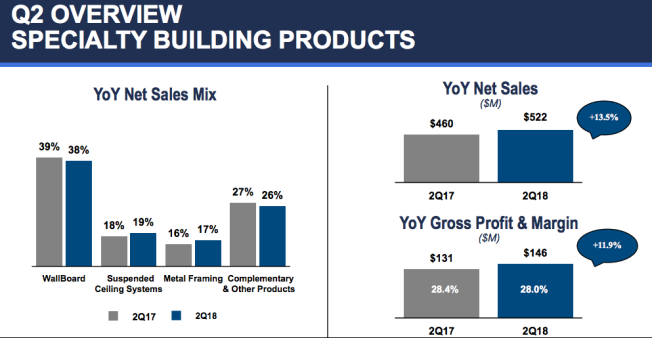

FBM operations also in business during the April-to-June 2017 quarter accounted for 9.5 of the 14.3 percentage points of sales growth, while sales at facilities acquired since the second quarter and branches merged with those acquisitions together provided the rest of the gain.

FBM presentation to analysts Aug. 9, 2018

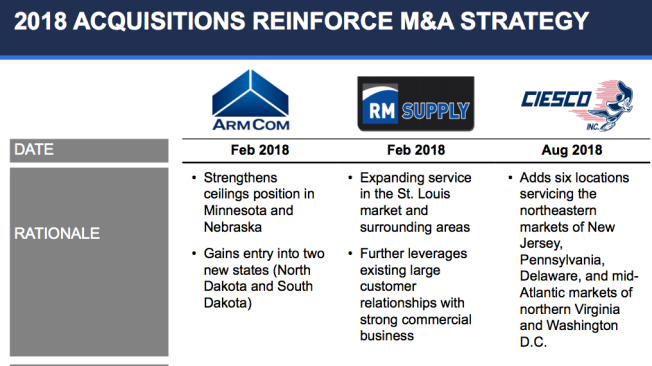

FBM has made three acquisitions totaling 13 branches this year and is looking to do more deals, it said in a news release. FBM also has opened five greenfield branches and expects to open one to two more by year-end.

Gross margin slipped to 28.0% from 28.3%. Tustin, Calif.-based FBM attributed that mainly to getting a higher percentage of sales from lower-margin products like suspended ceiling systems and mechanical insulation.

Selling, general, and administrative expenses grew 10.7% to $125.8 million; that’s 20.8% of sales, down from 21.5% a year earlier.

FBM presentation to analysts Aug. 9, 2018

FBM bills itself as one of the naton’s largest distributors of wallboard, suspended ceiling systems, and mechanical insulation. Sales of specialty building products rose 13.5% to $522.2 million and generated an 11.9% gain in gross profit to $146.3 million. Sales of mechanical insulation climbed 19.7% to $82.8 million, producing a 21.4% rise in gross profit to $22.8 million.

FBM likes to measure itself using adjusted EBITDA, which this quarter encompasses earnings before interest, taxes, depreciation, amortization, gains or losses on financial derivatives, stock-based compensation, losses on disposal of property and equipment, and transaction costs. By that metric, adjusted EBITDA grew by roughly $6 million to reach $46.3 million, or 7.7% of sales.

The balance sheet as of June 30 shows goodwill accounts for $46.8 million of the $1.42 billion in assets, while the liability side lists $539.2 million in long-term debt.