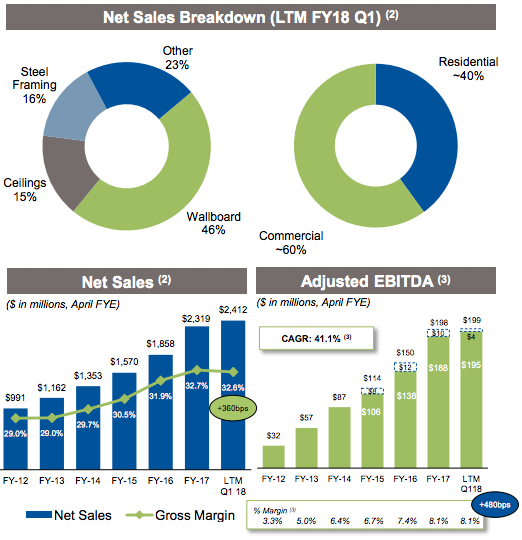

GMS, the wallboard and ceiling systems dealer that ranks 8th on the ProSales 100, reported today its net profit shot up 67.4% to $15.3 million in its fiscal first quarter ended July 31 from the year-earlier period. Sales for the acquisition minded company jumped 16.8% to $642.2 million; sales at stores operating since at least the first quarter of fiscal 2017 rose 7.8% year over year.

“Stronger commercial activity drove an 11% and 10% increase in ceilings and steel framing base business net sales, respectively, while wallboard base business sales were up mid-single digits,” President and CEO Mike Callahan said in a news release. He noted that the gross margin slipped to 31.9% from 32.5% in the quarter ended in July 2016, but added that “a variety of purchasing initiatives executed during the quarter” should enable the Tucker, Ga.-based dealer to average a 32.5% GM by the time fiscal 2018 ends next July.

GMS prefers to measure itself in terms of adjusted EBITDA: earnings before interest, taxes, depreciation, and amortization as well as before stock appreciation rights expenses, equity-based compensation, severance costs, transaction costs, management fees, interest-rate swaps, secondary public offerings, and debt transaction costs. By that metric, adjusted EBITDA rose 14.8% year-over-year to hit $52.8 million. That’s 8.4% of net sales.

GMS

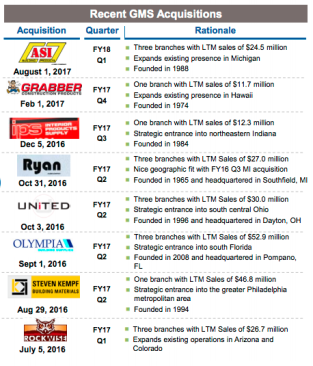

GMS acquisitions since spring 2017

GMS has been one of the most aggressive firms in the LBM mergers and acquisitions market over the past two years. It bought eight companies last fiscal year, and in August it announced it had acquired ASI Building Products, a three-unit dealer in eastern Michigan.

The company’s sales breakdown shows that wallboard sales climbed 13.3% to $284.7 million, ceiling sales went up 15.5% to $99.7 million, steel framing sales (one way to track the company’s commercial activity) jumped 24.1% to $104.7 million, and sales of other products went up 19.8% to $153.1 million.

Gross profit increased 14.8% to $205.1 million.

The company’s balance sheet shows that the company had $1.41 billion in assets as of July 31, of which goodwill accounted for $423.7 million. On the liabilities side, long-term debt not immediately due totaled $589.9 million as of July 31. GMS noted that it has reduced the interest rate on its first lien term loan by half a percentage point and extended its maturity to April 2023.

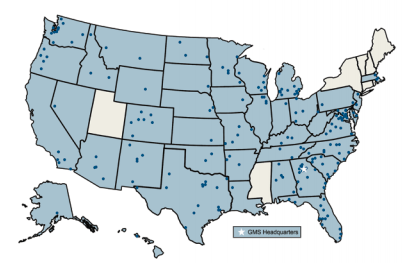

GMS

GMS locations as of Sept. 9, 2017

GMS describes itself as North America’s biggest specialty distributor of interior construction products. It has more than 205 branches in 42 states, all flying under the flags of roughly 50 different locally based companies. It claims to sell 14.6% of the nation’s wallboard and 16.7% of its ceiling systems.