A $259.1 million, 95.9% rise in net sales generated a $4.2 million rise in net profit for Foundation Building Materials (FBM) in its second quarter, enabling the specialty dealer to swing to a $1.26 million profit in the period from a $2.96 million loss the year before, FBM revealed today.

Consolidated net sales for the April-to-June quarter soared to $529.2 million from a year-earlier $270.1 million. “Acquired branches and existing branches that were strategically combined with acquired branches produced $239.5 million” of the $259.1 million total increase, the company said. FBM has been one of the LBM industry’s most active buyers of companies these past two years. It has announced eight deals in 2017 alone, adding 17 branches.

Foundation Building Materials' specialty dealer locations as of Aug. 3, 2017

FBM outlets operating as such in both 2Q16 and 2Q17 reported a 9% sales gain worth an extra $19.6 million.

Gross profit nearly doubled in the quarter, to $149.5 million (28.2% of sales) from $79.3 million (29.4%). Operating income was sharply higher, jumping to $16.9 million in 2017’s second quarter from $3 million the previous year, but a 75.4% jump in interest expense to $14.9 million kept much of that income from hitting the bottom line. The $1.26 million of net profit for the quarter represents 0.2% of net sales.

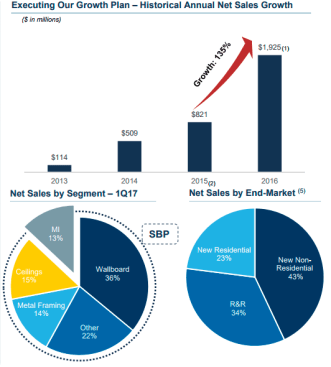

Excerpt of slide from Foundation Building Materials' presentation to analysts, Aug. 3, 2017

Tustin, Calif.-based FBM describes itself as the largest distributor of suspended ceiling systems and the second-biggest wallboard distributor in the U.S. and Canada. It also sells commercial and industrial insulation thanks largely to the August 2016 purchase of Winroc-SPI. FBM made its initial public offering in February, citing sales that would put it into the ProSales 100’s top 10.

FBM also reports adjusted EBITDA, which it defines as earnings before interest, taxes, depreciation, amortization, stock-based compensation, transaction costs and a few other measures unrelated to regular business. By that metric, adjusted EBITDA totaled $40.3 million, or 7.6% of sales.

The company’s balance sheet as of June 30 shows $452.2 million worth of goodwill out of $1.37 billion in total assets. Meanwhile, long-term debt totaled $529.8 million while the asset-based revolving credit facility showed a $74.2 million liability.