A $68 million benefit from the recent tax reform legislation turned what would have been a modest fourth-quarter turnaround for Foundation Building Materials (FBM) into a major swing, as the specialty dealer reported today its net income soared to $75.9 million from a net loss of $8.8 million in the year-earlier period.

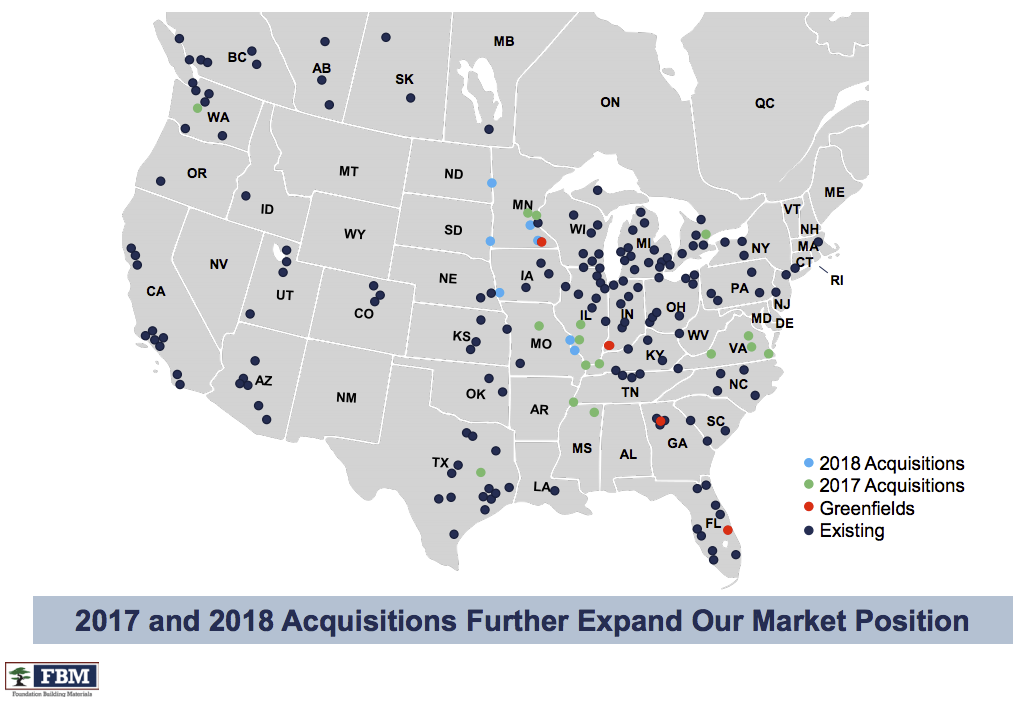

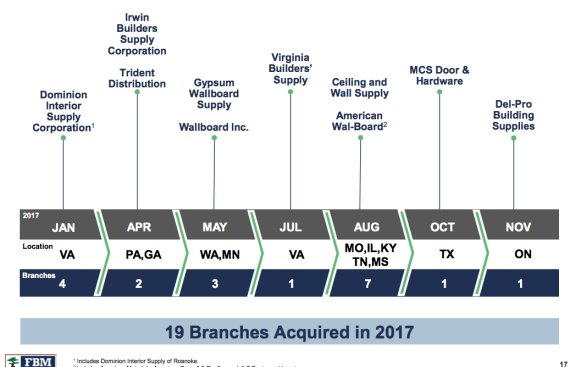

A slew of acquisitions (see graphic below) enabled the dealer’s net sales to jump 11.8%, or $54.6 million, to reach $516.8 million. Sales at operations that also were in business in 2016’s fourth quarter collectively rose 2.1%, or $4 million.

Gross profit climbed 16.2% to $153.6 million, a combination of both higher sales and the contributions from acquired operations. The Tustin, Calif.-based company’s gross margin jumped to 29.7% of sales from 28.6% a year earlier, primarily because of higher margins in the dealer’s specialties: wallboards and suspended ceiling systems. FBM also is a major seller of steel studs as well as commercial and industrial insulation.

Operating income nearly quadrupled to $16.4 million from $4.4 million.

Sales of specialty building products grew 10.8% to $443.7 million, or $43.2 million, while the margins on those sales climbed to 30.0% from 28.7%. Mechanical insulation sales grew 18.4% to $73. 1 million, with the margin holding steady at 28.0%.

The fourth quarter’s results pushed consolidated net sales for the year to $2.06 billion from $1.39 billion–a 48% increase. That likely will be enough to push the now-public company into the top 10 of this year’s ProSales 100 when the list is announced in June.

The same Tax Cut and Jobs Act of 2017 that has boosted Americans’ paychecks nationwide decreased FBM’s undiscounted liability under its tax receivable agreement by $68 million as of Dec. 31, FBM reported. All that money dropped to the bottom line and thus swelled the dealer’s net profit.

FBM likes to measure itself in terms of adjusted EBITDA–earnings before interest, taxes, depreciation, and amortization as well as before unrealized gains and losses on derivatives, IPO and public company readiness expenses, stock-based compensation, and non-recurring adjustments. By that metric, adjusted EBITDA climbed roughly by half, to $36.9 million in the fourth quarter from a year-earlier $24.7 million, while adjusted EBITDA margin jumped to 7.1% from 5.3%.

FBM presentation to analysts Feb. 27, 2018

The company’s balance sheet as of Dec. 31 shows that goodwill accounts for $458.7 million of FBM’s $1.35 billion in total assets, while the long-term part of the company’s debt totals $534.3 million.