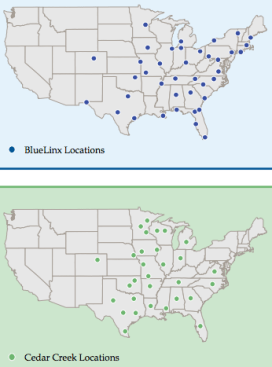

BlueLinx announced today it will acquire Cedar Creek for roughly $413 million, creating a $3.2-billion, 70-store wholesale distribution giant serving 15,000 LBM dealers and other corporate customers in 40 states east of the Rockies.

The purchase will be made with a combination of $345 million in cash and $68 million worth of capital leases, according to a news release. BlueLinx shares rose 77% on the news to close at $28.03.

BlueLinx President and CEO Mitch Lewis will run the combined company, while Cedar Creek CEO Alex Averitt will become COO. The parent company will be called BlueLinx and, initially, Cedar Creek will retain its name at its locations. The deal is expected to close by May 1.

Publicly traded BlueLinx is headquartered in Atlanta and generated $1.82 billion in sales and $63 million in net income from its 39 locations in 2017. Privately held Cedar Creek is based in Oklahoma City and has 31 locations. It recorded $1.42 billion in sales and $18 million in net income in 2017.

Cedar Creek had an adjusted EBITDA–earnings before interest, taxes, depreciation, amortization, and other non-recurring expenses–of roughly $60 million in 2017, BlueLinx said. That makes the purchase price 6.9 times adjusted EBITDA. But BlueLinx also expects to generate $50 million in run-rate savings by 2020, so with that in mind the EBITDA multiple is 3.8 times.

BlueLinx presentation to analysts March 12, 2018

The footprints and strategies of the two companies are similar. BlueLinx’s Lewis told analysts his company believes the merger will net roughly one-third of its $50 million annual savings through network and fleet consolidation, 45% through procurement savings, and 20% through general and administrative cost cuts.

But above all else, BlueLinx’s goal is to grow, Lewis said.

“There’s no intention of reducing the sales force,” which together totals 700 people, he told analysts. “We want to hold onto our sales and obviously grow. There may be some attrition of customers and sales, but we’re going to work hard … to show customers and suppliers how much value we bring to the market.”

Lewis told analysts that advisers have suggested for years that the two companies merge. Discussions became more intense in 2017’s fourth quarter, he says.

The deal marks a big turning point for BlueLinx, which has spent the past two years closing facilities and signing sale-leaseback deals on some of its warehouses. Meanwhile, Cedar Creek has grown rapidly since May 2010, when it was recapitalized by Charlesbank Partners.

The purchase price and further debt-cutting moves are being financed by a $750 million revolving credit facility from Wells Fargo and Bank of America as well as a $180 million term loan from HPS Partners.

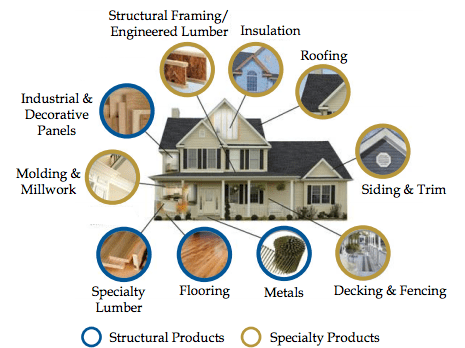

While known primarily as distributors, BlueLinx and particularly Cedar Creek also have manufacturing operations. Together they have 16 facilities that fabricate hardwood and softwood, six timber operations, five molding operations, and two plants that make prefinished siding. Between the two, the combined company will offer 50,000 branded and private-label SKUs.