Promising Early Results

It’s too soon for most dealers and distributors to draw cost/benefit conclusions about fleet management systems, although some are encouraged by what they’ve seen. Quite a few use GPS devices to help calculate fuel taxes, an invaluable function for multi-state companies. BlueLinx’s system provides drivers with paperless logs, so they aren’t wasting 30 to 40 minutes each day (usually while on overtime) filling out Department of Transportation compliance forms. The Qualcomm-supplied satellite system that Riverhead Building Supply installed two years ago provides information that led this New York dealer to redefine the delivery responsibilities of its nine locations and 85-vehicle fleet. “At some yards, vehicles were underutilized; other yards didn’t have enough trucks,” says fleet manager John Callahan.

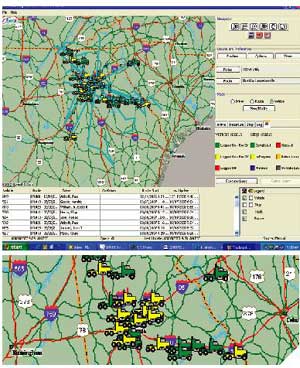

“There are two big opportunities for us,” says Brad Kostelich, senior vice president of business processes and technology for The Wolf Organization of York, Pa., which last summer installed GPS to track its 40 to 50 trucks for its nine-branch wholesale distribution. The first is to map routes that reduce the number of deliveries Wolf makes and the number of trucks it sends out that aren’t completely full. The second benefit, predicts Kostelich, is a “value proposition” that, in the future, might allow customers (for a fee, perhaps) to tap into a Web portal for real-time updates about their orders.

Some dealers and distributors are looking beyond fleet management to the not-too-distant future when their entire supply chain–from when products are received to when they reach their end users–is tracked electronically. Already, some companies are connecting the dots.

His company and Bradco are working on a dispatch module that would tie into this GPS. The “ultimate goal,” says Tremmel, is to link fleet management into Bradco’s NXTrend inventory management system, which would allow the distributor to route a delivery to a customer from its closest distribution center. “We’re not there yet, but that’s where we’re headed.”

However, there’s some debate about how necessary it will be to barcode individual products in order to track orders from beginning to end through scanning. “Ninety percent of what we deliver to jobsites is larger bundled complete units, so it wouldn’t be cost-effective to scan individual sticks or sheets,” says Heitzenrater of Carter Lumber.

Riverhead assigns a unique barcode to every unit that comes into its stores. That label includes information about which vendor it came from, when it arrived, and the description of the shipment. Each item in an order is then assigned a specific number that’s married to a driver and a truck. Robert Bowden scans batches (i.e., orders loaded onto its trucks) with a dispatch system called SHIPs, which interfaces with the company’s purchasing, receiving, and delivery departments. Cole, who manages this dealer’s Marietta, Ga., branch, says that eventually Bowden wants to download each product into SHIPs.

Schnell says Parr Lumber ultimately wants to scan every load and already has installed a barcode reader onto one of its trucks. Parr might start scanning loads at three of its yards by 2008.

Tagging Along

So far, wireless technology–and specifically RFID source tagging–for tracking inventories and fleets has also been slow to catch on, for a number of reasons. There’s no one giant building products retailer or manufacturer that’s championing RFID in a way that would drag the rest of the industry along with it, à la Wal-Mart in the discount field. And certain building materials have been less than RF-friendly: Mark Roberti, editor of RFID Journal, notes that tags have a history of being hard to read when embedded in wood that’s fresh or moist.

That being said, Roberti predicts that as RFID becomes more widespread, wireless technology is a wave of the future that even the building products industry will ride. IDTechEx, an Ann Arbor, Mich.?based consultant that promotes this technology, estimates that the market for source tags will more than quadruple to $12.35 billion in 2010 from $2.7 billion in 2005. Tags are now being used to track everything from livestock to medical supplies in a healthcare industry that’s almost as technophobic as the building materials field.

Besides, the argument that RFID is too sophisticated for structural products is fast becoming indefensible. In its November 2006 edition, Window & Door magazine reported how millwork distributors use this technology for inventory management, including one company that reduced the man-hours to count $3 million in inventory from 1,200 hours with 40 counters to less than 200 hours with 15 counters. Fully Integrated and Automated Technology (FIATECH), an Austin, Texas?based nonprofit consortium focused on the fast-track development and deployment of technology in the construction field, has conducted numerous field tests over the past few years to validate the efficacy of using RFID technologies to locate fabricated pipe spools and predict the strength of concrete as it’s drying.

“These tests show that using RFID to track just about anything is doable and practical,” says Dr. Richard Jackson, FIATECH’s director. Jackson concedes that there’s still “a lot of misunderstanding” about source tagging. But he’s convinced that any confusion will dissipate as the technology gets cheaper and as “more people realize that their fears are belied by the PDA in their back pockets and by the ability of their kids sitting in the backseat of their cars to tell them where they are. People are going to ask, ‘If my kids can do that, why can’t my suppliers tell me where my products are?'”

–John Caulfield is a contributing editor for ProSales.