About the Survey

The BIG BUILDER Study was conducted by mail in the fall of 2003 by BIG BUILDER magazine (a sister publication of PROSALES) under the direction of Readex, a nationally recognized independent research company. The final results were tabulated in November 2003 and released for publication in 2004.

The survey sample of 1,800 was selected from the domestic recipients of BUILDER magazine, another sister publication of PROSALES, who are classified as “builder, builder/developer, or general contractor” who work for firms that completed more than 100 residential dwelling units in the 12 months prior to the study. The margin of error for percentages based on 409 usable responses—a 30 percent response rate—is +/- 4.7 percent at the 95 percent confidence level.

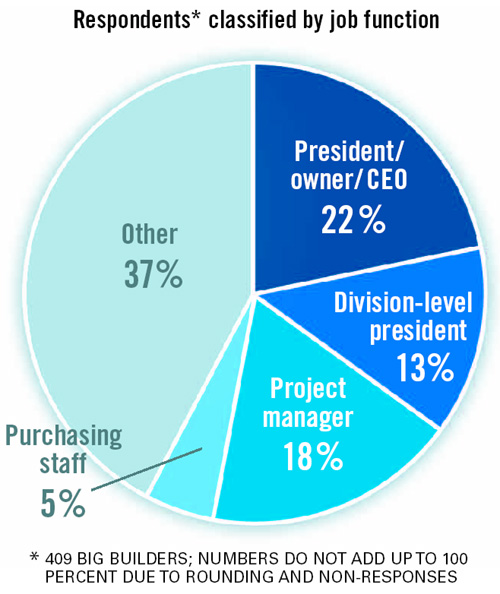

Figure 1 shows the profile of the respondents represented by this research. The highest proportion of respondents (35 percent) are presidents/owners/CEOs, including 13 percent who are division-level presidents. Project managers accounted for 18 percent of those surveyed, and no more than 5 percent indicated any single other job function.

Close to 9 in 10 (88 percent) of the big builder respondents indicated that their firms were involved in building single-family homes in 2003, compared to just over half (55 percent) who indicated their firms were involved in building multifamily homes last year. Those respondents who represented the nation’s top 100 home builders, which was determined by cross-referencing the respondents to BUILDER magazine’s 2003 BUILDER 100 ranking (published annually in May), reflect a slightly different profile, with virtually all of them involved in single-family construction, as seen in Figure 2.

The mean number of homes built by all the study respondents was 2,160. Breaking it down, the mean was 4,380 for the top 100 builders and 1,310 for all other builders participating, as shown in Figure 3.

Going forward, the 2004 outlook for building among the surveyed big builders is generally positive, with those who work for the top 100 firms the most optimistic. Two-thirds (67 percent) of big builders expect their firms will build more homes in 2004 than in 2003. That proportion increases to 85 percent for those respondents who work for the top 100 home builders. That’s good news for dealers looking to expand their reach in this growing market!

Critical Link

Manufacturers in line to serve big builders say pro suppliers can help seal the deals.

When MI Home Products, a Gratz, Pa.–based window manufacturer, negotiates purchasing agreements with large production builders, its outside salespeople coordinate their company’s supply chain efforts with dealers such as Stock Building Supply, the industry’s largest pro dealer. “Stock has realigned itself to sell into the BUILDER 100 [BUILDER magazine’s ranking of the nation’s largest builders],” observes Mike Jackson, MI’s president (BUILDER is a sister publication of PROSALES). Jackson adds that he has been “amazed” at how “unsophisticated” some dealers in the industry have been about linking up with big builders.

The relative involvement of pro dealers and specialty distributors in the supply chains that link manufacturers with builders can vary markedly by product. Indianapolis-based Delta Faucet goes two-step on every product it sells to builders, say Jeff Andress, trade channel manager for Delta. David Meyers, vice president of strategic accounts for the HVAC supplier Carrier (which sells to nearly all of the 40 largest home builders), says that dealers are “extremely important” to his company’s distribution and local servicing of builders “because of the technical complexity of the product.”

When the Timberlake division of American Woodmark establishes a supply program with a builder, its national accounts team typically will coordinate that program through Timberlake’s distribution network. In doing so, this Winchester, Va.–based kitchen cabinet maker likes to replicate the processes it undertakes for the builder with the dealer or distributor it’s selling through, explains Gary Rosenfield, Timberlake’s vice president of professional markets. He pointed out that at the local level, dealers and distributors can be interacting with a host of different builder contacts, including managers of design centers, construction, and even marketing.

Those contacts can also include third-party fabricators and subcontractors, who have their own specific needs, demands, and agendas. For example, most major paint manufacturers have been only modestly successful at negotiating multi-regional purchasing agreements with builders. The reason, explained Gary Saiter, director of marketing and e-commerce for Duron Paint & Wallcovering, has been that builders have resigned themselves to let local painting contractors decide where to purchase the paint they apply to new homes. Builders demand rock-bottom pricing for paint, so these contractors will favor those dealers or supply houses whose prices let contractors squeeze out some margin for themselves.

At the very least, pro dealers need to get beyond price in their relationships with builders, and to reach out to every party that can affect those relationships, to remain in the mix in any local or regional supply chain agreement.