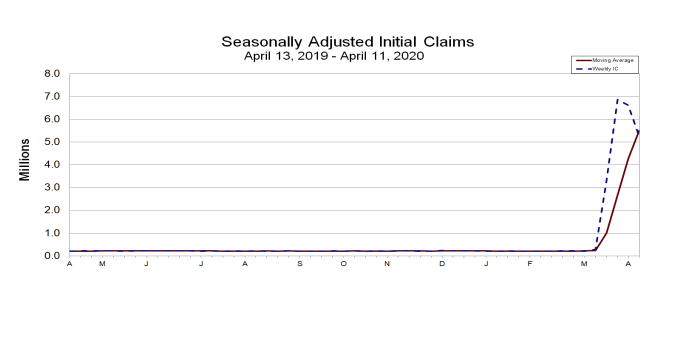

Seasonally adjusted initial jobless claims came in at 5,245,000, a decrease of 1,370,000 from the previous week’s revised level, the Labor Department reported Thursday.

The previous week’s level was revised up by 9,000 from 6,606,000 to 6,615,000.

The 4-week moving average was 5,508,500, an increase of 1,240,750 from the previous week’s revised average. The previous week’s average was revised up by 2,250 from 4,265,500 to 4,267,750.

The advance seasonally adjusted insured unemployment rate was 8.2% for the week ending April 4, an increase of 3.1 percentage points from the previous week’s unrevised rate. This marks the highest level of the seasonally adjusted insured unemployment rate in the history of the seasonally adjusted series. The previous high was 7.0 percent in May of 1975.

The advance number for seasonally adjusted insured unemployment during the week ending April 4 was 11,976,000, an increase of 4,530,000 from the previous week’s revised level. This marks the highest level of seasonally adjusted insured unemployment in the history of the seasonally adjusted series. The previous week’s level was revised down by 9,000 from 7,455,000 to 7,446,000. The 4-week moving average was 6,066,250, an increase of 2,568,500 from the previous week’s revised average. The previous week’s average was revised down by 2,250 from 3,500,000 to 3,497,750.

The total number of people claiming benefits in all programs for the week ending March 28 was 8,206,806, an increase of 4,759,027 from the previous week. There were 1,890,578 persons claiming benefits in all programs in the comparable week in 2019.

The highest insured unemployment rates in the week ending March 28 were in Rhode Island (11.9), Pennsylvania (9.8), Nevada (9.6), Washington (9.3), Connecticut (8.9), Massachusetts (8.7), Minnesota (8.7), Michigan (8.5), Ohio (8.4), and Georgia (8.2). The largest increases in initial claims for the week ending April 4 were in Georgia (+256,312), Michigan (+84,219), Arizona (+43,488), Texas (+38,982), and Virginia (+34,872), while the largest decreases were in California (-139,511), Pennsylvania (-127,037), Florida (-58,599), Ohio (-48,097), and Massachusetts (-41,776).

“While initial claims for unemployment insurance dropped from the previous week, an additional 5.2 million people are out of work, with almost 12 million people currently on the unemployment rolls,” observed Mike Fratantoni, SVP and chief economist at the Mortgage Bankers Association. “This sudden drop in employment is unprecedented, and highlights the need for continued household support through rental assistance programs, extended unemployment insurance benefits, and other income-related efforts to help people weather this crisis.”

For the status of the COVID-19 outbreak as of April 15, consult Stanford University’s COVID-19 Case Mapper below.