Pay as You Go

“We grew aggressively, but we did it the old-fashioned way: We paid for it as we went,” Bavry says. Today, Kimal’s business is 70% small, independent builders; 15% commercial; and the rest split between remodeling and consumer business. The dealer is covering the gamut between $150,000 homes to $6 million custom projects on barrier islands. “We identified three or four core types of sales,” he says. “We got good at it.”

Carl Thome

STANDSTILL: Partially completed housing developments, such as th…

Kimal Lumber scrutinizes the costs behind installed sales projects more than ever. A mini profit-and-loss statement is created for all installed jobs, tracking every trip an installer might have made to a job, every product delivery, and every material used, right down to the number of tubes of caulk.

“I want to know at the end of the job, to the penny, did we make money or did we lose?” Bavry says. The dealer is also tracking sales more diligently.

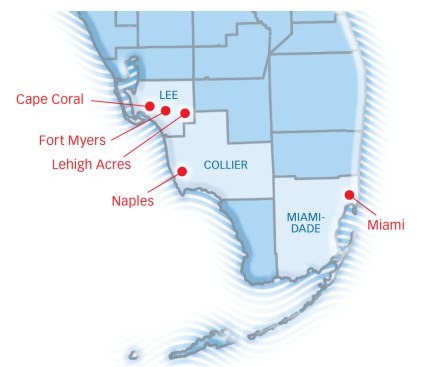

Naples Lumber was never tied to production builders, having focused on custom homes toward the upper end of the price spectrum. About 45% of the dealer’s sales are to custom to high-end builders, and the rest to commercial, remodeling, and some retail. About 95% of Naples sales are within a 40-mile radius of the dealer. Once Stock pulled out, its closest location to Naples is now nearly 100 miles away.

Shelter from the Storm

Naples Lumber has staff skilled enough to talk to upper-end builders and offer them the specialty windows, doors, columns, molding, and architectural hardware they desire, which has let the company ride out the storm.

“I don’t think we are at the end of the storm yet, though,” Labbe says. “It’s going to take a tremendous amount of work and perseverance, but we plan on coming out stronger in the end.”

Deerfield is keeping an eye on key metrics: payroll, workers’ compensation, safety. When its workers’ comp year ended in September, the company had a perfect safety record and received a five-figure safety dividend back. “We’re asking more from a smaller group of people,” Wanzenberg says.

The FBMA is optimistic that 2009 will be no worse than 2008 and along the lines that made up the market in 2000.

“Independent dealers probably are not only going to survive in 2009,” Tucker says, “but they might make a little money, too.”

Simple Steps

South Florida dealers have done a lot to fight the housing slump. Here are some ideas that might also work in your area.

Tracking Sales: When it comes to potential sales, do you have a system that tracks whether you captured them? Keep closer tabs on potential customers and whether you garnered business from them. If you didn’t, find what different approaches you may take toward making a sale.

Eagle-Eye Approach: Pay closer attention to the cost behind day-to-day operations, such as deliveries, or in the case of installed sales, materials that were not forecast originally. Are your trucks making too many dropoffs and pickups? Who is responsible for the extra treks or materials: you or the customer? Either way, it adds to the cost of your operations in time, manpower, and fuel.

Quality Service: The back-to-basics approach of offering quality service is always a first step in retaining the solid customer base you may have. Go the extra step when taking orders and make sure they’re right the first time. If you make a promise, stick to it. Get to know your customers and their needs. Don’t make your business the yard that the customer used to use.