In yet another unprecedented move, the Federal Reserve yesterday cut short-term interest rates as well as a number of other policy changes. The surprise announcement came after the group moved up their FOMC meeting by three days to rapidly address the economic challenges brought about by COVID-19.

The Federal Reserve’s new policies took a slew of measures to address liquidity and rates. Here are some of the key adjustments:

Short-term rates down 100 basis points. The Fed has raised and lowered rates by small denominations throughout this cycle, usually by 25 basis points each time. Earlier this month, the Fed made a bold move by cutting rates 50 basis points. Yesterday, they went even further with a 100 basis point drop, showing they believe extreme measures are warranted.

Jerome Powell, the Federal Reserve Chair, said the group intends on keeping rates at this level until they feel confident the economy is back on track for their dual mandate: maximum employment and price stability.

No negative rates. The latest 100 basis point cut brought the short-term rate near zero. Policymakers at the European Central Bank and the Bank of Japan have already moved short-term rates into negative territory. The US Federal Reserve did a year-long study on the efficacy of monetary policy and don’t believe negative rates make sense domestically. As such, the Federal Reserve is going to have to rely on other monetary policy tools to stimulate growth when needed using forward guidance and asset purchases.

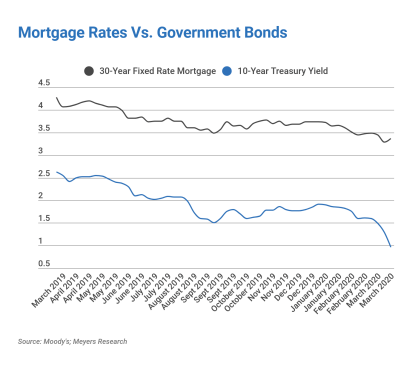

Restore normality to Treasurys and mortgage-backed securities. The Federal Reserve committed to buying at least $500B in Treasury bonds and $200B in mortgage-backed securities in an effort to normalize the markets. For example, the 10-year Treasury yield and mortgage rates typically move in tandem but recently diverged for two main reasons:

- Banks and mortgage brokers have been inundated with loan requests, especially refinances, and needed to control volume via higher rates.

- There has been a recent shift away from the mortgage-backed security market brought on by the refinance boom, which pushes the yield up.

The move by the Fed to buy $200B in mortgage-backed securities is looking to solve the latter.

Easier access to credit. Federal Reserve officials also acknowledged the stress for families and businesses as a result of COVID-19 and both lowered the interest rate at which they will lend to banks so that those institutions can lend to consumers and extended the term to 90 days.

The moves yesterday are designed to help the economy weather today’s slowdown and be well-positioned for growth when the virus slows. Jerome Powell acknowledged that no one knows whether this will be a temporary blip or longer-term issue. That depends on how the virus progresses.