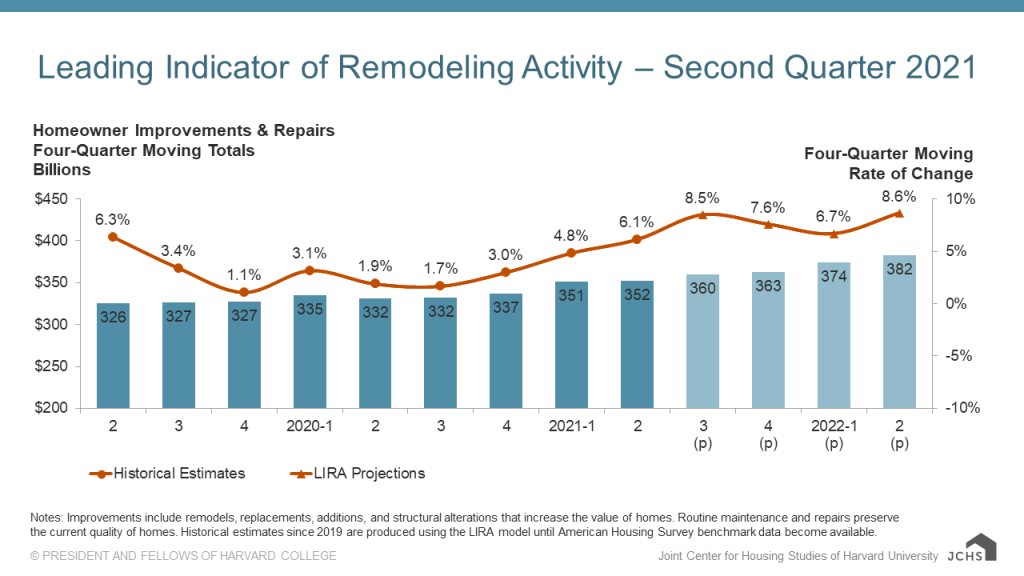

The Leading Indicator of Remodeling Activity (LIRA) projects an acceleration of growth in the remodeling market through the second half of 2021. The LIRA forecasts annual gains in homeowner improvement and maintenance spending will remain at elevated levels through mid-year 2022. The latest LIRA, released by the Remodeling Futures Program at the Joint Center for Housing Studies of Harvard University (JCHS), predicts the annual growth in home renovation and repair expenditures will reach 86% by the second quarter of 2022.

A year after unprecedented changes to the economy brought on by the pandemic, many economic indicators are showing extreme percent changes from pandemic-induced lows. To reduce immense growth rate volatility generated by many YOY comparisons, the JCHS said the projection for the second quarter of 2022 utilizes smoothed data for residential remodeling permits and single-family housing starts. According to the JCHS, using unsmoothed inputs in the LIRA model would have projected an annual growth roughly twice as large as reported.

The Q2 2021 LIRA is in line with recent LIRA reports, which have trended towards a more positive outlook for the remodeling industry. During the height of the coronavirus (COVID-19) pandemic, the LIRA forecast remodeling spending would decline by the middle of 2021. However, as more clarity emerged on the impact of the virus on the overall economy and the residential housing market demonstrated unanticipated resiliency and strength, the LIRA began to project more positive gains for homeowner spending on remodel and repair projects throughout 2021 and into 2022.

“Home remodeling will likely grow at a faster pace given the ongoing strength of home sales, house price appreciation, and new residential construction activity,” Chris Herbert, managing director of the JCHS, said in a press release. “A significant rise in permits for home improvements also indicates that owners are continuing to invest in bigger discretionary and replacement projects.”

The LIRA estimated year-over-year (YOY) growth in remodeling spending of 6.1% during the second quarter of 2021. Projections for YOY spending in the final two quarters of 2021 are approximately 3.5% higher than projections from the previous LIRA report.

“Larger gains in retail sales of building materials suggest the remodeling market continues to be lifted by DIY activity as well,” Abbe Will, associate project director in the Remodeling Futures Program, said. “By the middle of next year, annual remodeling expenditures to owner-occupied homes are expected to surpass $380 billion.”

While the LIRA provides a short-term outlook for national home improvement and repair spending, a recent report from the Remodeling Futures Program forecasts regional trends in remodeling spending for 2021. The report projected remodeling expenditures will increase between 1-13% in 42 of the nation’s major metropolitan areas, with the largest remodeling spending gains occurring in more affordable metros in the Sunbelt region, such as Oklahoma City, Okla., Tucson, Ariz., and San Antonio, Texas. Conversely, remodeling spending growth in several high-cost metros, including New York City, Washington, D.C., Boston, and San Francisco, is projected to either decrease or increase modestly in 2021, according to the Remodeling Futures Program.

The LIRA, which is measured as an annual rate-of-change of its components, is designed to project the annual rate of change in spending for the current quarter and the following four quarters. The indicator is intended to help identify future turning points in the business cycle of the home improvement and repair industry. The indicator is benchmarked to national spending estimates from the U.S. Department of Housing and Urban Development’s American Housing Survey (AHS) and was re-benchmarked in April 2016 to a broader market measure based on the AHS. The next quarterly LIRA report will be released in mid-October.