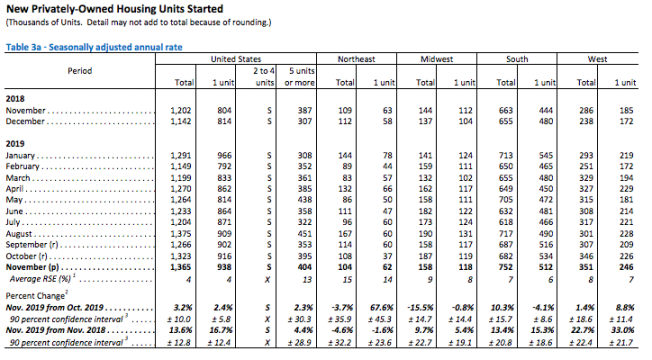

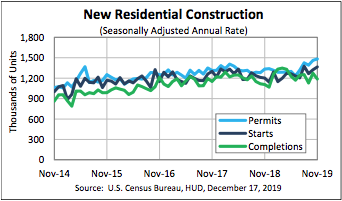

Housing starts in November were at a seasonally adjusted annual rate of 1,365,000, 3.2% above the revised October estimate of 1,323,000 and 13.6% above the November 2018 rate of 1,202,000, the Census Bureau and Dept. of Housing and Urban Development reported Tuesday.

Single‐family housing starts in November were at a rate of 938,000, 2.4% above the revised October figure of 916,000. The November rate for units in buildings with five units or more was 404,000.

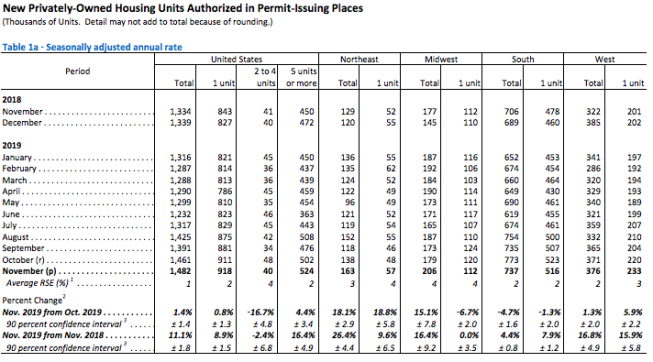

Building permits in November were at a seasonally adjusted annual rate of 1,482,000, 1.4% above the revised October rate of 1,461,000 and is 11.1% above the November 2018 rate of 1,334,000.

Single‐family authorizations in November were at a rate of 918,000; this is 0.8% above the revised October figure of 911,000. Authorizations of units in buildings with five units or more were at a rate of 524,000 in November.

Housing completions in November were at a seasonally adjusted annual rate of 1,188,000. This is 6.6% below the revised October estimate of 1,272,000, but 7.3% above the November 2018 rate of 1,107,000.

Single‐family housing completions in November were at a rate of 883,000; this is 3.6% below the revised October rate of 916,000. The November rate for units in buildings with five units or more was 295,000.

“Optimism has returned to the market on the heels of stronger economic data and low mortgage rates. Increased confidence translates into more building and additional home sales,” said Ali Wolf, director of economic research for Meyers Research, a corporate sibling of BUILDER. “During the housing boom of the mid-2000s, the problem was too much building. In today’s environment, the problem is too little. The limited supply of housing is driving home prices up and exacerbating the already worrisome affordability issues.”

Wolf added, “I don’t think we will ever get back to historical levels of construction starts unless something changes. High construction costs and limited land availability are holding back the housing market from reaching full potential.”

“The robust growth in home construction highlighted in the November data is quite welcome,” said Mike Fratantoni, SVP and chief economist at the Mortgage Bankers Association. “For the last few years, the lack of inventory has constrained the pace of home sales and increased the rate of home-price growth, leading to affordability challenges across the country. November’s strong monthly and annual gains indicate that potential home buyers next year will have more properties to choose from.”

He continued, “The strongest growth in single-family housing starts was in the West, which had a 33% increase year-over-year. The South also saw a strong increase relative to last year, but was actually down for the month. These two regions account for the bulk of housing construction nationwide, so the trends there are key to watch.

“The continued increase in permits indicates that the pace of construction should stay strong in early 2020. The solid permits reading is confirmed by the incredibly strong read on builder sentiment, which came in yesterday at the strongest level since June 1999,” he added. “Today’s home builder data support MBA’s forecast of continuing growth for purchase originations in 2020.”

Lawrence Yun, chief economist at the National Association of Realtors, said, “The latest housing starts numbers are good and rising, but still short by 135,000 compared to the long term average — and well short of the 5 to 6 million that is now needed to fully end the housing shortage. More home construction appears to be on the way as we move into 2020, as reflected in the very high confidence of home builders. They are clearly recognizing an improved business opportunity. Some innovation in the industry is required as construction workers are hard to obtain in the current tight job market conditions. Modular factory-produced aspects need to be considered more intently to boost productivity. Overall, more construction will mean more housing inventory to choose from for consumers. Home sales can then easily rise while taming the fast growth in home prices.”