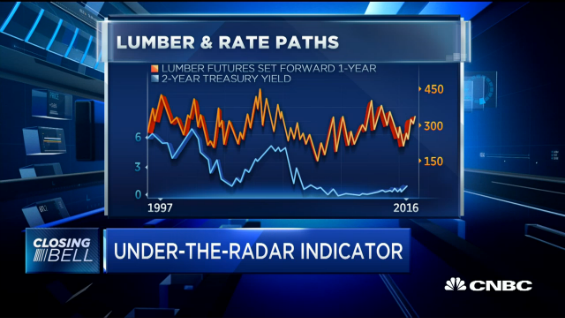

A Seattle-based financial analyst says the Federal Reserve and other economy-watchers should pay more attention to how lumber prices point to higher interest rates in 2017.

Tom McClellan told CNBC he’s found a correlation between how lumber prices do one year and what happens with interest rates in the next. “Lumber prices were up nicely in 2016, which suggests short-term interest rates will be up in 2017, after that one-year lag,” he told the financial network in a Dec. 22 interview.

“The economic growth that allows for a rise in short-term prices tends to show up first in lumber prices,” said McClellan, who authors both periodic and daily reports analyzing many financial markets. “You’ve got to remember that lumber is the finished product, and it’s made up of timber, and electricity, and labor, and fuel, and transportation. All those things are inputs into lumber, and that meets the demand for home building and other uses of lumber. So it’s a great intersection of all sorts of economic forces, and it tends to find out ahead of the Fed what short-term rates pressures are going to be doing. … The correlation over many years has been great. It hasn’t been perfect”

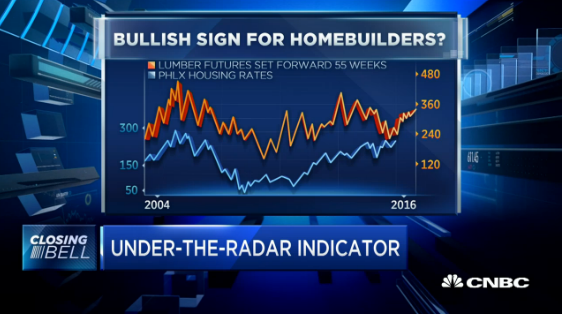

McClellan said lumber prices also give a one-year leading indication for how housing stocks will do. His conclusion: “The direction is going to be choppy, but upward, in 2017.”