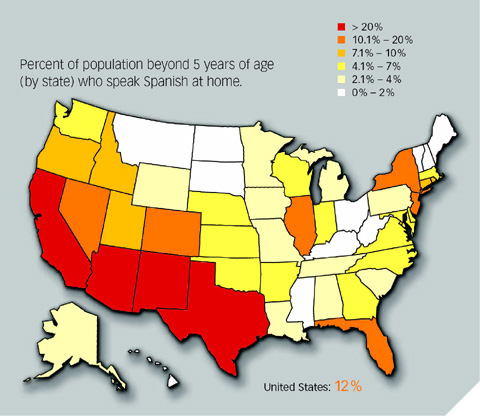

But serving Hispanics won’t necessarily force pro dealers to start working in another language, if overall population statistics are any indication. Roughly 20% of all Hispanics don’t speak any Spanish at all, and of the other 32.2 million, just over half speak English modestly to fluently. That leaves 15.4 million who say they speak English less than “very well,” the Census Bureau says. The number of Hispanics you’re likely to meet who prefer to speak Spanish will range vastly; 29% of all Texans speak Spanish at home, while just 0.7% of Vermonters do (see “Mi Casa Es Su Casa,” above).

So far, the surge in Hispanic population and their proliferation across regions isn’t necessarily translating into increased yard traffic from Hispanic contractors. “There aren’t a lot [of Hispanics] who are general contractors, mostly crews that have been subcontracted by turnkey framers,” says Hamid Taha, vice president of Alpine Lumber Co., a 17-location, $189 million operation based in Westminster, Colo., a state in which nearly 20% of the population is Hispanic. “Right now, they’re an end-user group that we don’t really target yet,” though he does see increasing sales of fasteners and framing connectors to that segment.

That experience is backed up by a brand usage survey conducted this year for PROSALES in which more than 400 home centers responded to questions about Hispanic customers within the larger survey questionnaire. The findings: On average, currently about 5% of dealers’ customers are Hispanic, and they account for less than 10% of the mix among nearly two-thirds of the dealers responding.

One reason why might be found in federal Bureau of Labor Statistics numbers on Hispanic contractors. It found that only 24% are categorized as carpenters and thus likely to come into lumberyards. The rest are spread among construction trade specialties that use products that often are out of the realm (or the primary focus) of most LBM dealers, such as masonry, paint, plumbing, and insulation.

That said, dealers recognize the impending impact of the Hispanic sector. In the brand usage survey, more than 40% of dealers said they expect the proportion of their Hispanic customers to increase (with 9% nationally indicating a “significant” increase, and even more in the South). Only 1% foresee a decrease in their presence at the pro desk. “We’re seeing more Spanish-speaking contractors, though they aren’t big accounts,” says Cally Fromme, vice president of Zarsky Lumber, a 10-location, $83.5 million dealer based in Victoria, Texas.

What They Need Whether budding business owners or serving as subs to larger building companies, Hispanic construction workers share many of the same needs as any contractor on the jobsite.

Like others in the industry, those in charge of their own operations seek a reliable and trained labor pool and worry about obtaining construction financing, according to Labor Department research; they also need better business training, from marketing and sales to accounting and employment issues. “We struggle with the same challenges as other contractors,” says Castillo. “We’re always looking for opportunities,” to work and to grow and sustain the business.

For dealers, especially those noticing an increasing influence among Hispanic contractors in their markets, a precursor to serving that segment is securing their LBM needs as they grow in volume and specialty. “Serve Hispanic contractors well once, and they’re likely to return and retain their business,” says Victor Ornelas, president and CEO of Ornelas & Associates, a Dallas-based marketing firm. “Hispanics require a long-term commitment, but they return it with long-term loyalty.” —Rich Binsacca is a contributing editor for PROSALES.