That same sensitivity extends to component suppliers, including lumber dealers with manufacturing operations, which sell trusses and panels to framing contractors. “Success as a panel manufacturer depends on your teamwork with framers,” says Johansen, whose reputation as a framing sub enables his company to gain business from local framers. “We know that a framer doesn’t want to change how he builds or fix someone else’s mistakes.”

To put local framers at ease about the possibility of snatching their builders away, Johansen’s crews field-train new customers on the nuances of panelization and work to align their expectations about the imperfections of factory-built framing. “We prep them to expect small errors, just like in stick-farming,” says Johansen. “If a problem is going to cost them time off the schedule, we’ll send a crew to fix it while [the framer’s crew] moves on.”

With plated roof trusses, configured in almost any way the building code allows, framing a roof takes less than 40 percent of the time it would take to stick-frame.

Courtesy Hayward Lumber Co.

Generally, component suppliers with framing roots tend to fare better with the contractors in their markets. “Other framers want to do business with us because they know our process is designed around being successful as a framer, not just to sell components,” says Scott Stevens, president of Modu Tech, a Baltimore-based turnkey framer with truss and wall panel capacity that sells about 10 percent of its production to other framers in its market. “We’re a construction services business, not a manufacturer.”

In short, builders in any market, whether geographic or by building type, are looking for the easiest and most reliable way to build faster, better, and cheaper—a demand components definitely can satisfy. “Whatever business is supplying the framing marketplace, they need to be tied into the component segment in some way,” says Grundahl, including lumber dealers seeking to survive the sea of change. “We’re in the midst of a pretty significant evolution in the component industry, so it’s critical to look at your market conditions and decide how to participate.” —Rich Binsacca is a contributing editor for PROSALES.

Proof Positive

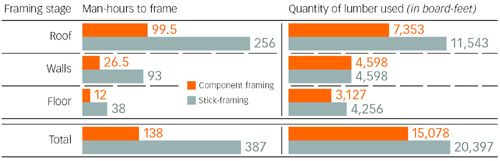

When the Wood Truss Council of America and Proof Positive NAHB’s Building Systems Council set out to compare costs and materials usage between component and stick-framing on identical, 2,600-square-foot single-family houses, it proved the kinds of cost and materials savings for trusses and panels that the component industry had been promoting for years. In the end, using components garnered a materials and labor savings of 249 fewer man-hours and 5,319 fewer board-feet of lumber.

SOURCE: FRAMING THE AMERICAN DREAM, COURTESY WTCA.

Sidebar: Signs of the Times

If you’re looking for a sign that components are the wave of framing’s future, check out the following stats:

In 2002, 39 percent of single-family homes and 56 percent of multifamily homes employed plated roof trusses, the highest percentage of any roof framing method for both types of housing. (2003 NAHB Builder Practices Survey)

Installed materials purchased among builders include framing (71 percent), roof trusses (57 percent), floor trusses (52 percent), and wall panels (23 percent). (PROSALES 2003 Builder Revolution Study)

An estimated 790,000 homes built in 2002 (or about half of all new homes) had some form of panelized construction, most commonly roof trusses. (PATH Technology Roadmapping: Panelized Systems in Residential Construction)

From 1997 to 2001, production of trusses and prefabricated [wall] panels increased at an average annual rate of 9 percent to $8.5 billion [in sales]. (U.S. International Trade Commission)

In 2001, 29 percent of reported truss sales were to building material dealers and 71 percent to home builders, framers, and others. (U.S. International Trade Commission)

Some large home builders have integrated backward into component manufacturing while some truss manufacturers have integrated forward into framing. (U.S. International Trade Commission)

In 2001, the national market share for open-web floor trusses was 10.4 percent, up from 9.7 percent in 1997; the greatest growth occurred in the Midwest (13.6 percent from 9.4 percent). (U.S. International Trade Commission)

In 2001, the national market share for panelized wood exterior walls was 10.3 percent, with the greatest growth occurring in the Northeast (22.1 percent from 14.8 percent). (U.S. International Trade Commission)

In 2001, the national market share for roof trusses was 62.8 percent, led by the West (85.8 percent) and the Midwest (81.9 percent). (U.S. International Trade Commission)

In 2000, 56 percent of WTCA members reported component sales of less than $7 million per year. (WTCA Financial performance Survey, 2001)

Lines of Distinction

Since 2001,the nation’s leading pro dealers have promised—and delivered—more extensive framing component manufacturing capabilities.

SOURCE: PROSALES 100, 2002-2004