BlueTarp

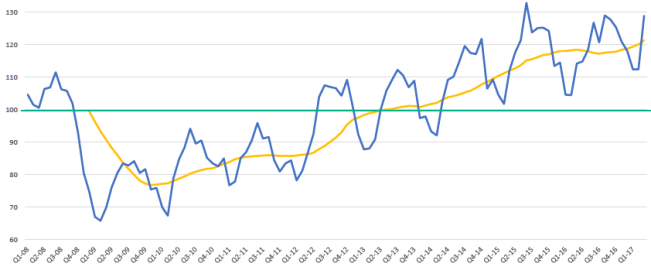

Economic conditions for dealers keep getting better, and building material suppliers’ optimism is well justified, BlueTarp Financial reports in its latest Building Supply Index for 2017’s first quarter. The index’s value of 117.9 represents a 9.4% gain from 2016’s opening three months, while 1Q17’s trailing 12-month average of 120.24 is 1.6% better than the trailing average for 2016’s fourth quarter.

BlueTarp, which provides credit management services to 2,000 suppliers that together have 120,000 pro customers, bases its index on a combination of public data–construction permits, construction spending, and consumer confidence–and its own spending and delinquency data. A score above 100 reflects healthy economic activity. The report was issued May 19.

BlueTarp also surveys its members about their outlook. In the first quarter, the percentage of respondents who said their sales were trending higher was 22 points higher than did the share who said sales were declining. And for the next 12 months, there was just over a 40-point difference in favor of dealers who felt the economic was growing.

“Respondents are anticipating a more business-friendly environment driven by President Trump,” BlueTarp said in a news release.

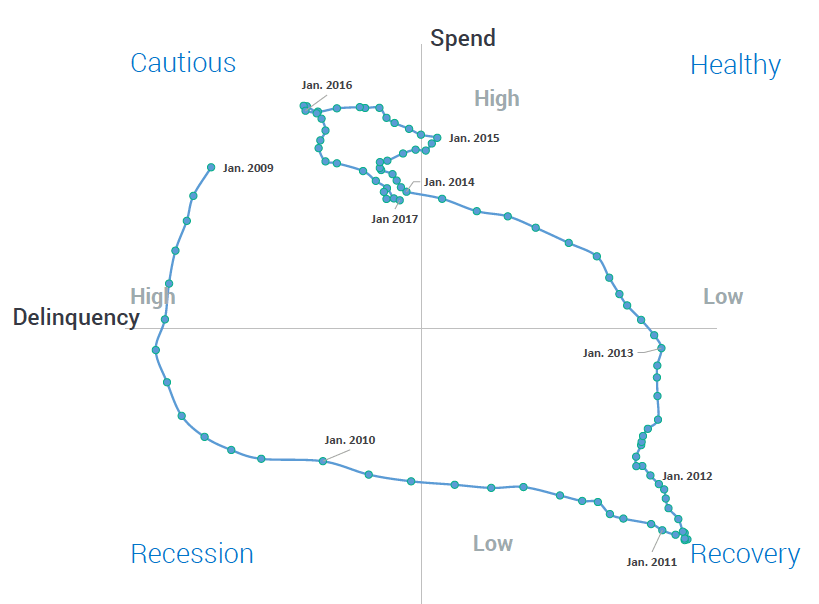

BlueTarp also charts the state of spending by dealers’ customers on a grid that measures both spending and delinquencies. That chart shows a gradual decline away from comparatively high spending but also toward accounts with lower delinquency rates.